Chicago — Tokyo — Shanghai

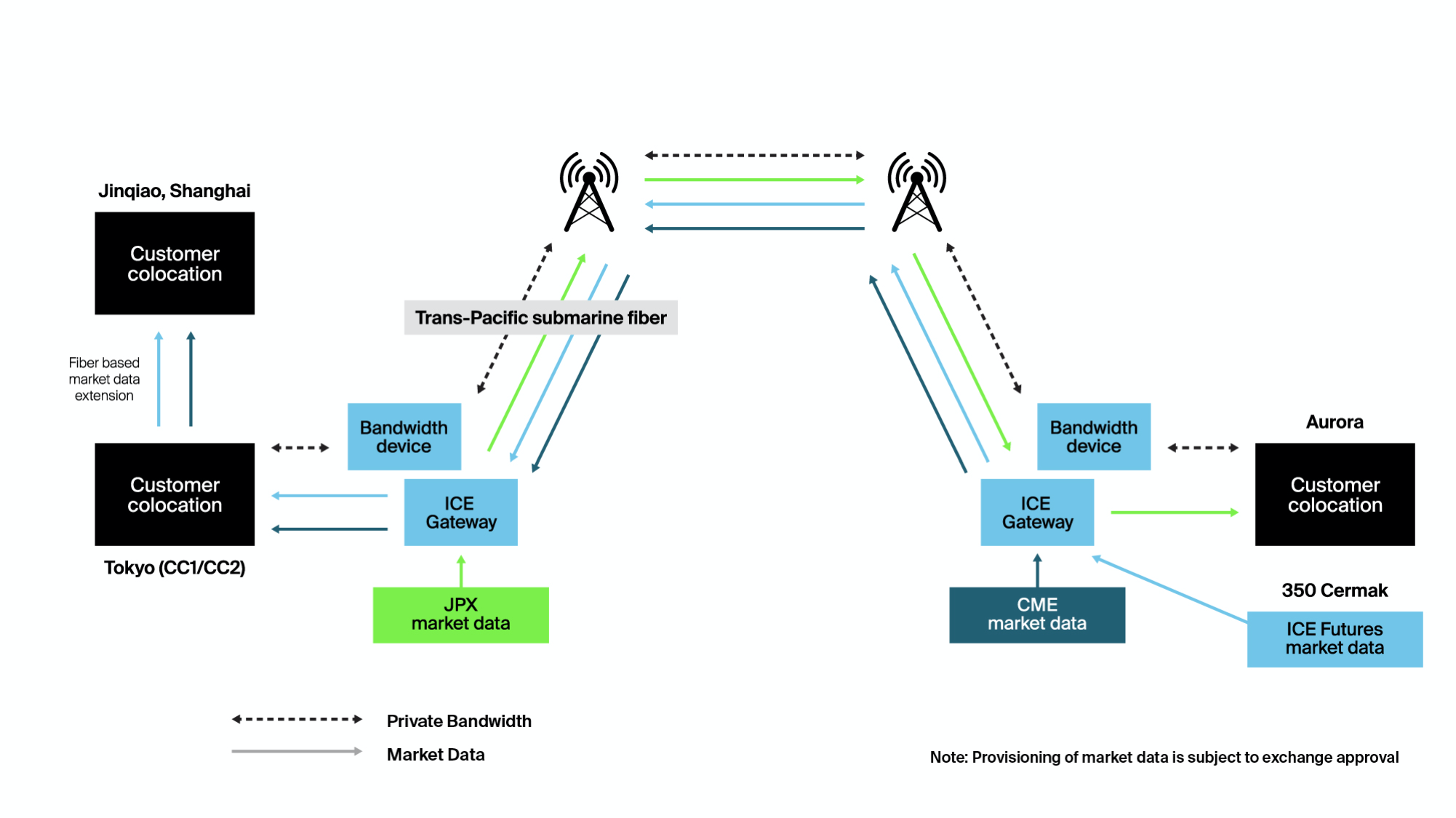

The Chicago to Tokyo route offers efficient access to North American and Asian financial markets. Designed and built specifically for the needs of low-latency traders, this network is engineered to deliver competitive market data and discretionary bandwidth services while also ensuring high levels of reliability.

Chicago — Tokyo

This hybrid network of wireless towers, fiber-optic lines and submarine cables connects the Japan Exchange Group (JPX) data center in Tokyo, to CME’s data center in Chicago. Market data includes the most widely traded futures on the ICE, JPX and CME; including equities, metals, energy, cryptocurrency and soft commodities futures.

Connectivity in Shanghai

Market Data Feeds

CME and ICE data delivered in Tokyo (CC2/CC1) and Shanghai (JinQiao)

JPX data delivered in Aurora

Best bid and ask, front two contracts

Proprietary market data protocol, optimized for wireless service

Bandwidth

Bi-directional layer 2 private bandwidth

Available in 1Mb/s – 5Mb/s allocations

Bandwidth aggregation using FPGA

Market Data Feeds

CME and ICE data delivered in Tokyo (CC2/CC1) and Shanghai (JinQiao)

JPX data delivered in Aurora

Best bid and ask, front two contracts

Proprietary market data protocol, optimized for wireless service

Bandwidth

Bi-directional layer 2 private bandwidth

Available in 1Mb/s – 5Mb/s allocations

Bandwidth aggregation using FPGA

Symbol list

Westbound ICE data

Brent Crude Futures (B)

WTI Crudes Futures (T)

Dubai 1st Line Futures (DBI)

Sugar No. 11 Futures (SB)

Cotton No. 2 Futures (CT)

MSCI EM Index Futures (MME)

Westbound CME data

E-Mini S&P 500 (ES)

E-Mini NASDAQ 100 (NQ)

E-Mini DOW $5 (YM)

E-Mini S&P Midcap 400 (EMD)

Gold (GC)

Silver (SI)

Copper (HG)

Crude Oil (CL)

Soybean (ZS)

Bitcoin (BTC)

Ethereum (ETH)

Eastbound JPX data

Nikkei 225 Futures

Nikkei 225 Mini

Topix Futures

Mini-Topix Futures

JPX-Nikkei Index 400 Futures

10-Year JGB Futures

Gold Standard Future

Crude Oil Future

Westbound ICE data

Brent Crude Futures (B)

WTI Crudes Futures (T)

Dubai 1st Line Futures (DBI)

Sugar No. 11 Futures (SB)

Cotton No. 2 Futures (CT)

MSCI EM Index Futures (MME)

Westbound CME data

E-Mini S&P 500 (ES)

E-Mini NASDAQ 100 (NQ)

E-Mini DOW $5 (YM)

E-Mini S&P Midcap 400 (EMD)

Gold (GC)

Silver (SI)

Copper (HG)

Crude Oil (CL)

Soybean (ZS)

Bitcoin (BTC)

Ethereum (ETH)

Eastbound JPX data

Nikkei 225 Futures

Nikkei 225 Mini

Topix Futures

Mini-Topix Futures

JPX-Nikkei Index 400 Futures

10-Year JGB Futures

Gold Standard Future

Crude Oil Future