Chat API Solutions

ICE Connect’s Chat application combines the power of messaging, automation and data integration to help you both streamline market communications and make more informed trading decisions. Leverage the Chat API to help create efficiencies and speed up business processes by automating the delivery of information to users on the Chat platform.

All APIs are available as a client side API that connects directly to the Chat application, or as a REST/Websockets server API.

Using the Chat API

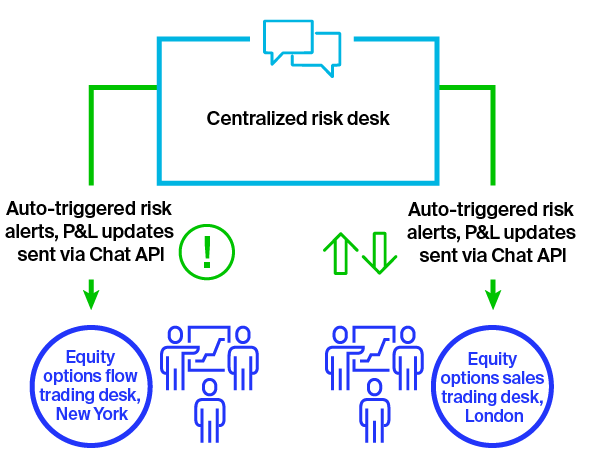

Auto-trigger risk and position alerts from in-house risk models to trading desks

The Chat API can be used to auto-trigger risk alerts and profit and loss (P&L) updates to traders directly within their chat workflow, as in-house risk desks update their risk parameters and volatility models throughout the trading day.

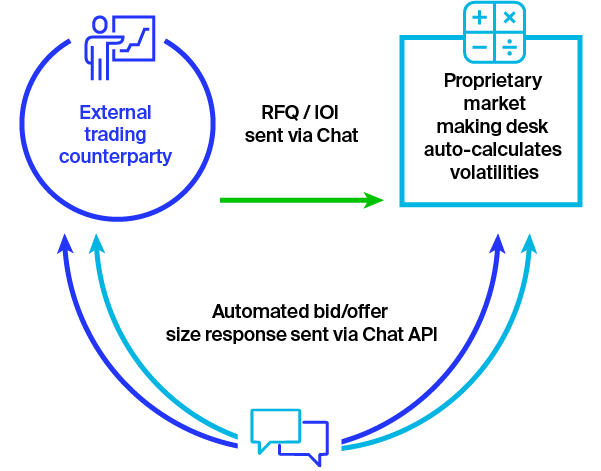

Automatically review and respond to RFQs and IOIs from external trading counterparties

The Chat API can be used to automate bid/offer size responses back to an external trading counterparty as proprietary market making desks auto calculate volatilities.

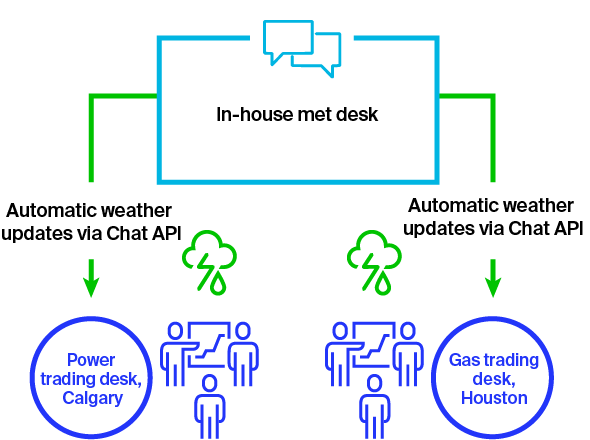

Auto-disseminate proprietary research or breaking news to help your traders gain a competitive edge

Using the Chat API, observed and forecasted weather data can be automatically disseminated to internal gas & power trading desks from in-house meteorologists.

Functionality available via the ICE Connect platform

Trade

Seize opportunities with access to ICE's liquid and transparent global markets

Chat

Build relationships with global market participants in a secure, compliant environment

Options Analytics

Seek to outperform with an intuitive options pricing tool tailored for your trading needs

Trade

Seize opportunities with access to ICE's liquid and transparent global markets

Chat

Build relationships with global market participants in a secure, compliant environment

Options Analytics

Seek to outperform with an intuitive options pricing tool tailored for your trading needs