ESG Investing:

Q&A with MSCI’s Guido Giese, Executive Director, MSCI Research

Guido Giese

Executive Director, MSCI Research

How do you define “ESG investing” and what are the main types of ESG Indices that MSCI calculate?

Environmental, social and governance, or ESG, investing is a term often used synonymously with sustainable investing, socially responsible investing, mission-related investing, or screening. At MSCI ESG Research we define it as the consideration of environmental, social and governance factors alongside financial factors in the investment decision-making process. We see three common investor objectives or motivations when considering an ESG strategy.

- ESG Integration: Integrating ESG can help you assess long-term financial risks and opportunities.

- Values/Screens: It can help you align investments with your values.

- Impact: Identify companies that generate positive societal or environmental benefits while still offering positive returns.

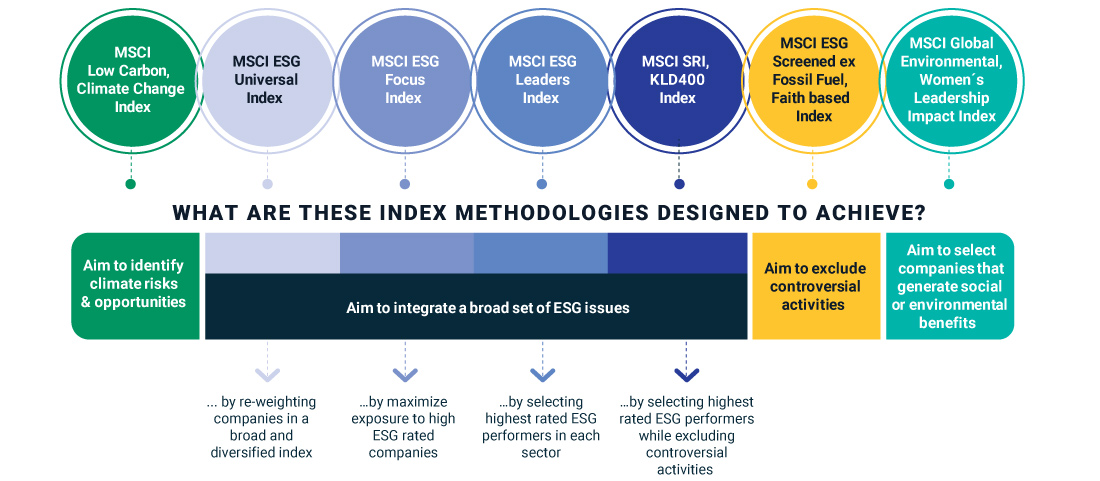

- Integration: These indices target companies that have the highest ESG-rated performance in each sector of the parent index. (e.g., MSCI ESG Leaders)

- Values and screens: These indices screen out companies involved in controversial business activities such as controversial weapons, fossil fuels, tobacco and civilian firearms, etc., and exclude companies that are involved in controversies (e.g., ex Fossil Fuels indices, ESG Screened indices, Socially Responsible Investing (SRI))

- Impact: Indices which aim to include companies that generate a measurable benefit to society and the environment (e.g. MSCI Sustainable Impact Indices, MSCI Women’s Leadership Indices)

How do you define “ESG investing” and what are the main types of ESG Indices that MSCI calculate?

Environmental, social and governance, or ESG, investing is a term often used synonymously with sustainable investing, socially responsible investing, mission-related investing, or screening. At MSCI ESG Research we define it as the consideration of environmental, social and governance factors alongside financial factors in the investment decision-making process. We see three common investor objectives or motivations when considering an ESG strategy.

- ESG Integration: Integrating ESG can help you assess long-term financial risks and opportunities.

- Values/Screens: It can help you align investments with your values.

- Impact: Identify companies that generate positive societal or environmental benefits while still offering positive returns.

- Integration: These indices target companies that have the highest ESG-rated performance in each sector of the parent index. (e.g., MSCI ESG Leaders)

- Values and screens: These indices screen out companies involved in controversial business activities such as controversial weapons, fossil fuels, tobacco and civilian firearms, etc., and exclude companies that are involved in controversies (e.g., ex Fossil Fuels indices, ESG Screened indices, Socially Responsible Investing (SRI))

- Impact: Indices which aim to include companies that generate a measurable benefit to society and the environment (e.g. MSCI Sustainable Impact Indices, MSCI Women’s Leadership Indices)

Guido Giese

Executive Director, MSCI Research

MSCI has calculated socially responsible indices for 30 years. How have MSCI ESG Indices evolved over the years?

