Four motivations that drive ESG data use

Understanding motivation to create a tailored approach

Head of Sustainable Finance, ICE Data Services

Data is a key ingredient to the ESG revolution. Lack of quality data can hinder investors, issuers and policymakers’ ability to quantify the impact of decisions or make informed choices about resource allocation. For many companies, the application of ESG data is new. This, combined with the limited amount of available and disclosed data, has historically led data providers and rating firms to provide information they deemed most material - for example, emissions data is seen as important for a heavy industrial, not so much for a financial services firm.

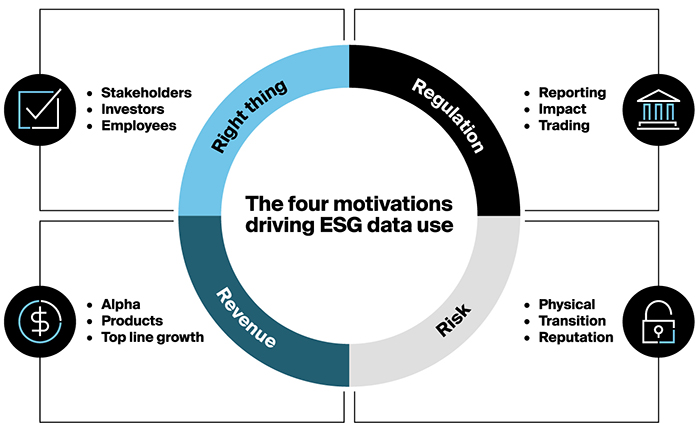

Yet this approach can fall short in reflecting the data user’s goals and motivations. As the ESG revolution evolves, I believe we need a more tailored approach to help inform better outcomes. For this, I‘ve found it helpful to examine the motivation of a data user through four categories: Right thing, Risk, Revenue and Regulation. For users of ESG data, clarity around this topic can help inform the data they need.

While most market participants won’t sit neatly into one category, it speaks to their primary motivation.

Right thing

The genus of ESG investing came from the world of SRI or Socially Responsible Investing, which focuses on investment that aligns with a specific set of values. I call this “Right thing” investing. A similar approach is seen in social impact investing, where investors assess the impact of their capital on a group/s of stakeholders - such as people living in a locality who would benefit from the investment.

Having a positive “socially responsible” impact is still a key driver for many investors. This motivates fund managers to apply it to investment strategies and marketing. To some degree this is where the concern about greenwashing arises - where claims could be made around an investment approach without utilising the data to justify it. One test for investors is ensuring that a portfolio manager can clearly articulate how ESG is driving decision making.

A focus on the “right thing” is apparent in approaches such as negative screening, where investors seek to exclude companies whose actions conflict with their beliefs. Here, a trend to be aware of is the growing range of attributes that are screened for. For example, negative screening initially focused on business sectors like tobacco, pornography and controversial weapons, but now includes activities like the use of palm oil in food and animal testing. Negative screening is also reflected in many standards with a “do no significant harm” overlay, ensuring that investments don’t start off with a negative impact, albeit unintended.

Another approach sees investors seeking to affect societal change by influencing the actions of large organisations through engagement with management of their holdings. This could include changes to benefits such as maternity/ paternity leave or policies around gender pay parity. We see this approach in the way stewardship departments at institutional investors interact with firms to influence policies.

On the vendor side, understanding a “right thing” motivation means a data provider like ICE can tailor its solution. For example, in the U.S. we supply data to help users quantify multiple dimensions of socioeconomic vulnerability. Municipal bond clients can compare the impact of an investment between specific locations, and public company clients can benchmark themselves to peers with similar impact goals.

Risk

Investors, lenders and issuers have always sought to understand the risks they face using a range of data sets. This includes data on activities which could result in financial penalties such as emissions of toxic materials, and governance aspects which may raise a company’s risk profile.

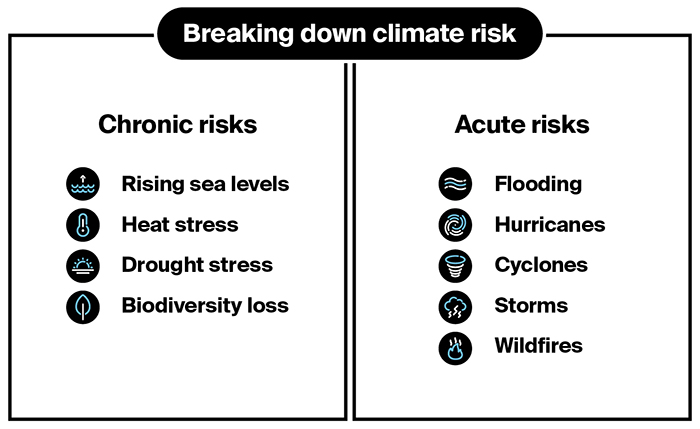

Climate risk has been one area spotlighted in sustainable finance. This manifests in two ways, physical risk and transition risk. Physical climate risk represents the risk to investments and loans through changes to the environment where their physical activities are situated. In addition, we see both acute and chronic risks which impact operations and, increasingly important, supply chains. ICE has worked with risQ to understand both these risks and apply them to the issuers of individual securities, allowing users to compare investments.

ESG data users should also consider different scenarios for the transition to a “net zero” carbon economy and plan accordingly. Here, the Intergovernmental Panel on Climate Change has described possible pathways the world may take depending on actions taken to mitigate climate change. Equally important is how society and governments are adapting to climate change. These changes come in the shape of societal norms, regulation and policies which impact the business environment. Examples include an increased plant-based diet impacting meat producers, or power generation mix changes impacting mining firms. As financial institutions review their investments, they need to assess the size, speed and directions these changes will have.

