April 2022

Accidental Greenwashing:

How asset managers can use data to help avoid it

As investor appetite for sustainable funds booms, asset managers eager to capitalize on demand face rising scrutiny in a sector where “greenwashing” is a growing concern. Greenwashing by an asset manager - presenting misleading information on the environmental attributes of a product - is a particular focus for regulators, given that environmentally-focused funds continue to dominate the ESG scene. Here, an emphasis on better disclosure and transparency is growing. Greenwashing can also be accidental, because asset managers face a dizzying array of choice around data sets and ratings to support their claims. Yet there are steps they can take to verify the attributes of their product (see "Know your data") which will help them to minimise compliance risk.

Meanwhile, green finance rules are proliferating. The U.S. Securities and Exchange Commission has proposed rule changes that would require registrants to make certain climate-related disclosures, including information about climate-related risks that are likely to have a material impact on their business. In the EU, rules came into effect this year requiring any listed entity with more than 500 staff to publish the percentage of revenue, capital expenditure and operating costs from activities covered by the European Commission’s “Green Taxonomy,” a definition of environmentally sustainable activities. These rules come on top of the EU’s Sustainable Finance Disclosure Regulation (SFDR) which requires financial institutions to make product-level disclosures on sustainability objectives, performance against those objectives, and how a product considers principal adverse impacts on enumerated sustainability factors.

While asset managers are figuring out how to meet stakeholder expectations and comply with new regulatory requirements, the risk of being accused of greenwashing rises when they cannot provide sufficient support for claims around the ESG attributes of their funds. Greenwashing is now being defined by regulators, with the EU’s market watchdog announcing it will start working on a legal definition of the concept to underpin enforcement action. Key stakeholders in the ESG investing community are also taking action, with Morningstar revealing it removed more than 1,200 funds with a combined $1.4 trillion in assets from its European “sustainable” investment list after reviewing the funds’ legal documents in connection with the SFDR.

Financial firms’ ability to protect themselves against accusations of greenwashing and to comply with disclosure requirements depends on access to comprehensive, timely, and detailed data. Investors will likely consider relying on ratings or other composite information to be insufficient to support their detailed due diligence requirements. Ratings are unlikely to help an investor determine whether, for example, an investee biofuels company’s Scope 2 emissions are material, or if the company is operating on a site with water stress, which is not captured because data that would show this was not part of the ESG rating the asset manager used. Instead, a more realistic assessment may require the use of raw data to understand the environmental impact of a portfolio.

ICE ESG Data uses raw data with detailed, normalised, ESG attributes and indicators about public companies. It offers this in a standardized format, mapped to individual bonds and equities. ICE’s data quality is managed through the combined use of technology and a dedicated team of data analysts. Every data attribute is carefully analysed by ESG specialists and validated with technology.

For maximum granularity, ICE’s data includes GHG Scope 1, Scope 2, Scope 3 (see definitions below) and companies’ progress on meeting carbon reduction targets. Data is also available for other ESG metrics, including other environmental-related issues, workforce (broken down by gender, race and location), and company board changes. Through its offering of detailed ESG attributes and indicators in a standardized format, ICE ESG Data provides clients with needed transparency and tools to uncover opportunities, manage risk, and meet regulatory obligations.

The direction of travel on investor demand for ESG products is clear: it’s growing. Since the mandatory classification of European funds against the SFDR classifications came into force last March, funds classified as “sustainable” grew by almost 30%. A recent global survey conducted by PwC, which focused heavily on exchange-traded fund providers, also showed 46% of participants expected over half of their product launches in the coming year would be ESG-focused. Against this backdrop, using data to unlock the best insights and provide transparency on ESG performance will increasingly be the best way for asset managers to avoid accidental greenwashing.

Learn more about ESG Data

Related Content

Know your data

For asset managers, obtaining and applying raw, granular data is a first step toward meeting regulatory demands around transparency and disclosure. Being aware of the potential bias and limitations of the data they receive from data vendors is also crucial. Data vendors can introduce bias in the way they collect data and the sources they collect it from as well as how they report it. For example, if only a portion of index constituents report their Scope 1 and 2 emissions, a data vendor might provide a total index output that is “inferred” rather than being “fact”. Asset managers should push to understand if the data vendor provides any derived data, and, if so, what the support is for such data. Additionally, where data vendors provide scores or ratings, asset managers should push for supporting information. For example, a “high” rating for an ESG fund could be highly subjective, depending on the inputs used by the data vendor. The bottom line: a focus on facts rather than scores is critical, and asset managers should not apply data itself without a clear understanding of potential biases introduced by the data vendor.