The practice of ESG investing began in the 1960s, as socially responsible investing, with investors excluding stocks or entire industries from their portfolios based on business activities such as tobacco production or involvement in the South African apartheid regime.

Today, ethical considerations and alignment with values remain common objectives of many ESG investors. This field is rapidly growing and evolving to include the practice of incorporating financially significant ESG factors into the investment process alongside traditional financial analysis. This is being driven partly by better data and analytics and a longer history of data which can help with back testing strategies.

MSCI Inc. is the world’s largest provider of ESG indices by number of indices and by assets tracking the indices.1

Through its legacy businesses, MSCI was the first to launch an ESG Index: MSCI’s KLD 400 Index is the longest running ESG index with over 30 years of live history and above-benchmark returns since 1994.2

We understand there are many approaches to integrating ESG and that there is a strong desire for customization and choice to meet the growing range of ESG and investment objectives. We currently offer a range of over 1,500 ESG equity and fixed income indices which are designed to help institutional investors more effectively benchmark ESG investment performance, understand the role of ESG in the total portfolio and manage, measure and report on ESG mandates.

Once considered a niche approach, we now see ESG investing frequently in headlines and capturing investment flows. What is driving this appetite?

- Investors are adopting ESG across their investment portfolios.3

- There is growing academic research demonstrating how ESG has helped identify risks and opportunities that may not be covered by traditional financial analysis. A recent MSCI study showed that ESG affected the valuation and performance of many of the companies in the study.4

- Increased regulatory pressure in Europe is pushing ESG into the mainstream investment space.

- The growing use of technology enhances access to better ESG data, research, indices and analytics. This enables more dynamic, quantitative, objective and financially relevant approaches to ESG investing.

MSCI has strong views about integrating ESG. What steps should investors consider when seeking to integrate ESG in their portfolios?

We recently published the MSCI Principles of Sustainable Investing; a framework designed to illustrate specific, actionable steps that investors can and should take to improve practices for ESG integration across the investment value chain. The framework includes three core pillars to full ESG integration:

- Investment Strategy: Asset owners should integrate ESG considerations into their processes for establishing, monitoring and revising their overall investment strategy and asset allocation.

- Portfolio Management: Portfolio managers should incorporate ESG considerations throughout the entire portfolio management process, including security selection, portfolio construction, risk management, performance attribution and client reporting.

- Investment Research: Research analysts assessing companies and issuing investment recommendations to portfolio managers should integrate ESG considerations (including ESG company ratings) into their fundamental company analysis.

Client demand for ESG products is rising fast. Where do you see the strongest demand?

MSCI ESG Indices is the market leader with ESG ETP providers by assets for equity and fixed income. ESG indices provide investors with a cost effective, transparent, rules-based approach to integrating ESG in their investment process. These qualities avoid a subjective approach and instead offer a measurable way of analyzing the performance of investments. An investor’s motivations may be to improve long-term risk-adjusted returns, to invest in alignment with their personal values and beliefs, or to have an impact on the environment or society. ESG indices can be used as performance benchmark, investment universe tailored to specific ESG standards, underlying for financial products and for asset allocation decisions.

During the COVID-19 crisis, some of your ESG indices have consistently outperformed the market. What have been the main contributing factors?

The COVID-19 outbreak — while over a very short term and limited in scope — is the first real-world test since the 2008 global financial crisis of the resilience of companies with high MSCI ESG Ratings.