Poorly managed reputational risks can also be devasting to companies. These events include data breaches or human rights violations, which can have a material impact on both immediate and longer-term cash flows. Here, ESG data can help firms review potential markers before such risks materialise. ICE’s partnership with RepRisk - a company which combines advanced machine learning with analyst expertise - means we can offer insights and data for back-testing and analysis around specific risk events. Managing reputational risk includes reviewing policies, governance aspects and related historic incidents, along with evaluating new developments as they happen. Through systematic utilisation of these data sets, firms can better protect their investments.

Revenue

Approaching ESG with the purpose of making money may seem an anathema to some. Yet there are indications that many investors are unwilling to sacrifice returns to achieve ESG goals. In addition, a better understanding of companies through the application of rich ESG data sets can help market participants outperform.

Asset managers have found ESG to be good for business, with the pandemic accelerating demand for sustainable investments. Here, Europe has attracted the bulk of global inflows, followed by the U.S. While flows into the broader U.S. market fell 29% in the third quarter of 2021, flows into sustainable funds were more resilient, dipping by 12%. Many large asset managers view ESG as a profit driver and are investing in ESG-specific platforms and processes.

Similarly, many firms recognise ESG analysis as fundamental to their investment process. Bank of America incorporates ESG metrics from ICE in its client research reports to help enhance its global equity and credit analysis. This reflects a philosophy that sees integrated ESG assessment as central to profit motivations versus an additional step.

In the corporate issuer space, many of the largest owners of equity and debt securities see ESG awareness as integral to profit generation - BlackRock and State Street being key examples. Private companies that want to go public are increasingly subject to scrutiny around factors like board diversity and must address these issues or face hurdles to tapping public markets. Even companies which remain private but want to partner with or provide services to publicly-listed companies, may be increasingly asked to meet ESG criteria given wider scrutiny of the way companies do business. Reflecting this, a survey of over 1,000 CEOs by the U.N. Global Compact and Accenture found that nearly 80% said the pandemic highlighted the need for more sustainable business models. Here, there is growing recognition that overexposure to sectors in permanent decline is inherently bad for business, while efforts to address sustainability challenges can align businesses to long-term growth trends.

Access to ESG data across asset classes is crucial for market participants who want to align ESG goals with profit growth. While many data vendors focus on equities, ICE’s ESG data also includes 2 million fixed income instruments, with coverage of corporate bonds, municipals, sovereigns and money markets across the U.S., Europe and Asia.

Regulation

As application of ESG data and analytics become more mainstream, governments and regulators are applying greater scrutiny to the space. First, regulators seek to protect investors (especially retail investors) by ensuring that statements regarding ESG data, investment policies and impact are credible. Secondly, governments are increasingly using ESG data to drive policy, especially environmental policy, and to manage risks to regulated entities.

Efforts to crack down on greenwashing among both issuers and investors are growing, both from a policy perspective and oversight effort. The introduction of the EU Green Bond Standard is a good example, where the EU is seeking to ensure that issuance of green bonds (and in subsequent actions will expand to other impact bonds) is carried out to the highest standards. Whilst there have been good voluntary standards, notably the ICMA Green Bond Standards, there is no requirement to adhere to them. Now, more detailed data and information will allow investors to critically assess how the impact of the capital allocation of bonds aligns with their policies and approaches.

More broadly, we have seen a focus around company data disclosure, and the presentation of this information by financial market participants. The introduction of the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR) in Europe spotlight the need for high quality data for impacted firms. I’m expecting similar requirements in the UK and US based on recent statements by the FCA and SEC. To help with compliance, ICE offers an SFDR Principle Adverse Impact solution. This tool has up-to-date input values for most of the SFDR indicators, taken from a dataset that captures over 500 company-reported data points in addition to ESG Risk analysis.

Companies should be aware that the breadth and completeness of data required is often the “new” part of regulatory requirements, rather the data itself. As regulators scrutinize how investors make ESG-related decisions, there’s increasing demand for investors to formalize how they evaluate the as-reported ESG data around an investment, instead of relying solely on third-party ratings. This requires firms to focus on both managing and understanding their ESG data. As initiatives such as the European Single Access Point and CSRD come into play, they will also increase the data available. This will need to be collected and presented in a logical model to support users and ensure an efficient process. The user interface ICE has developed to manage these data sets means firms can better view and understand these ever-expanding data sets.

Governments have used regulation as a tool for policy implementation in many different spheres and sustainable finance is no different. We have seen the EU, in aiming to meet carbon reduction targets, use regulation to achieve this through the EU Green Taxonomy. This is designed to drive capital investment, through greater transparency and detail, to companies and projects aligned with its policy. We see the same with the introduction of Paris Aligned Benchmarks (PAB) and Carbon Transition Benchmarks (CTB), aiming to drive investment in companies aligned with carbon reduction goals. ICE indices help investment managers meet these objectives by providing a range of solutions for tracking and benchmarking purposes.

Finally, regulators have a requirement to manage risks, across the market as well as those specific to institutions. Here, we’ve seen growing regulatory focus on systemic climate risk. To demonstrate compliance, many companies are running specific climate risk stress testing. This has been evident in the UK with the Bank of England, and Europe through the European Central Bank. At ICE, we’ve focused on developing data sets which can help institutions to understand the possible impact of climate change on their investments.

There are myriad reasons for interest in ESG, and by extension ESG data. Understanding the motivations of each market participant is key to ensuring that the right data is presented, in the right way, at the right time. I expect that the current practice of looking at ESG as a single factor to be created and applied to decision making will evolve quickly into a more nuanced and complex environment where data will be specific to the use case required.