Connecting to IRM 2

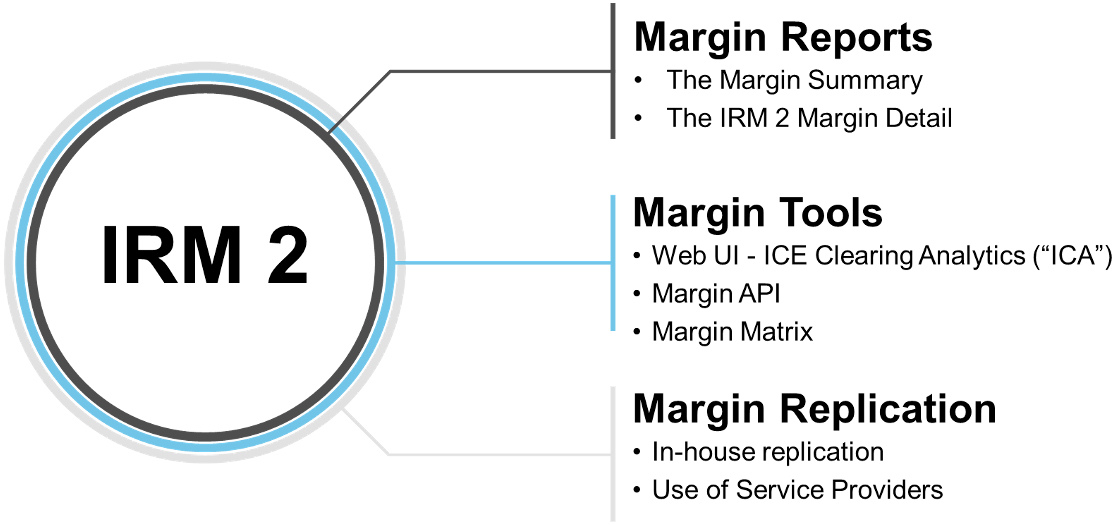

Margin Reports

Margin Tools

Margin Replication

Users who wish to replicate the margin calculation in-house can implement the model locally. Developer resources, including an External Developer Guide, Input Data File Specification and Reference implementation are available here.

A list of approved vendors who provide IRM 2 margin calculation services is available below. If you wish to use a vendor that is not on the list, please contact the vendor to ensure they are aware of the IRM 2 Project.

Margin Reports

Margin Tools

Margin Replication

Users who wish to replicate the margin calculation in-house can implement the model locally. Developer resources, including an External Developer Guide, Input Data File Specification and Reference implementation are available here.

A list of approved vendors who provide IRM 2 margin calculation services is available below. If you wish to use a vendor that is not on the list, please contact the vendor to ensure they are aware of the IRM 2 Project.

Connection options

See Approved Vendor list below for service provider solutions.

| Margin Solutions | Clearing Reports | Margin Tools | Margin Replication | |||

| Type | Clearing House Margin Reports | ICE Clearing Analytics - Web UI | Margin API | Margin Matrix | In-house Margin Replication | Service Provider |

|---|---|---|---|---|---|---|

| Supported Methodology | IRM 1 & IRM 2 | IRM 1 & IRM 2 | IRM 1 & IRM 2 | IRM 2 | IRM 2 | Check with Service Provider |

| Availability |

IRM 1: Live IRM 2 (ICUS): Live IRM 2 (ICEU): Jan 2024 (Parallel Run) Available to Clearing Members via ECS and MFT |

IRM 1: Live IRM 2 (ICUS): Live IRM 2 (ICEU): 2024 |

Jan 2024 (Parallel Run) | Jan 2024 (Parallel Run) |

ICUS - Now ICEU - Conformance Test started now Register to access Developer Resources |

See Approved Vendor list below |

IRM 2 Approved Vendors

| Vendor Name | Contact Details |

|---|---|

| Adenza Inc. | |

| Alphalion Technology Limited | |

| Cassini Systems | T: +44 20 7031 5730 Marc Knaap: [email protected] Frances Pickup: [email protected] Anthony Campbell-Brown: [email protected] |

| Cumulus9 | |

| FIS Global | |

| IF Informatica srl | |

| ION Group | |

| Nasdaq Technology AB | |

| OpenGamma Limited | |

| OptiMargin Software | |

| Revendex Solutions GmbH | Peter Hollenstein T: +41 43 305 83 64 +41 79 677 94 99 |

| Sernova Financials Ltd | |

| TS Imagine |

Resources

IRM 2 Methodology

ICE Risk Model 2 utilizes a Filtered Historical Simulation (FHS) Value-at-Risk (VaR) approach that models the behavior of a portfolio.

ICE Clearing Analytics

ICE Clearing Analytics (ICA) is ICE’s new web-based platform for calculating ICE Risk Model 2 initial margin (IM) and related margin add-ons.

Frequently Asked Questions

A list of questions and answers relating to ICE Risk Model 2.

IRM 2 Methodology

ICE Risk Model 2 utilizes a Filtered Historical Simulation (FHS) Value-at-Risk (VaR) approach that models the behavior of a portfolio.

ICE Clearing Analytics

ICE Clearing Analytics (ICA) is ICE’s new web-based platform for calculating ICE Risk Model 2 initial margin (IM) and related margin add-ons.

Frequently Asked Questions

A list of questions and answers relating to ICE Risk Model 2.