ICE Size-Adjusted Pricing for fixed income

Data for rapidly evolving markets

Published

February 2024

Senior Director, Product Management, ICE Data Services

Senior Manager, Business Development, ICE Data Services

Executive Summary

- ICE’s Size-Adjusted Pricing (SAP) is intended to be used by clients to help value fixed income transactions and/or holdings that are smaller than the institutional round lot position represented by ICE’s fixed income evaluations (typically 1MM or greater current face USD or local currency equivalent). SAP’s utility covers a wide range of applications across the front, middle and back offices:

- Trading - greater insight by security, market, side, and size to assist in making trading decisions.

- Oversight - assists firms by providing an independent data-based metric to perform internal review processes.

- Indicative values - helps firms value a wide variety of positions or transactions by taking into consideration size and trade direction.

- ICE has been offering SAP since 2018 as part of its Best Execution (Best Ex) service. The process to generate a size-adjusted price leverages the statistical distribution analysis generated by the ICE Best Ex service (as further described below and more fully in the Best Ex Methodology available to clients). Additionally, to generate SAP, ICE requires the user to enter the security ID, the side (i.e. buy or sell) and the size of the transaction and/or holding.

- The number of smaller fixed income transactions has risen significantly in the past few years (see Figure 2 below) and may be attributed to several factors, including, but not limited to:

- The “electronification” of fixed income markets

- Increase in passive investing leading to the greater adoption of fixed income exchange-traded fund (ETFs)

- The return of traditional retail and private banking investors to the fixed income market as a result of higher interest rates

- ICE can generate both a SAP bid and a SAP ask by using distributions for dealer buy trade activity and dealer sell trade activity, respectively. The size distinction varies by asset class and is primarily used to create distributions for various size categories including odd lot and micro lot type sizes for over 2 million fixed income instruments on-demand.

- SAP is part of ICE Trading Analytics, a robust suite of data and analytical tools involving the aggregation and contextualization of substantial amounts of structured and unstructured fixed income market data.

Introduction

Historically, the fixed income market has been the domain of institutional players, trading large blocks of bonds with limited transparency. With this came a need to protect from information leakage, which meant relying on trust between the asset management and dealer community tasked with sourcing the bonds. Creating a market for a fixed income instrument revolved around the trader getting “an order” which would allow the trader to create a market (offer to buy or sell a bond at a specified bid price and ask price) and to get traders interested in buying or selling the security (axed), which would help generate “flow” (trading). Having a sizeable buyer or seller would create the opportunity to generate flow. Trade size matters, so when a dealer could put out a 5 million-up or, better yet, a 10 million-up market (signifying they would buy 10M or sell 10M at the bid and ask that they were presenting respectively), it meant the difference between a trader being considered a reliable and consistent market maker and liquidity provider or not. The dealer community had large teams of salespeople who were responsible for getting an order that could be used to help get the trader established as a market maker. Once the trader got established as a market maker, two significant things occurred:

- It gave the rest of the salesforce an opportunity to generate trade flow.

- Traders would start to mentally keep track of who the buyers and sellers were.

If item #1 was a success the firm would generate profits from trading bonds between different accounts. If the trader was successful at item #2 then they would also increase their individual worth. Traders who had successfully established themselves as market makers in the fixed income market would consider themselves “the market” for certain bonds. Some traders even thought of themselves as “the market” for whole sectors, because by being able to remember who the main buyers and sellers were for the sector, they were able to be more efficient and successful in completing trades. Furthermore, the more successful traders would even remember the sizes of many of the trades they completed which often gave them an edge, because not only did they develop a good sense of who held what, they also knew how much of it they owned and this knowledge helped them establish themselves as a fixed income market maker. Although transparency increased and analytical tools became more widely available, the fixed income market structure remained largely intact. Except for municipal bond transactions, smaller transactions remained somewhat of a rarity in the fixed income market.

Over time, a more consistent approach to managing fixed income trading evolved. As balance sheets shrank and firms recovered from the 2008 financial crisis, fixed Income ETFs gained more popularity and trading desks began to respond. A new generation of fixed income order flow management was born.

Enter market evolution

More recently, the “electronification” of fixed income trading has created new ways to access the market, allowing more “non-traditional” market participants to have a greater role. Technology has played a large part in this process and has transformed the role of a traditional trader. Over the last 15-20 years, fixed income traders have migrated from using the telephone for most trade activity to using screens, chat, as well as trading applications, and more recently leveraging tools that cannot be seen: algorithms transmitted through feeds and APIs.

