Procyclicality

In stressed or volatile market conditions, margin models could drive increases in margin requirements.

ICE Clear Europe assesses procyclicality using percentage changes in margin requirements over a 5-day (short-term) and 30-day (long-term) windows. Threshold conditions are applied to the 95th expected shortfall level of the percentage changes over a rolling 250-day window. The monitoring triggers an amber warning if the expected shortfall exceeds 50% and a red warning if it goes beyond 100% for the short-term metric. For the long-term metrics these thresholds are respectively 125% and 250%. These metrics are calculated for top benchmark products per market on a daily basis.

Back-testing

Initial margin requirements are back-tested against the price changes to ensure that requirements are performing within the stated risk parameters. Back-testing exercises are performed on a daily basis and cover a number of different parameters and portfolio configurations.

Further details of back-testing results of the Clearing Member portfolios are contained within ICE Clear Europe’s CPMI-IOSCO Public Quantitative Disclosure Standards for CCPs. Please see Section 6.5 of the Aggregated Data File available under the Quantitative Disclosures section of ICE Clear Europe’s Regulation webpage.

Default Management

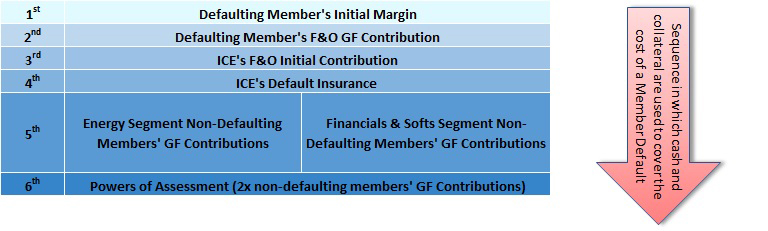

In case of an Event of Default being declared in relation to a Clearing Member, ICEU’s first Default Management objective is to take timely action to return the Clearing House, as soon as is reasonably practicable, to a matched book while aiming to contain both losses and liquidity pressures.

This protects both the non-defaulting Clearing Members and the Clearing House from losses and by extension the markets that the Clearing House provides clearing services to.

ICE Clear Europe has extensive powers under Part 9 of the Clearing Rules that allow it to perform this function. This includes details on events that could constitute an Event of Default.

The Clearing House will, on a best endeavours basis and subject to Part 9 of the Clearing Rules, assist clients of the Defaulter in the transfer of their positions to an alternative Clearing Member. For further information on porting of client positions, please see ICE Clear Europe’s Client Clearing webpage.