Reference Data

Enhance risk management, maintain compliance and maximize operational efficiency with high-quality reference data on over 35 million financial instruments covering more than 210 markets including exchanges and Alternative Trading Systems (ATS). Continued expansion of our Reference Data solutions means we are regularly adding key sources to improve the quality and completeness of our offering.

Learn more about our reference data solutions

Benefits

Completeness

We continually expand data attribute coverage to offer a comprehensive set of data.

Coverage

Extensive database covering fixed income, equities, derivatives and funds asset classes.

Flexibility

Find the licensing arrangement and delivery method that best suits your needs.

Timeliness

On-demand or intraday access.

Completeness

We continually expand data attribute coverage to offer a comprehensive set of data.

Coverage

Extensive database covering fixed income, equities, derivatives and funds asset classes.

Flexibility

Find the licensing arrangement and delivery method that best suits your needs.

Timeliness

On-demand or intraday access.

Solutions

Gain better clarity and transparency in the Fixed Income markets with our Terms and Conditions service providing access to a broad range of up-to-date data from our Terms and Conditions database. Our breadth and depth of coverage is critical throughout the entire securities processing lifecycle, supporting a range of use cases including trade execution, decision support, order management, confirm generation, clearance, settlement, compliance, and risk management.

Coverage

Debt | Equity | Listed Derivatives | |

Assets | Agency Corporate Government CMO/ABS Government Municipal MBS | Common Convertible Funds Preferred | Futures Options Options on Futures |

Attributes | Accrued Interest Basic Descriptive Data Call, Put, and Sinking Fund Schedules Credit Ratings Guarantors Income Data Industry Classifications Issuer & Issue Information | Basic Descriptive Data Dividends Exchange Information Issuer and Issue Information Industrial Classifications MIC Codes Shares Outstanding | Contract Details Identifiers Market Exchange and Sector Information |

Representative use cases

Asset Set Up and Maintenance

Enable faster time to trade and ensure ease of processing through access to quality data.

Decision Support

Empower valuation and risk models in search of alpha using detailed analysis for individual securities or drive sophisticated portfolio valuation and risk analytics.

Enterprise Data Management

Service multiple lines of business from a centralized store of data content.

Index Construction

Enable creation of user defined populations within an asset class, an asset type or a specific sector.

Risk Management, Compliance and Regulatory Reporting

Compile an aggregated view of current adjusted positions across all holdings to determine exposure.

Portfolio Monitoring

Retain a more consistent risk profile within the portfolio and monitor corporate actions to determine whether the portfolio is correctly weighted.

Asset Set Up and Maintenance

Enable faster time to trade and ensure ease of processing through access to quality data.

Decision Support

Empower valuation and risk models in search of alpha using detailed analysis for individual securities or drive sophisticated portfolio valuation and risk analytics.

Enterprise Data Management

Service multiple lines of business from a centralized store of data content.

Index Construction

Enable creation of user defined populations within an asset class, an asset type or a specific sector.

Risk Management, Compliance and Regulatory Reporting

Compile an aggregated view of current adjusted positions across all holdings to determine exposure.

Portfolio Monitoring

Retain a more consistent risk profile within the portfolio and monitor corporate actions to determine whether the portfolio is correctly weighted.

- « First

- ‹ Previous

- 1

- Next ›

- Last »

Effectively monitor events that impact the financial markets and help reduce your exposure to operational and reputational risks with timely, high quality information on global corporate actions throughout the business day.

Features

Manage risk with critical information

Tracks sources throughout the event lifecycle to create a composite record and provide critical updates and amendments as they are announced. Better mitigate operational risk by leveraging features to establish the audit trail.

Coverage

Comprehensive global coverage includes capital changes, mandatory and voluntary corporate actions from approximately 80,000 companies operating in over 100 countries. Our global data collection team uses a wide range of sources, including corporate filings, exchange feeds, transfer agents, newswire services and other informative sources, to show you a consolidated view.

Complement your workflow

Choose from a variety of timely delivery options including scheduled batch delivery, message-based, and request/retrieve web service API. The service features an intraday capability with delivery every hour throughout the trading day.

Manage risk with critical information

Tracks sources throughout the event lifecycle to create a composite record and provide critical updates and amendments as they are announced. Better mitigate operational risk by leveraging features to establish the audit trail.

Coverage

Comprehensive global coverage includes capital changes, mandatory and voluntary corporate actions from approximately 80,000 companies operating in over 100 countries. Our global data collection team uses a wide range of sources, including corporate filings, exchange feeds, transfer agents, newswire services and other informative sources, to show you a consolidated view.

