Methodology

ICE Risk Model 2 (IRM 2) utilizes a Filtered Historical Simulation (FHS) Value-at-Risk (VaR) approach that models the behavior of a portfolio as a whole rather than measuring risk on an instrument by instrument basis. IRM 2 leverages a portfolio-level perspective by capturing all relationships and diversifying effects within a portfolio.

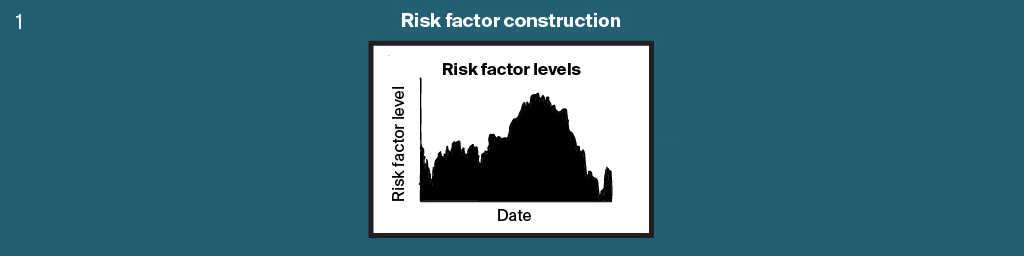

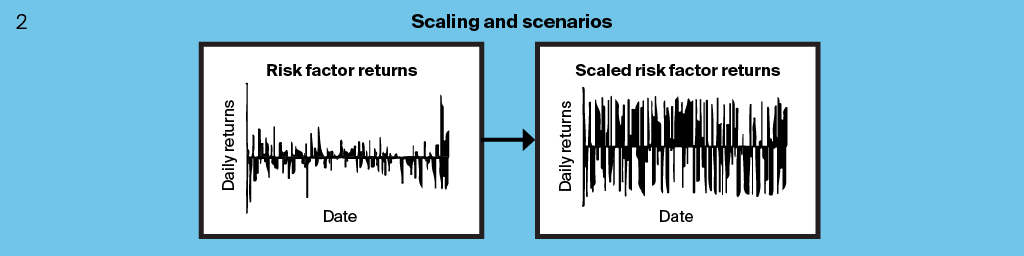

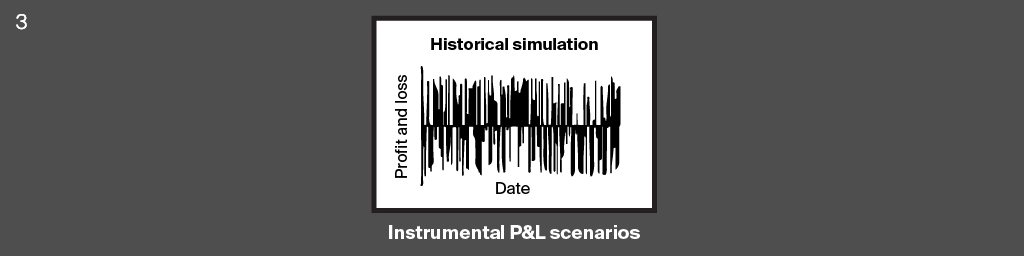

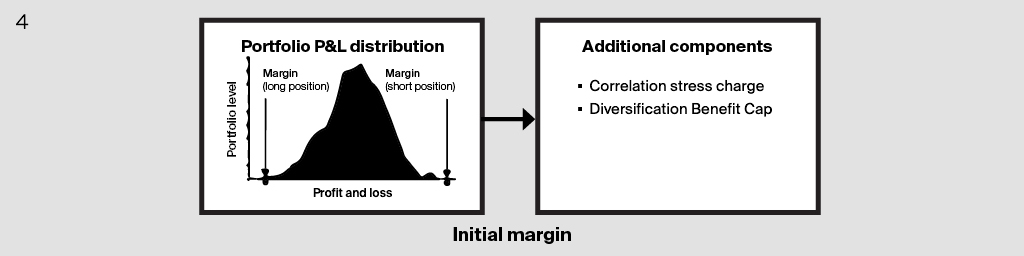

IRM 2 follows four calculation steps to generate the base margin. The first step is a transformation of market data objects from the original instruments to coherent set of risk factors. A risk factor may be in price, rate and volatility required to price all types of traded futures and options. These risk factors are then scaled to generate risk scenarios which reflect the current market conditions. IRM 2 then applies relevant pricing functions to convert the risk factor scenarios back to the instrument P&L. In the final step of the calculation, all individual instrument P&Ls are aggregated up to the portfolio to generate the P&L distribution over the lookback window from which to compute the Value at Risk at the target confidence level.

