Treasury and Banking

Assured Payment System (APS)

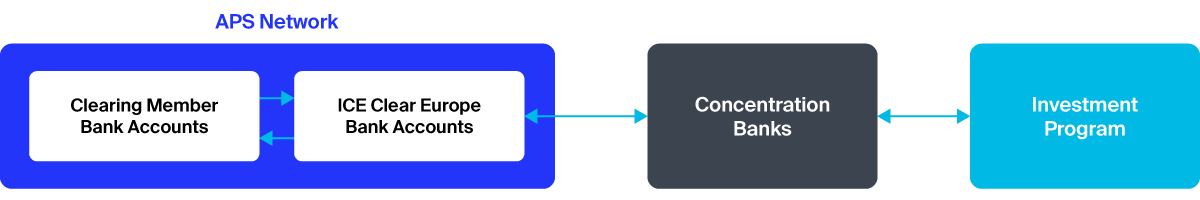

ICE Clear Europe operates the Assured Payment System (APS) in order to ensure the safe and secure transfer of payments between the Clearing House and its Clearing Members.

The APS consists of a number of approved banks, which hold accounts for the collection of margin between Clearing Members and the Clearing House.

The following banks currently participate in the APS:

| APS Bank | Branch |

|---|---|

| Bank of America NA | London (non-USD) & New York (USD) |

| Barclays Bank PLC | London (NY after 17:00 London time) |

| BMO Harris NA | Chicago (USD only after 14:00 London time) |

| BNY Mellon | New York |

| Brown Brothers Harriman & Co. | New York |

| Citibank NA | London (NY after 17:00 London time) |

| Deutsche Bank | London (non-USD) & New York (USD) |

| HSBC Bank PLC | London (NY after 17:00 London time) |

| JP Morgan Chase Bank NA | London |

| Skandinaviska Enskilda Banken AB - (House business only) | London |

| Wells Fargo Bank NA - (House business only) | London (non-USD) & New York (USD) |

APS Requirements

In order to operate in the Assured Payment System, a bank must be able to adhere to the requirements in the below document.

Treasury Questionnaire - APS Bank Setup, Contingency and COACS and Income Settlement

Currencies

For Initial Margin

- U.S. Dollars (USD)

- British Pounds (GBP)

- Euros (EUR)

For Variation Margin

- U.S. Dollars (USD)

- British Pounds (GBP)

- Euros (EUR)

- Canadian Dollar (CAD)

- Swiss Franc (CHF)

- Swedish Krona (SEK)

- Japanese Yen (JPY)

- Norwegian Krona (NOK)

- Danish Krona (DKK)

- Hungarian Forint (HUF)

- Czech Krona (CZK)

- Polish Zloty (PLN)

- Australian Dollar (AUD)

Constraints in relation to currency usage are contained within the Rules.

All Clearing Members are required to hold House accounts in the currency of the contracts they trade at an approved financial institution participating in the APS (a "Payment Bank") and in an alternative currency which will be used on Currency Holidays.

A list of 2024 Currency Holidays can be found here.

Clearing Members must complete the APS Mandate for each account/currency pair which authorises the Clearing House to issue direct debits for amounts due in accordance with the Rules.Constraints in relation to currency usage are contained within the Rules.

Concentration Accounts

ICE Clear Europe has appointed JPMorgan Chase Bank NA, Citibank NA, Bank of America NA, the Bank of England and European Central Bank as consolidation banks. J.P. Morgan Chase Bank NA provides multi-currency payments, global custody and additional securities services, as well as a cash investment program. Citibank NA provides services for multi-currency payments and cash investments.

| Bank of America NA |

|---|

| Bank of England |

| Citibank NA |

| European Central Bank |

| J.P. Morgan Chase Bank NA |

Investment Activities

The primary objectives of the Clearing House’s investment activities are to safeguard the principal (safety), provide sufficient liquidity to meet all operational requirements (liquidity), obtain a reasonable rate of return (yield) whilst complying with relevant laws and regulations.

Cash is invested fully collateralised mainly via tri-party reverse repos and direct purchases of government bonds. Counterparties must have a minimum short-term rating of A-1/P-1 and a minimum long term rating of A-/A3 from any one of the following agencies; S&P, Moody’s or Fitch.