Complement your workflow

Choose from a variety of timely delivery options including scheduled batch delivery, message-based, and request/retrieve web service API. The service features an intraday capability with delivery every hour throughout the trading day.

Corporate Actions Service

- Award-winning service that seamlessly delivers mission-critical information to help mitigate processing risk

- Centralized, integrated source of scrubbed corporate actions data delivered in a consistent format

- Comprehensive global coverage with exceptional depth of data for numerous corporate action types, including capital changes, mandatory and voluntary corporate actions; covers approximately 80,000 companies operating in over 100 countries

- Timely, high-quality information; intraday capability with delivery every hour throughout the trading day

- Flexible delivery platform allowing access to data in a variety of formats, including XML, proprietary and standard ISO 15022, streamlining integration into financial systems and applications

- Ease of navigation

- Self-managed portfolio tracking tools for "out-of-the-box" processing

- Online query access for research and event confirmation

- Features to show audit trail – key for operational risk management

- Choice of delivery options: scheduled batch delivery, message-based, and request/retrieve web service API

- Cross-referencing support across industry identification standards including CUSIP, ISIN and SEDOL

Our business entity data links our vast security reference database of more than 35 million financial instruments to comprehensive business entity information for the issuers of these instruments and their legal hierarchy of ownership.

Features & benefits

With over 140 data items supported, the service covers key areas of relevance:

Coverage

Specialist researched data on over 473,000 entities

Location

Entity registered address, operating address

Activities

Industry Classification Standards (NACE, NAICS, SIC, ESA 2010)

Coverage

Specialist researched data on over 473,000 entities

Location

Entity registered address, operating address

Activities

Industry Classification Standards (NACE, NAICS, SIC, ESA 2010)

Linkage

Issue > Issuer > Immediate Parent > Ultimate Parent entity linkages (including full legal names)

Identify

Legal Entity Identifiers for over 248,000 entities to uniquely identify a firm with an industry standard code

Updates

Ongoing monitoring for corporate actions affecting an entity or structure

Linkage

Issue > Issuer > Immediate Parent > Ultimate Parent entity linkages (including full legal names)

Identify

Legal Entity Identifiers for over 248,000 entities to uniquely identify a firm with an industry standard code

Updates

Ongoing monitoring for corporate actions affecting an entity or structure

Use cases

The service supplies robust entity-level data to help you:

- Calculate risk through exposure to a particular entity, group, industry or region

- Get a clearer picture of the corporate hierarchy of an entity in order to understand the entity’s capital structure and perform analysis

- Identify risks associated with corporate events within the family tree of an entity

- Conduct screening of company business activities to ensure compliance with investment policies

- Facilitate compliance with regulations such as AIFMD, UCITS, Basel II and IFRS-9 using the entity linkages in the compilation of data for credit worthiness and concentration risk measurements.

The entity content from ICE's Entity team is delivered via our IDS and APEX feed platforms today

Upon receipt of a client's securities of interest, the securities are linked to the associated entity and/or parent information which is delivered daily

Client portfolios are tracked to check for unlinked ISINs which are then linked to an issuer / a parent hierarchy by our team of specialists

Entity records are enriched to contain 67 core attributes to describe and classify the entity

Entity content is also available via a web portal in order to search and view entity details and hierarchy

The entity content from ICE's Entity team is delivered via our IDS and APEX feed platforms today

Upon receipt of a client's securities of interest, the securities are linked to the associated entity and/or parent information which is delivered daily

Client portfolios are tracked to check for unlinked ISINs which are then linked to an issuer / a parent hierarchy by our team of specialists

Entity records are enriched to contain 67 core attributes to describe and classify the entity

Entity content is also available via a web portal in order to search and view entity details and hierarchy

The Corporate Actions of NYSE Group Listings provide daily and intraday event updates for securities including stock splits, dividends, rights issues, spin-offs, and much more.

Our exchange traded derivatives reference data solution offers a comprehensive set of attributes for products traded and cleared on ICE global exchanges and clearing houses. By automating the collection and normalizing the data across the ICE repository, our product offers a broad and comprehensive reference data solution for your portfolio of benchmark futures and options contracts.

Data delivery is customizable; customers can access data through intra-day and/or end-of-day files through ICE Data Services’ APEX, an advanced delivery platform for pricing, analytics and reference data. The end-of-day file contains key security updates and new security setups to help prepare for the next trading session.