The final IRM 2 margin incorporates additional margin components including correlation stress charge, diversification benefit cap, anti-procyclicality, seasonality adjustment and volatility floor to achieve full regulatory compliance and prudent risk management objectives.

IRM 2 Initial Margin Flow

IRM 2 Model Components

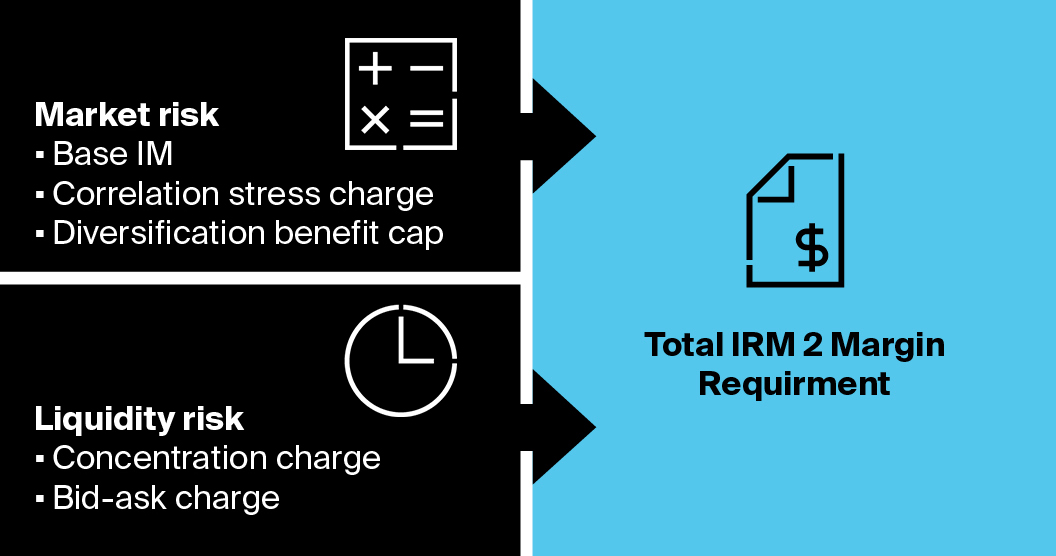

The overall IRM 2 portfolio margin requirement is the sum of two model components, the portfolio’s market risk and liquidity risk charge components.

The market risk component corresponds to the base margin requirement over the standard margin period of risk. The base margin is measured using the Value at Risk approach with additional regulatory and risk-based model features.

The liquidity risk component accounts for additional cost of liquidation which is not captured in the base margin. The liquidity risk component further breaks down into the concentration and the bid-ask charges.

Base IM The Base IM represents the base market risk derived from the FHS and portfolio time series returns. |

Correlation Stress Charge (CSC) The CSC incorporates the potential impact of correlation breakdown between the portfolio instruments. |

Diversification Benefit Cap (DBC) Similar to a spread charge found in IRM 1, the DBC value represents an increase in initial margin that ensures offsets between different product groups do not exceed specific thresholds. |

Concentration Charge (CC) The CC covers the additional risk associated with liquidating concentrated positions that exceed a predetermined volume threshold. |

Bid-Ask Charge (BAC) The BAC provides protection against liquidation costs arising from crossing the bid-ask spread of any given market. The Bid-Ask Charge is applicable to all positions in all portfolios regardless of size. |

Resources

IRM 2 Methodology

ICE Risk Model 2 utilizes a Filtered Historical Simulation (FHS) Value-at-Risk (VaR) approach that models the behavior of a portfolio.

ICE Clearing Analytics

ICE Clearing Analytics (ICA) is ICE’s new web-based platform for calculating ICE Risk Model 2 initial margin (IM) and related margin add-ons.

Frequently Asked Questions

A list of questions and answers relating to ICE Risk Model 2.

IRM 2 Methodology

ICE Risk Model 2 utilizes a Filtered Historical Simulation (FHS) Value-at-Risk (VaR) approach that models the behavior of a portfolio.

ICE Clearing Analytics

ICE Clearing Analytics (ICA) is ICE’s new web-based platform for calculating ICE Risk Model 2 initial margin (IM) and related margin add-ons.

Frequently Asked Questions

A list of questions and answers relating to ICE Risk Model 2.

IRM 2 is covered under various patents and patent applications in the US, Canada, Europe and Singapore, including US Patent Nos. 10,922,755; 11,023,978; 11,216,886; and 11,321,782.