ICE Options Analytics

Gain a competitive edge with options valuation, analytics and risk management.

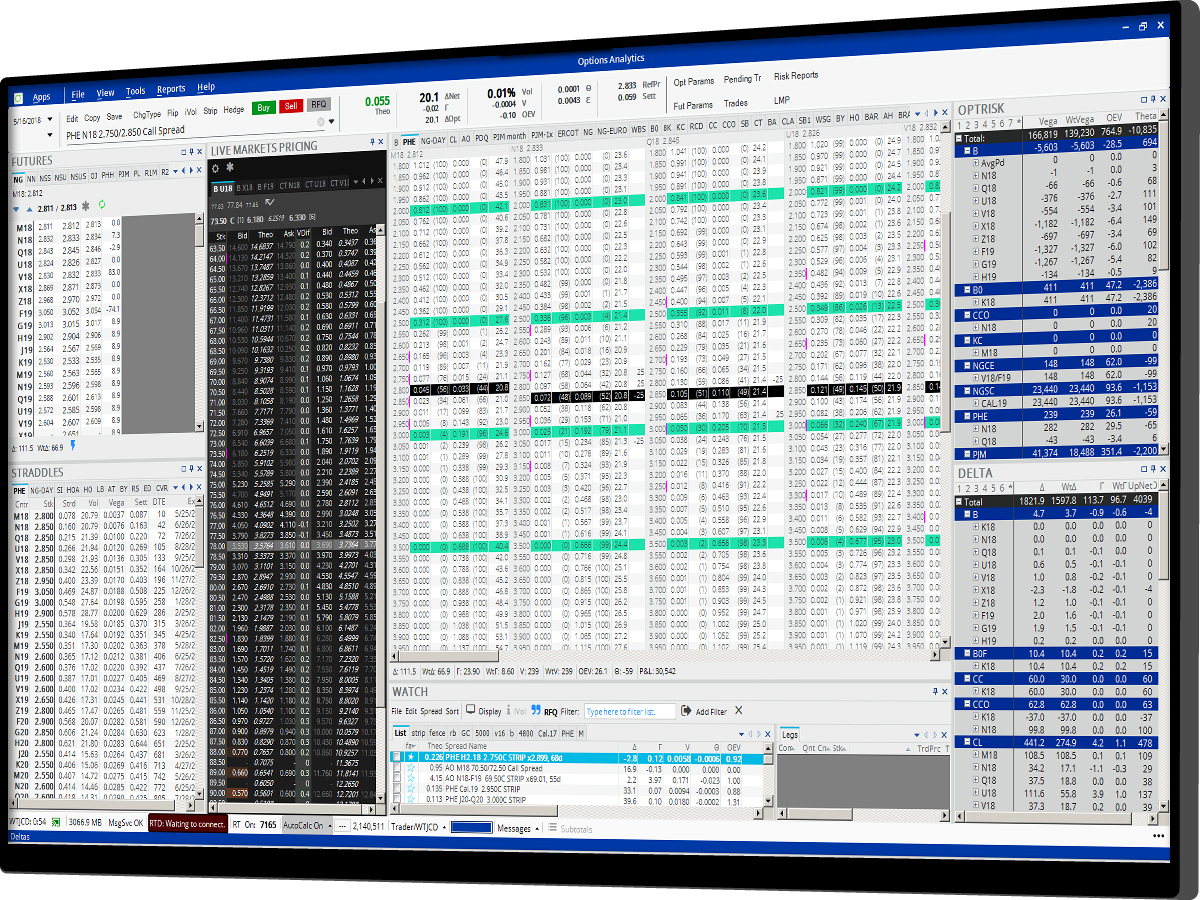

Quickly price strips and spreads, identify trading opportunities and manage risk in real time with advanced options valuation, analytics and risk management that supports the latest and most complex options trading strategies.

Why Options Analytics?

Options Valuation

Price and manage basic options to exotics with sophisticated options pricing models and volatility curve management.

Options Pricing Sheets

Quickly price spreads and strips right from the options pricing sheet with highly customizable layouts.

Real-time Risk Reports

Run different scenarios based on changes to volatility, futures prices and time to expiration.

Options Valuation

Price and manage basic options to exotics with sophisticated options pricing models and volatility curve management.

Options Pricing Sheets

Quickly price spreads and strips right from the options pricing sheet with highly customizable layouts.

Real-time Risk Reports

Run different scenarios based on changes to volatility, futures prices and time to expiration.

Live Markets Pricing

Spot opportunities with real-time options market quotes by strike, and corresponding theoreticals.

Valuation Service

Generated theoretical valuations and greeks can be viewed live with Instant Message and Trade.

Order Fill Service

Automatic updates of trades and risks, provided by exchanges in real time, for electronically executed futures and options.

Live Markets Pricing

Spot opportunities with real-time options market quotes by strike, and corresponding theoreticals.

Valuation Service

Generated theoretical valuations and greeks can be viewed live with Instant Message and Trade.

Order Fill Service

Automatic updates of trades and risks, provided by exchanges in real time, for electronically executed futures and options.

Request a demo

ICE Option Analytics suite of option models allows for negative underlying prices. Users can manage their risk on any exchange traded option in Commodity & Energy, even if the option market merely implies that there is chance for such event.