Fixed Income Trading Analytics

Increase transparency and help modernize your fixed income order flow

Technology enhancements are facilitating the electronification of fixed income markets. And with increased electronification, new practices are emerging—an increase in electronic trading, the automation of trading workflows, an introduction of new trading protocols, and increase in the number of firms engaging in portfolio and ETF trading—just to name a few.

ICE Trading Analytics

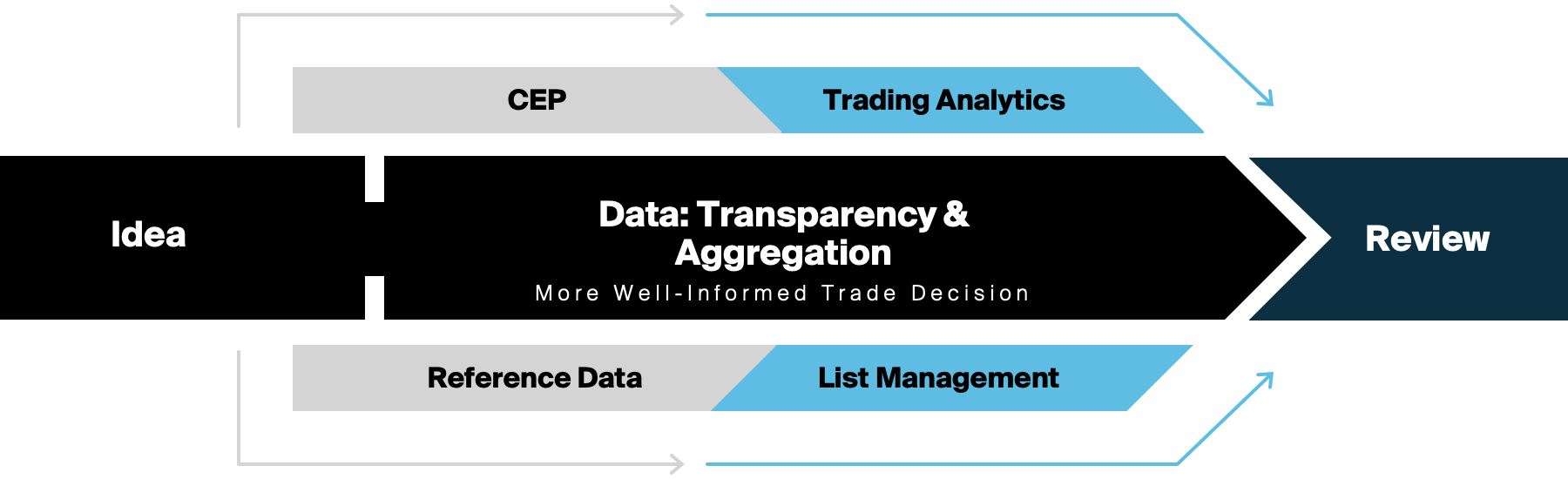

To help support the evolution of the fixed income market structure, ICE provides more timely fixed income data related to pricing, liquidity, execution quality, transaction cost analysis, market depth and market sentiment. Insightful, high-quality fixed income evaluated pricing and trading analytics data can be critical components to help inform fixed income trade execution.

ICE offers a comprehensive suite of fixed income trading analytics.

Analytic use-cases

Develop or enhance low-touch trading

- Algorithmic automated trading

- Automate RFQ request & response

Improve overall high-touch trading

- Increase electronic trade flow

- Higher quality, more informed trade decisions

- Reduce information leakage

- Attribute trading

Expand fixed income trading protocols

- Portfolio trading

- RFQ

- Create / redeem

- Central Limit Order Book

- Crossing

Broker selection & ranking by

- Asset class

- Sector

- Tenor

- Instrument

Develop or enhance low-touch trading

- Algorithmic automated trading

- Automate RFQ request & response

Improve overall high-touch trading

- Increase electronic trade flow

- Higher quality, more informed trade decisions

- Reduce information leakage

- Attribute trading

Expand fixed income trading protocols

- Portfolio trading

- RFQ

- Create / redeem

- Central Limit Order Book

- Crossing

Broker selection & ranking by

- Asset class

- Sector

- Tenor

- Instrument

The suite of content solutions

Support intra-day workflows with our innovative, rules-based pricing applications. Overseen by a team of evaluators, our fixed income evaluations systematically capture and incorporate market information and are designed to be responsive to market conditions. |

ICE Data Services offers Size Adjusted Pricing (SAP) for fixed income instruments, extending the reach of our end-of-day (EOD) evaluations and continuous evaluated pricing (CEPTM) for fixed income securities. SAPs are intended to be used by clients to help value transactions and/or holdings that are smaller than the institutional round lot position represented by ICE’s evaluations. |

A statistical distribution approach for measuring bond trade execution quality, our Best Execution Service utilizes ICE’s evaluated prices to help clients monitor trading activities and help measure execution quality across counterparties, trading venues as well as a growing number of trading protocols. This content can also assist users with meeting regulatory obligations such as MiFID II in Europe, and FINRA Rule 5310 and MSRB Rule G-18 in the U.S. |

We define liquidity as “the ability to exit a position at or near the current value.” For fixed income securities, ICE developed quantitative and heuristic models to solve for this definition -- whether we are measuring liquidity for instruments that have generally experienced infrequent trading or for instruments that have an abundance of observable trading activity. |

Transaction Cost Analysis The Transaction Cost Analysis (TCA) model was created based on observing the relationship between BestEx Scores and the ICE Liquidity Indicators™ scores. The regression model runs using a rolling, timeweighted lookback during the trading day, to establish near-term market trend sensitivity while accumulating a reasonable amount of trade data to produce statistically viable results. |

Continuous Market Depth Indicators Continuous Market Depth Indicators provide perspective on the number of sources quoting a security as well as the number of trades executed on the security. |

Market Sentiment Service Market Sentiment scores are intended to help clients identify when there may be greater dislocation and differences of opinion in the market as to what an asset’s value may be. |