Index Solutions

Selecting a benchmark that suits your strategy can be hard, but switching an existing benchmark can be even harder. Yet many prominent ETFs have done just that with ICE – all in search of quality data, flexible technology, and deep index expertise. Find out why active and passive managers benchmark trillions of dollars in assets under management against ICE Indices.

Update

ICE Data Indices, LLC completes Independent Assurance of its adherence to the IOSCO Principles for Financial Benchmarks

A copy of IDI’s Management Statement of Adherence to the IOSCO Principles along with the independent accountant’s assurance report can be accessed on IDI’s Regulation page.

ICE Indices are the benchmark for $1.8 trillion in assets under management. Over $150 billion in ETF assets under management from five different ETF sponsors have transitioned to ICE Indices, including some of the largest fixed income and Preferred ETFs in the market.

benchmarked with over $500 billion benched passively to ICE Indices across all asset classes

IOPV business with over 80% of U.S.-listed ETPs, ICE is one of the leading providers of IOPV calculation services globally

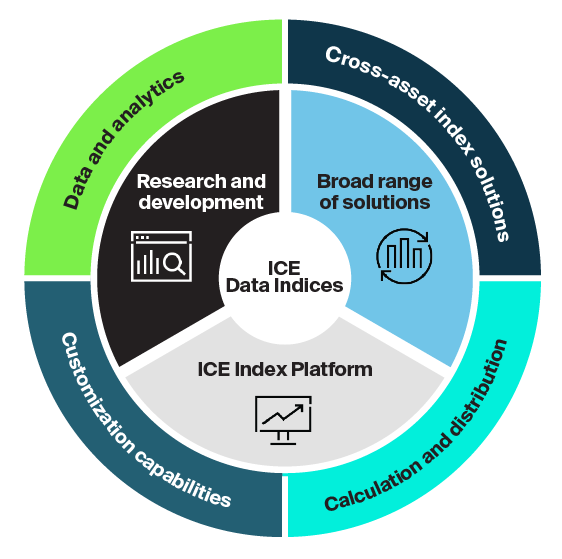

A solutions-based approach

ICE Data Indices offers solutions for a variety of use cases including research, and creation of custom indices and ETF strategies (benchmarking, asset allocation, research, product creation and transitioning ETF benchmarks).

Index families

ICE Index Platform

Gain full access to top-level and constituent index data for the complete universe of the ICE Data Indices. The ICE Index Platform has extensive functionality that allows you to access current and historic index and security level performance data and statistis.

ETF + Index Solutions

Design and manage solutions across the ETF lifecycle

ICE delivers a comprehensive ETF offering supporting the needs of investors, issuers, APs, liquidity providers and custodians. From research, data, pricing and portfolio management to trading, risk analysis and performance attribution, we aim to support a broad range of ETF asset managers.

The New York Stock Exchange offers the world’s premier venue for listing and trading ETFs. Our platform is built on industry-leading technology that facilitates primary trading in over 75% of U.S. ETF assets and 1,800 ETFs.

Access the ETF primary markets through the ICE ETF Hub which offers standards to simplify the creation and redemption process for all market participants.