Trading desk…. what trading desk?

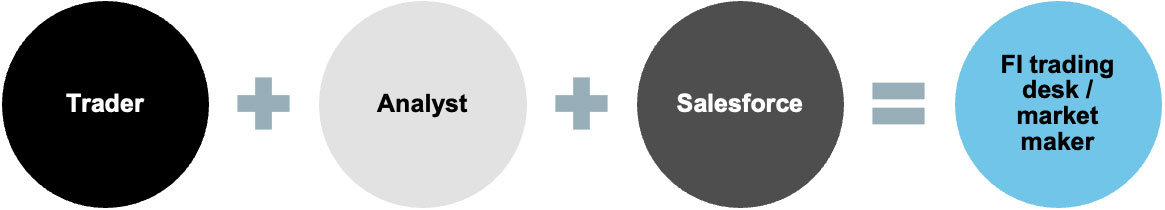

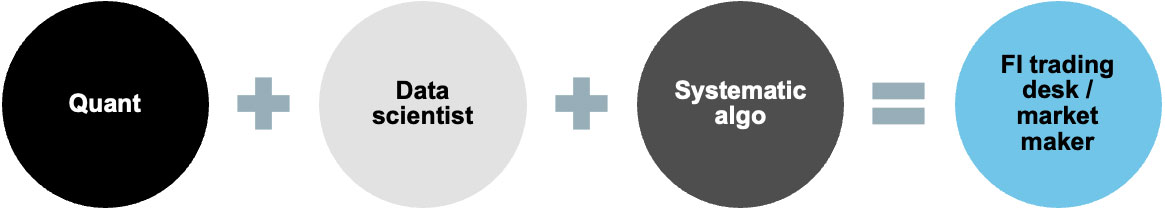

The new-age fixed income trading desk does not have a large salesforce. It does not need to start with a block-sized firm order or for the traders to remember which account had bought and sold the bond and how much of it the account accumulated or liquidated. Today’s fixed income trading desk looks quite different from the traditional fixed income trading desk:

Example: traditional FI trade desk structure

(avg. trade size >1M)

Example: a new generation of FI trade desk structure

(avg. trade size <1M)

Figure 1: A figurative representation of illustrating various roles involved with fixed income trading.

The trading community not only looks different, but operates, differently. Block trading and social trading size markets still exist, but most trade activity (by trade count) is now done electronically in credit markets. Trade activity also looks noticeably different compared to years past as seen in Figure 2.

Considering this shift in fixed income market structure, we have made a significant effort at ICE to analyze market trading trends. While the volume of institutional sized transactions has remained stable over the past few years, smaller trades (i.e., <$100k) have risen dramatically.

US Corps: Trade Count by Trade Size (USD Par Notional)

Figure 2: Approximate counts calculated by ICE from FINRA® Trade Reporting and Compliance Engine® (TRACE®)

*YTD through October, not a full year of data

With this additional volume in smaller trades, market participants have been seeking to analyze the impact of size on pricing. For years, a relative pricing disadvantage had been a concern for firms transacting in smaller sized fixed income trades. The general acceptance of smaller size transactions has broadened the need for insightful data to make informed decisions.

The price adjustments for size to what has traditionally been an institutional (or round lot) market in fixed income has largely been a qualitative exercise by the trader, applying knowledge gained during their career. With relatively low volumes, long transaction times and an investor base that was less likely to “shop” around, the system limped along. Traders, from the sell side, viewed these smaller size trades not worth their effort - or just wanted to avoid getting stuck with an odd lot or micro lot on the books. Today by contrast, an explosion of fixed income ETFs (as shown in Figure 3), increased adoption of separately managed accounts, and higher interest rate backdrop have combined to help transform fixed income trading.

Fixed Income ETF AUM

Figure 3: Source: ICE/NYSE

The create/redeem process for ETFs brought new participants into the fixed income market, while existing institutional trading desks also continue to play a role. The create/redeem process often deals with smaller trade sizes (i.e., <1mm in USD par notional per issue), even though the number of issues transacted during any one process may total in the dozens or hundreds. The result is a changing market dynamic, which challenges historic assumptions.

Recent trade data reflects the impact of these ongoing changes. Our analysis of the data generated by these new dynamics has led us to conclude that the fixed income market is undergoing an evolutionary change. In our view, this evolution has created increased access and transparency to fixed income markets and has provided benefits to all investors.