Key features

- Comprehensive data attribute coverage for products trading on ICE exchanges. Data dictionary is available upon request

- APEX aggregates and normalizes product reference data from multiple independent ICE sources

- Swaps to Futures reference data is now made available through APEX

- Employs a structured data model organized by product / individual contract

- Full cross-referencing capabilities for securities: ICE Market IDs, exchange tickers, Bloomberg identifiers, RTS tickers, eSignal tickers

- Full cross-reference capabilities for underlying assets: ICE Market IDs, ISIN, SEDOLs, exchange tickers

- New issues, key security updates and contract adjustments are applied and made available in a single end-of-day file, prior to the start of the next trading session (8:00 PM EST)

Coverage

Market | Included Exchange(s) | MIC(s) | General Market Types* | Region |

|---|---|---|---|---|

| ICE Futures U.S. | IFUS | Various Agricultural, Metals, FX, Equity Indexes, USD Index, Financial Gas, Financial Power, Oil | Americas | |

| ICE Futures Canada | IFCA | Canadian Grains, Canadian Oilseeds | Americas | |

| ICE Futures Europe (excluding S2F) ICE Futures Europe - Agriculture | IFEU IFLX | Various Energy Futures, Liffe Commodities | Europe | |

ICE Futures Europe - Financial ICE Futures Europe - Equity | IFLL IFLO | Eurodollar, GCF Repo, Interest Rate Futures, Liffe: Bonds, Index Futures, STIRs, Swapnotes, 3-month Euro & EONIA Liffe: Equity Derivatives (non-US based), Liffe Index Options | Europe | |

| ICE Endex Derivatives B.V. | NDEX | Belgian, Dutch, German, Italian: various power and gas futures | Europe | |

| ICE Futures Singapore | IFSG | Singapore: Metals, Energy, Financials | Asia | |

ICE Futures U.S. Energy Division ICE Futures Europe (S2F only) | IFED IFEU | Canadian Financial Gas, Financial Gas, Financial Power, Henry Hub, Physical Environmental | Americas/Europe |

Sample use cases

Trading New Products & Contracts: Developing trading strategies

Trading on the most up to date information following changes/updates to the product

Processing Trades

Trading New Products & Contracts: Developing trading strategies

Trading on the most up to date information following changes/updates to the product

Processing Trades

Clearing and Settling Trades in these Products

On-Going Performance and Risk Management

Compliance and Regulatory Reporting

Clearing and Settling Trades in these Products

On-Going Performance and Risk Management

Compliance and Regulatory Reporting

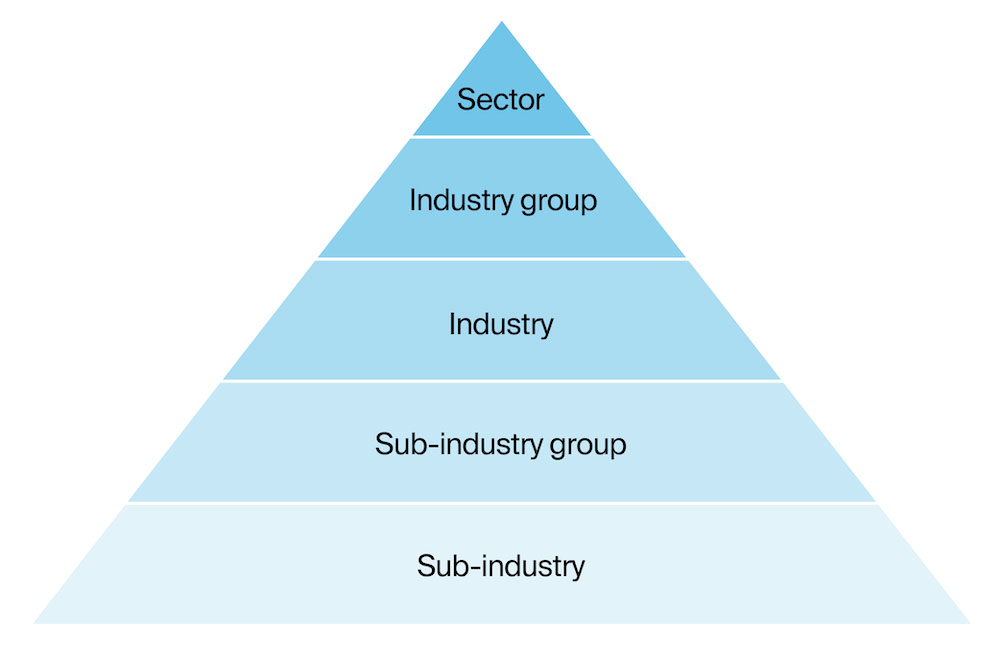

Better assess environmental, social and governance (ESG) risks and opportunities of companies, obligors and municipalities.