In compliance with the European Market Infrastructure Regulation (“EMIR”) requirements on Investment Policies, whenever possible non cash collateral is now held in dedicated ICE Clear Europe accounts at the CSDs used by the Clearing House.

Payment Flows

Cash Cut-Off Times

The cut off times for the deposit and withdrawals of cash to cover initial margin requirements in ECS are as follows.

Currency | Cut-off |

|---|---|

| EUR | 10:00 London time |

| GBP | 10:00 London time |

| USD | 11:45 Eastern time |

Acceptable Collateral & Haircut Calculation

The list of Permitted Cover accepted by ICE Clear Europe to cover initial margin and guaranty fund requirements is limited to cash and securities that demonstrate low credit, liquidity and market risk.

Haircuts applied to Permitted Cover and cross currency haircuts (where collateral is posted in a currency other than that of the initial margin liability) are set to a 99.9% confidence interval using a two-day holding period and a 4 year look-back period. Haircut floors and concentration limits may also be applied.

Further restrictions are in place for Permitted Cover lodged in respect of Futures & Options Guaranty Fund requirements as set out in Section 14 of the Finance Procedures.

Asset Cover Value Calculation

Cover value = Nominal*Price/100*(1-Haircut) + Nominal*Accrued where price is clean and accrued is expressed in %

Please be advised the Clearing House is permitted to adjust the price of assets at its own discretion. As standard practice at ICE Clear Europe, Posted Collateral* are given no cover value 2 business days prior to maturity and a cash call will be issued if your account is in deficit. Accrued interest will lose value one day prior to coupon pay date.

*For UK assets no cover value is given 7 days before expiry

Non-Cash Cut-Off Times | ||

|---|---|---|

CSD | Collateral Type | Cut-off |

| Euroclear UK & International Limited | Bilateral | 15:30 London time |

| Euroclear Bank | Bilateral & Triparty | 16:00 London time |

| Clearstream Banking S.A. | Triparty | 16:00 London time |

| Federal Reserve | Bilateral | 17:00 London time |

Cross Border Instructions via Euroclear Bank:

CSD | Collateral Type | Cut-off |

| Euroclear France | Bilateral | 12:00 London time |

|---|---|---|

| Clearstream Banking Frankfurt | Bilateral | 12:00 London time |

| Clearstream Banking Luxembourg | Bilateral | 12:00 London time |

Non Cash Collateral Securities Settlement Instructions to be completed before depositing non cash collateral.

ICE Clear Settlement Details

CSD | For Non-FCM Client segregated accounts | FCM Client segregated accounts |

| Euroclear UK & International Limited (For Gilts) | ICE Clear Europe CREST: 6NUAA | N/A |

|---|---|---|

| Euroclear Bank (For non-US Securities) | ICE Clear Europe EOC participant: 14800 | ICE Clear Europe: 60765 |

| Federal Reserve (For US Securities*)** | JPMorgan Chase US ABA 021000021 FED mnemonic: JPMCHASE/IECLRCLEAR Account: G68702 | JPMorgan Chase US ABA 021000021 FED mnemonic: JPMCHASE/IEDCLEARUS Account: G68713 |

*The maximum amount per instruction is 50M

** ICE Clear Europe also uses State Street as a Custodian for US Treasuries on certain accounts. Members wishing to use State Street as a custodian for US Treasuries should contact ICE Clear Europe Treasury

Account & Margin Fees

Application & Annual Fee | Application Fee | Annual Fee |

| House and Affiliate Accounts (“H”, “F” and “R”) | Waived | Waived |

| Segregated Customer Accounts (“C”, “E”, “K”, “S”, “T”, “W” and “Z”) | Waived | Waived |

| Standard Omnibus Indirect Customer Accounts (O”, “P”, “X” and “Y”) | Waived | Waived |

| Gross Omnibus Indirect Customer Accounts (“A” and “B”) | Waived | €5,000 per annum per Customer Account |

| Individually Segregated Operationally Co-mingled (“ISOC”) Account (“I” and “J” Account) | Waived | €5,000 per annum per Individual Customer |

| Individually Segregated Sponsored Account (“Sponsored Principal”) | €10,000 per Sponsored Principal | €25,000 per annum per Sponsored Principal |

Circular C15/099 dated 21 July 2015 includes additional information in relation to Charges for EMIR Customer Accounts.