As the trading market evolved, the need for better pricing led to greater demand for intra-day fixed income pricing. The next natural step is to acknowledge the need for a more quantitative approach to account for trade size. This is the void that ICE Size-Adjusted Pricing can help to fill.

ICE Size-Adjusted Pricing (SAP)

ICE uses a well-established methodology to evaluate fixed income instruments globally. The process to calculate the SAP for an instrument starts with a process that combines and pairs the relevant ICE evaluation with the statistical analysis generated by the ICE BestEx service (as further described in the ICE Best Ex Methodology document). The ICE evaluation is the reference price used in the Best Ex service to build the trade price distributions. When creating distributions by comparing ICE’s evaluations to trade prices, we are able to identify consistent patterns. These patterns become more obvious when breaking the distributions into different trading buckets based on asset class, tenor, trade direction and trade size. We extrapolate this price distribution based on side and size across a wide range of fixed income assets (see Figure 4). The dealer buy side of the distribution is the “bid” side of the size adjusted price. The dealer sell side of the distribution is the “ask” side of the size-adjusted price. The size-adjusted price is an estimate of what a holder may receive in an orderly transaction based on the inputs provided by the user.

| ICE Asset Class | |

|---|---|

| US Preferred North America | US Municipal Money Markets North America |

| US MBS Pass-Throughs & SBA North America | US Municipal Derivatives North America |

| US MBS TBAs North America | European Fixed Income Europe |

| US Treasury Bills, Notes & Bonds North America | Asian Fixed Income Asia Pacific |

| US Agency Debentures North America | Bank Loans North America |

| US Corporate Investment Grade North America | Convertibles Global |

| US Corporate High Yield North America | Agency CMO / CMBS North America |

| Cross Regional Bonds Global | ABS / CMBS North America |

| US Municipal North America | Canadian Corp / Gov’t North America |

| Latin America South America | Non-Agency CMO North America |

Figure 4: Source: ICE

Figure 5 represents price differences for a few different asset types including US Investment Grade Corporates, US High Yield Corporates, US Tax-Exempt Revenue Investment Grade Municipals and MBS FIX Specified Pools. These prices differences are referred to as trade buckets and as they are presented here it helps to appreciate the generally widening pattern as you move from larger size trade activity to smaller size trade activity.

10Yr USIG Corporates - Scorecard

5Yr USHY Corporates - Scorecard

US Tax-Exempt Rev IG 0-5Yr (USD) - Scorecard

MBS - Fix-Specified Pools 10Yr - Scorecard

Figure 5: Source: Calculated by ICE BestEx Service

For further information regarding ICE’s Best Ex Methodology, please contact ICE Data Services.

SAP evolution

Over the years there has been no shortage of questions about the pricing of smaller trades. At ICE, we defined evaluated prices as market-based measurements that are processed through a rules-based pricing application and represent our good faith determination as to what the holder may receive in an orderly transaction for an institutional round lot position (typically 1MM or greater current face USD or local currency equivalent) under current market conditions. In reality, a baseline institutional size trade may be defined differently based on each individual fixed income asset class. For example, for U.S. Treasuries and Mortgage TBAs, one might consider an institutional round lot trade to be much higher, but for global corporate bonds and municipal bonds it is reasonable to consider a one million par notional trade size as the threshold for what constitutes an institutional round lot size trade. For this reason, one million USD or greater in par notional continues to be a widely, almost unanimously, agreed amount when thinking about institutional round lot trading. There are two reasons ICE continues to view 1mm+ as a reasonable threshold to define institutional size:(i) trading in 1mm+ lot sizes most often happen between institutional market participants; and (ii) under normal market conditions trading in larger sizes typically takes place in a more tight, well defined pricing context.

Since 2016, ICE has been able to identify and quantify the distance between “round lot - institutional trading” compared to smaller trade size activity. Figure 6 below is an overall view of how the size-adjusted bid/ask has evolved. The chart provides context on the core 10yr. U.S. Corporate bond trade size trading buckets. The analysis below examines various sizes through the lens of bid/ask in percentage of par, dollar price terms and is presented as TCA or a transaction cost analysis.

