The auction process runs on the ICE Trading Platform which provides real-time order management, separation of house and client orders, live credit limit controls, a full audit history, compliance monitoring tools and advanced straight through processing using ICE’s APIs for trade capture, order entry and surveillance.

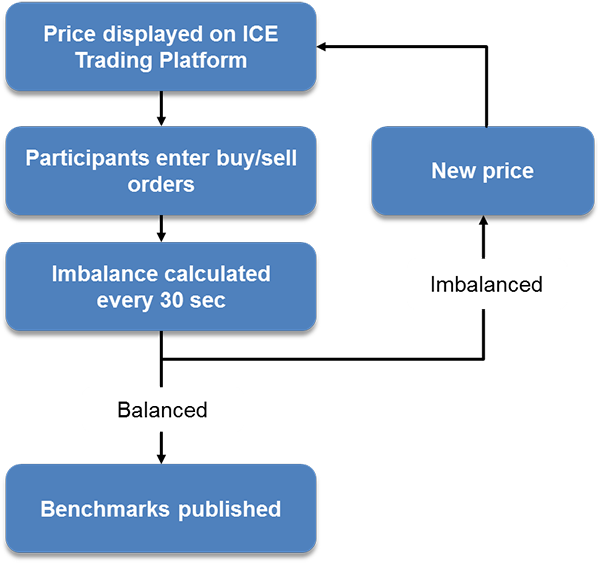

The auctions run in rounds of 30 seconds. At the start of each round, IBA publishes a price for that round. Participants then have 30 seconds to enter, change or cancel their orders (how much gold/silver they want to buy or sell at that price). At the end of each round order entry is frozen and the system checks to see if the difference between buying and selling (the imbalance) is within the imbalance threshold (normally 10,000 oz for gold and 500,000 oz for silver).

If the imbalance is outside of the threshold at the end of a round, then the auction is not balanced, the price is adjusted and a new round starts.

If the imbalance is within the threshold then the auction is finished and the price is set. Any imbalance is shared equally between all direct participants (even if they did not place orders or did not log in) and the net volume for each participant trades at the final price.

The final price is then published as the LBMA Gold Price or LBMA Silver Price in US Dollars and also converted into the benchmarks in British Pounds and Euros using foreign exchange rates from when the final round ended. N.B. the gold and silver auctions settle against US Dollars only. The benchmarks in British Pounds and Euros are not tradeable directly through the auction.

The prices during the auction are determined by an algorithm that takes into account current market conditions and the activity in the auction. Each auction is actively supervised by IBA staff.

Participants also have 30 minutes directly before the auction starts to queue up their orders. This is known as ‘Round zero’.

Licensing

The LBMA Gold Price and LBMA Silver Price benchmark settings are available under licence from IBA (including for valuation and pricing activities and for use in transactions). Prospective licensees should contact IBA’s licensing team at [email protected] for information on how to obtain a usage licence from IBA.

Please read IBA’s Benchmark and Other Information Notice and Disclaimer.