Regulation

ICE Clear Netherlands is an authorized central counterparty and has a license in accordance with articles 14 and 17 of the Regulation (EU) No. 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (EMIR).

De Nederlandsche Bank (Dutch Central Bank, DNB) granted EMIR authorization on 12 December 2014. Both DNB and AFM are the National Competent Authorities for ICE Clear Netherlands. ICE Clear Netherlands is dedicated to ensure supervision, compliance and reliable operation of markets. All obligations required by EMIR are implemented and are monitored continuously.

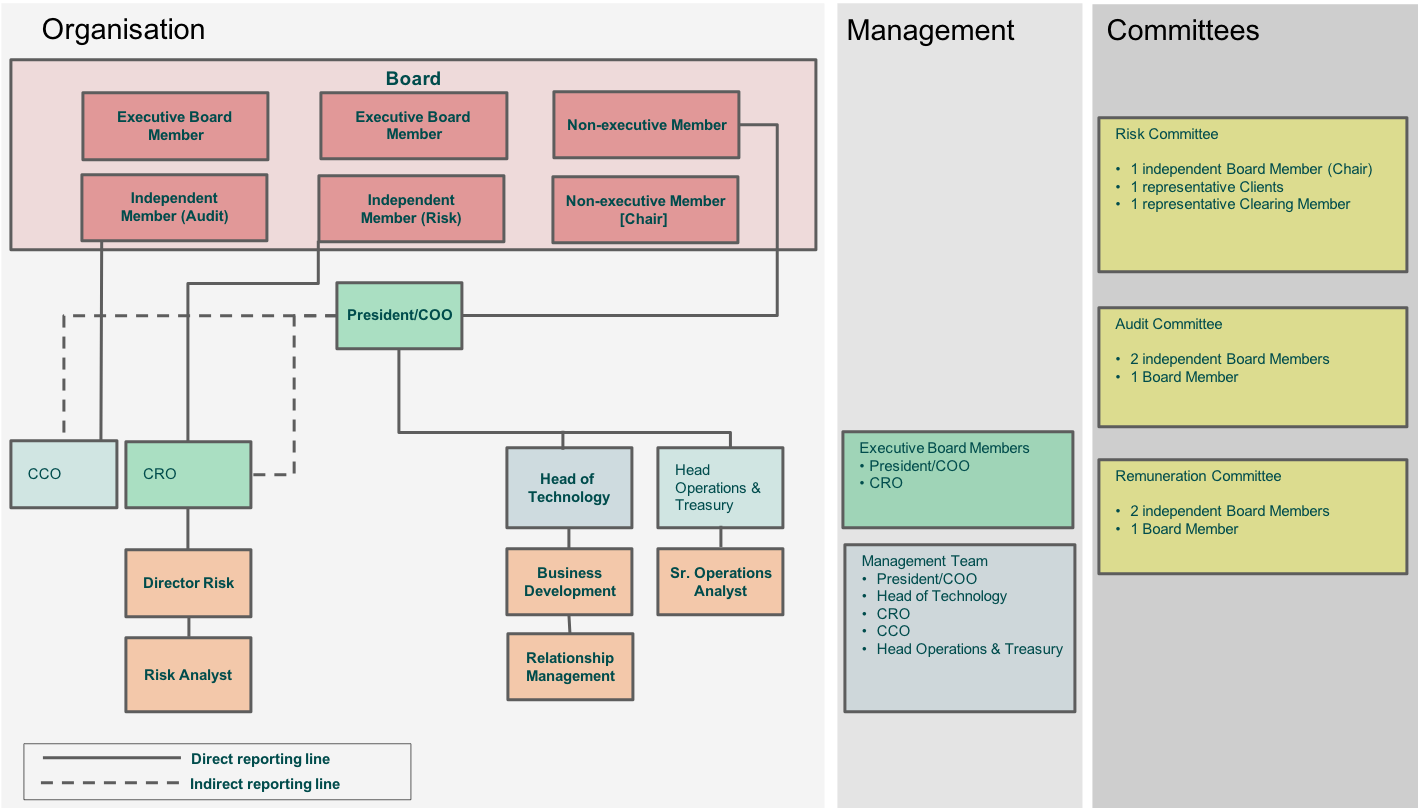

ICE Clear Netherlands governance structure and risk & compliance frameworks are set-up according to EMIR. This is supported by a remuneration policy that promotes sound and effective execution of all functions without any incentive to relax the internal standards. In addition to a fixed pay, employees could be granted a variable pay that is not linked with ICE Clear Netherlands financial business results.

ICE Clear Netherlands

Rules

Disclosures

Statutory Accounts

Regulatory Disclosures

Reporting