USIG 10yr. Corp, 50th Percentile TCA

Figure 6: Source: ICE Data Services - Timeseries view showing transaction cost analysis (TCA) for 10-year US Investment Grade Corporates

Figure 7 presents four charts which examine a specific moment in time and calculate what the market implied size-adjusted bid/ask price is at the 50th percentile (i.e., a Best Ex score of 50). This view is used to illustrate how the various size-adjusted percentiles vary by trade size. As a result, we infer a market implied transaction cost analysis (TCA). The charts represent the 10yr. U.S. Investment Grade (top) and 5yr. High Yield (bottom) Corporate bond market implied size adjusted expected TCA in dollar price across a variety of best execution percentiles (scores). In this example we calculate half of the market implied size-adjusted bid/ask as a way to illustrate the compression we have seen on trade activity across various trade sizes. We use these examples to focus on two main themes:

- The overall compression lower across all trade sizes closer to zero at the 50th percentile or median

- The overall compression between various trade sizes

USIG Corp February 2016 TCA

USIG Corp August 2023 TCA

USHY Corp February 2016 TCA

USHY Corp August 2023 TCA

Figure 7: Source: ICE Data Services TCA using half the market implied bid/ask spread at BestEx percentiles ranging from 1-100

As previously stated, the amount of smaller fixed income transactions has increased dramatically in recent years while during the same period, institutional size transactions (on count) have remained steady or even declined slightly. The greater trade flow in smaller sizes brought about by the evolving market has resulted in transaction price compression. The compression is within the variance between round lot trading and odd lot / micro lot trading as seen in Figure 8. The compression also existing within the bid/ask spread, or the “markup”, associated with round lot trading compared to odd and micro lot trading.

We see similar behavior when we look at U.S. Municipal trading in Figure 8 - the difference between micro lot trading to round lot trading continue to compress, having a direct impact on overall TCA:

US, Tax-Exempt GO, 5yr. + IG, 50th Percentile TCA

US, Tax-Exempt Rev, 5yr. + IG, 50th Percentile TCA

Figure 8: Source: ICE Data Services - Timeseries view showing transaction cost analysis (TCA) for 5+ year Investment Grade Tax-Exempt General Obligation & Revenue Municipals.

Micro Lot = <100k, Odd Lot = 100k-500k, Round Lot = >500k.

Seeing these results in a table (Figure 10) helps illustrate the dramatic evolution we have seen in Municipal Bond TCA. The market implied cost to trade over the past seven years has been virtually cut in half for trading of micro lot transactions (see Figure 9). ICE’s Size-Adjusted Price is a quantification of that compression.

US Tax-Exempt GO IG February 2016 TCA

US Tax-Exempt GO IG February 2023 TCA

US Tax-Exempt REV IG February 2016 TCA

US Tax-Exempt REV IG February 2023 TCA

Figure 9: Source: ICE Data Services TCA using half the market implied bid/ask spread at BestEx percentiles ranging from 1-100.

| Asset Type | 2016 Micro | 2016 Odd | 2023 Micro | 2023 Odd | Micro Diff | Odd Diff | Micro % | Odd % |

|---|---|---|---|---|---|---|---|---|

| U.S. Tax-Exempt GO IG TCA | 0.984 | 0.397 | 0.528 | 0.326 | -0.456 | -0.070 | -46% | -18% |

| U.S. Tax-Exempt Rev IG TCA | 1.214 | 0.511 | 0.647 | 0.363 | -0.568 | -0.148 | -47% | -29% |

Figure 10: Source: ICE Data Services - Point in time comparison between 2016 and 2023 of half the bid/ask spread at the 50th percentile of BestEx Score of 50.

Conclusion

Decades of pricing experience makes SAP a natural extension of an evaluation which is a core competency ICE offers. To be clear the methodology to derive the traditional ICE evaluations are separate and distinct to how ICE derives SAP. However, we feel SAP offers a differentiated dataset that may serve as a great source of information for firms dealing with an ever changing fixed income market dynamic.

Although the magnitude of differentials has consolidated over time, we still see value in tracking and using SAP to help provide greater transparency in the market. Although the trend toward smaller size adjustments have been good overall for investors there are “white space” gaps between the “inside market” on larger trades compared to the “inside market” on smaller trades.

In a fast-changing landscape and unprecedented access to fixed income markets it is critical to have access to data that better reflects what one may expect when entering odd lot or micro lot transactions. This content represents yet another set of data and analytics that can help provide more transparency. Combining public trade data with proprietary data from ICE helps to quantify size adjustments related to pricing - something for years market participants had to manually. ICE SAP can finally help fill the void that has long existed in the market for odd lot or micro lot pricing.