Enable deeper analytical insights using our enhanced global classification schema that is applied to entities who issue debt as well as equity. Sector granularity is critical to ensure decisions are informed by the core business of the issuing company, which can differ from that of the parent.

When applied to investment and risk-management use cases, robust sector classification allows for more precise peer comparison on a like-for-like basis. Index and sustainable finance benchmarking are likewise enhanced by high quality sector data.

To learn more about ICE Uniform Entity Sectors, view our methodology here.

ICE Classification Levels

Features & benefits

Coverage

Over 182,0001 issuing entities, including categories such as Cannabis Production, SPACs, BDCs, and Renewables

Granularity

Five ICE classification levels, including more than 270 business classification categories

Methodology

Our proprietary schema assigns based on the core business of the issuing entity, not simply that of the parent company

Workflow

Available via Files (XML or Flat File Format), ICE Data API, or ICE Data Viewer, with flexible licensing solutions designed for scalability and ease of integration

Coverage

Over 182,0001 issuing entities, including categories such as Cannabis Production, SPACs, BDCs, and Renewables

Granularity

Five ICE classification levels, including more than 270 business classification categories

Methodology

Our proprietary schema assigns based on the core business of the issuing entity, not simply that of the parent company

Workflow

Available via Files (XML or Flat File Format), ICE Data API, or ICE Data Viewer, with flexible licensing solutions designed for scalability and ease of integration