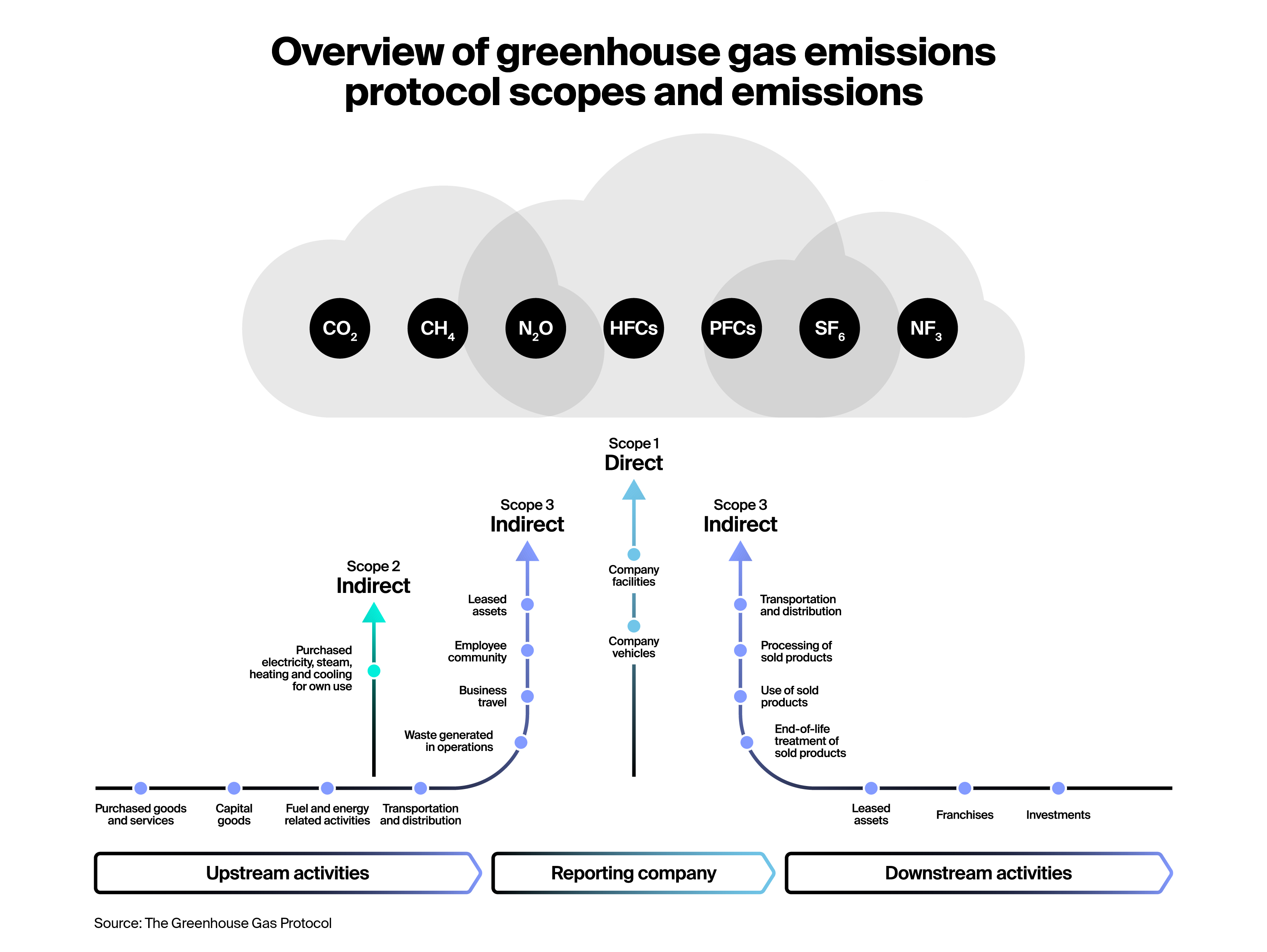

How Greenhouse Gas Emissions are Defined

Scope 1

Emissions are direct emissions from owned or controlled sources.

Scope 2

Emissions are indirect emissions from the generation of purchased energy. This can be reported as “market based” which reflects any direct agreements the reporter may have with energy producers, such as Renewable Energy Certificates (RECs). It can also be reported as “location based” which reflects the emissions from the energy used by the reporter.

Scope 3

Emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream activities.