Rates of Return: Margin Deposits | Cash | Collateral | Triparty Collateral |

| House and Affiliate Accounts (“H”, “F” and “R”) | Clearing House pays IDR | Clearing House charges 10 basis points | Clearing House charges 10 basis points |

| Segregated Customer Accounts (“C”, “E”, “K”, “S”, “T”, “W” and “Z”) | Clearing House pays IDR | Clearing House charges 10 basis points | Clearing House charges 10 basis points |

| Standard Omnibus Indirect Customer Accounts (O”, “P”, “X” and “Y”) | Clearing House pays IDR | Clearing House charges 10 basis points | Clearing House charges 10 basis points |

| Gross Omnibus Indirect Customer Accounts (“A” and “B”) | Clearing House pays IDR minus 15 bps | Clearing House charges 12 basis points | Clearing House charges 12 basis points |

| Individually Segregated Operationally Co-mingled (“ISOC”) Account (“I” and “J” Account) | Clearing House pays IDR minus 15 bps | Clearing House charges 12 basis points | Clearing House charges 12 basis points |

| Individually Segregated Sponsored Account (“Sponsored Principal”) | Clearing House pays IDR minus 20 bps | Clearing House charges 15 basis points | Clearing House charges 15 basis points |

Guaranty Fund: Margin Deposits | Cash | Collateral | Collateral |

| All Clearing Members | Clearing House pays IDR | Clearing House charges 10 basis points | N/A |

For more information regarding the ICE Deposit Rate (“IDR”), which is the basis of the rate of interest paid to Clearing Members on cash balances from their cash margin deposits, please refer to latest Circular No. C23/131. The IDR file is available to Clearing Members via our SFTP site, MFT. If you require access to MFT, please contact [email protected].

Triparty Collateral

ICE Clear Europe offers Clearing Members the option of depositing collateral via the Triparty mechanism via Triparty agents Euroclear Bank and Clearstream Banking Luxembourg to cover initial margin requirements. More information on depositing Triparty collateral with the Clearing House can be found below.

The Member’s arrangements with Triparty may require operational arrangements independent from ICEU.

Triparty Agreements

Euroclear

Triparty Contract Annex III CSA

Triparty Contract (upon request)

Clearstream

Gold Bullion

ICE Clear Europe offers Gold Bullion as permitted collateral to cover initial margin requirements. More information on using Gold Bullion to cover initial margin requirement can be found below.

Gold Collateral Signatories Form

Clearing Members

Extensible Clearing System (ECS)

The Extensible Clearing System (ECS) provides Clearing Members with information about the assets deposited and can be used by Clearing Members to instruct a deposit of cash, securities and other assets into the Clearing House and, when there is excess margin, to instruct to withdraw assets held on deposit. Training is provided on ECS by the Clearing House (as required).

Collateral Bulk Deposit Withdrawal file format Specification

Banking Reports

Report | Description |

|---|---|

| MBCAA(C) | Provides detail of all cash movements relating to Member position including Variation Margin, Mark to Market Margin, Interest payments, NLV, PAI etc. |

| MBCC(C) | Provides detail of utilization of assets to cover Standing Requirements. |

| MBCOB(C) | Provides detail of collateral balances and valuation. |

| MBCOT(C) | Provides a list of all Collateral movements processed. |

| MBIA(C) | Provides detail of accrued interest on Cash balances maintained by the Clearing House. |

| MBIP(C) | Provides detail of Interest posted at end of accrual period. |

| MBSR(C) | Provides detail of all margin requirements including Initial Margin (as calculated by ICE Risk Model), Buyer’s/Seller’s Security, Net Liquidation Value, Contingent VM; this provides comprehensive and complete details regarding the totality of margin that the Member must cover. |

| MBCD | The report provides members with a breakdown of the assets used to cover the standing requirements for each currency (CSV only). Please note that this information is also available in MBCC PDF but not in MBCC CSV. |

| GBCP | Provides prices for collateral. This file can be found on MFT in pub/reference. |

| GBFX | Provides FX rates. This file can be found on MFT in pub/reference. |

| GBIR | Provides interest. This file can be found on MFT in member/reference. |

The full report specification for ICE Clear Europe can be found at: Report Spec Link