1as of Aug. 1, 2023

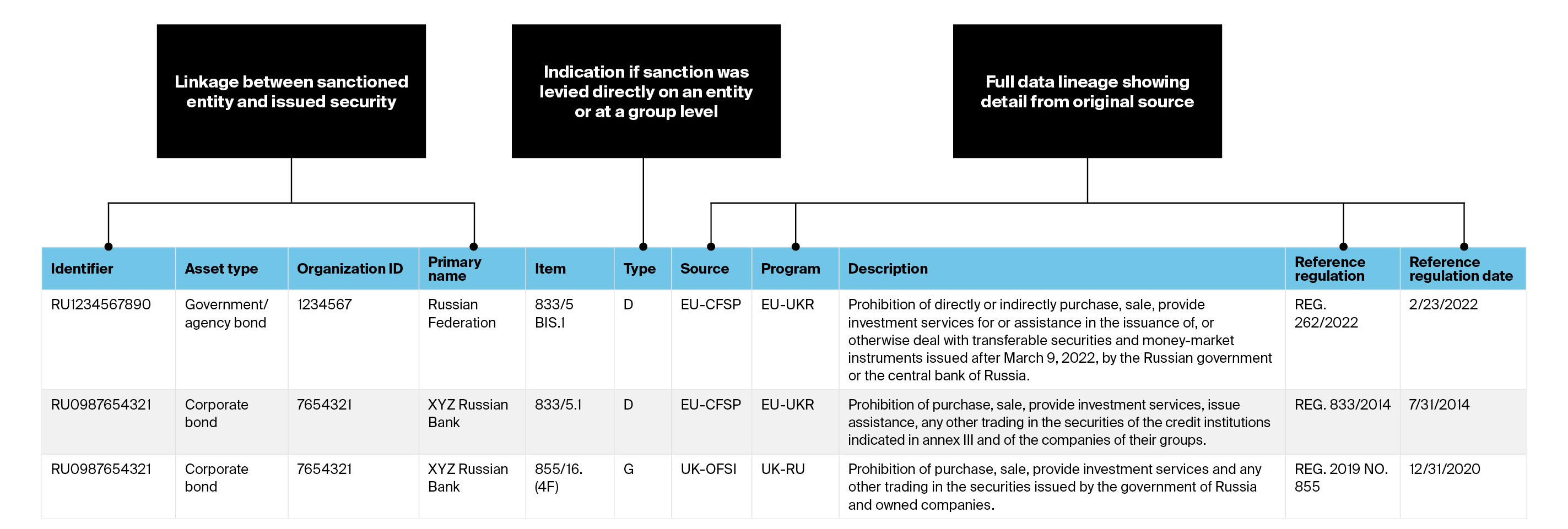

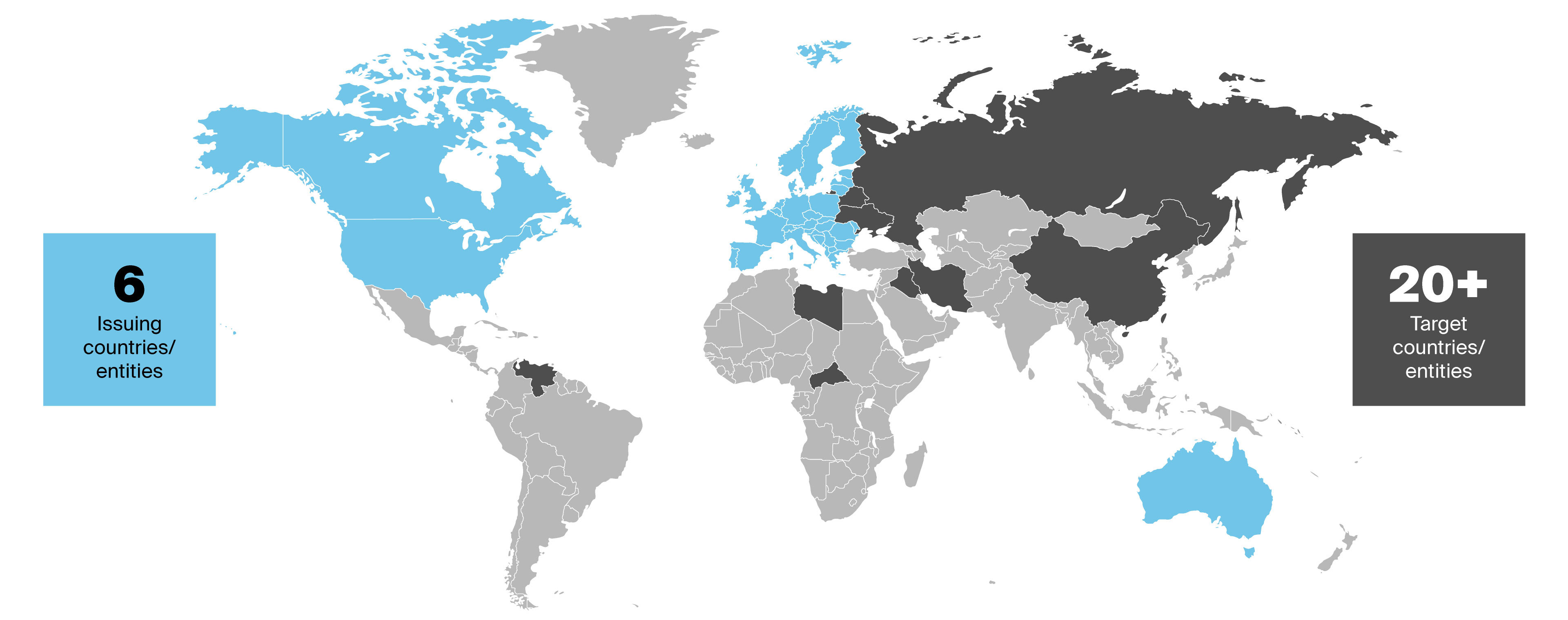

Help facilitate institutional compliance with a complex and dynamic landscape of global sanctions. Compliance with sanctions programs can be more complete when the identification and monitoring of sanctioned companies (and their affiliates) is combined with linkages between entities and the securities issued by those entities.

Save time and resources by leveraging a single source to consolidate and normalize data and documentation from multiple national and supranational governing bodies.

Armed with high quality sanctions information, market participants are better able to assess and respond in the face of ever-changing criteria.

ICE Sanctions Data monitoring coverage*

*As of October 2023

Features & benefits

Quality

All sanctions related data are collected from official and primary sources only, then monitored and maintained daily as regulations change or affected issuing entities are added or removed from the relevant programs.

Transparency

Core sanctions information at the entity or group level is linked with reference data at the securities level for better insight into exposure obligation and risk management.

Automation friendly

Daily output delivered in simple, codified files for ease of client implementation allowing for automation of compliance program processes.

Quality

All sanctions related data are collected from official and primary sources only, then monitored and maintained daily as regulations change or affected issuing entities are added or removed from the relevant programs.

Transparency

Core sanctions information at the entity or group level is linked with reference data at the securities level for better insight into exposure obligation and risk management.

Automation friendly

Daily output delivered in simple, codified files for ease of client implementation allowing for automation of compliance program processes.

Case studies

The Bank of America Merrill Lynch index business transitioned its reference data source to ICE with immaterial impact on the composition and risk structure of the indices.

By working closely with the client, ICE successfully integrated ICE Reference Data delivered via NeoXam’s DataHub without interruption of service.