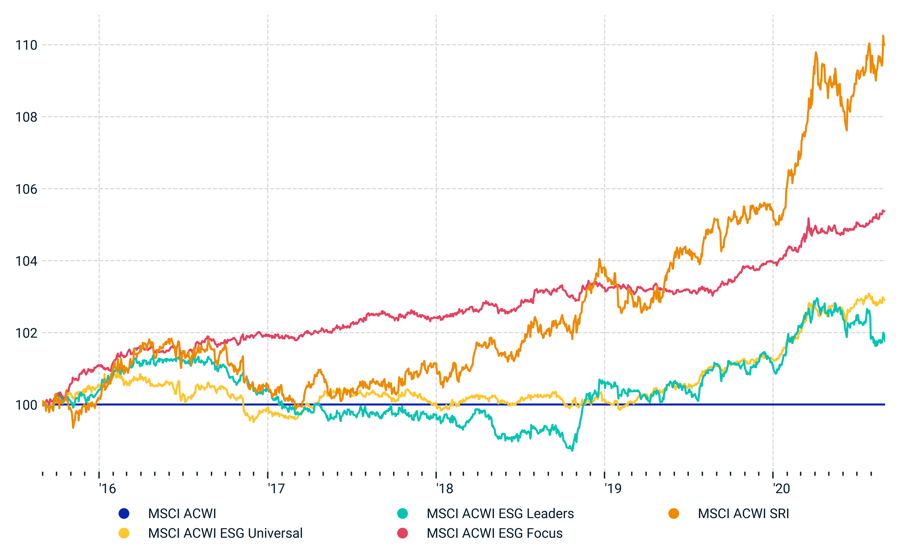

Active return attribution from 31 August 2015 to 31 August 2020

We compared four global MSCI ESG indices to their parent indices during the COVID-19 sell-off as well as for longer periods. MSCI’s Global Equity Model with an ESG factor showed that a large part of the Q1 2020 performance of the indices was attributable to the systematic tilt of these indices toward higher ESG-rated stocks. This was similar to what we observed over the past five years.

Several regional and sub-regional ESG indices outperformed their market-cap-weighted parent index during Q1 2020, though some approaches underperformed in emerging markets.

The outperformance of our four ESG indices in global markets during the crisis was attributable mainly to equity style tilts. ESG was the strongest contributor, followed by tilts toward lower beta, lower volatility and better quality. Over the past five years, the ESG factor provided less significant though still relatively high levels of contribution. The methodology used to construct the MSCI ESG Leaders, ESG Focus and SRI indices aims to reduce differences from the parent index in sector exposures. This methodology helped reduce the contribution from industry factors (sectors include numerous industries).

We launched a new tool, the ESG Portfolio Extended Summary Report, which is geared toward wealth managers. We made our data available on additional third-party platforms to facilitate ESG reporting and the integration of ESG factors into portfolio and risk management. We also launched two APIs (Application Programming Interface) to improve the accessibility of MSCI ESG Research’s analysis and data.

MSCI is also committed to greater ESG transparency to raise awareness educate the market and drive ESG standards. Our ESG transparency tools provide ratings and metrics for thousands of companies, funds and indices:

What’s next for ESG? How do you see ESG investing evolving in the future?

Changing investor objectives, better data, improved technology, greater ESG transparency and corporate disclosure are affecting investor interest in ESG investing and indices.

We go beyond what corporates disclose, incorporating alternative data sets to fill the gaps and identify risks, such as product recalls data from regulators, customer complaints, warning letters, academic and NGO databases (e.g., on water stress levels), news, etc. Our rules-based ESG ratings obtained an average 45% of data from alternative data sources and utilized artificial intelligence (AI) technology to extract and verify unstructured data.

With AI, we are able to train computers to help identify themes for indices as well as risks for companies. We can leverage machine-learning techniques such as topic modeling and natural language processing to improve data-gathering, and create flexibility and scalability for ESG indices.

In terms of the evolution of ESG investing, the continued or emerging trends we’re seeing among clients, include:

- Expanding ESG integration across asset classes: Asset owners and asset managers are continuing to deepen their integration efforts across all asset classes, including fixed income sub-asset classes (bank loans, municipal bonds, securitized), real estate and other private asset classes. They are also looking for more ways to seamlessly integrate ESG into their investment workflow, by leveraging third party distribution channels and APIs.

- Climate Change continues to be a key and growing concern for many investors. We are seeing increasing demand for data and solutions to help investors align with the Taskforce on Climate-related Financial Disclosures (TCFD) requirements, and stress test portfolios for different climate scenarios. Investors are also looking to measure their climate risk exposure across all asset classes, in particular equity, fixed income and real estate.

- Growing regulatory developments aimed at investors, in particular the EU Sustainable Finance Action Plan, will require index providers and investors to provide greater transparency on ESG characteristics and how they are integrating sustainability risks, including portfolio reporting.

- Corporates and capital markets: we are seeing greater engagement from corporates and demand from capital markets teams looking to offer innovative financing options, such as green bonds and ESG-linked loans.

- Finally, the COVID-19 crisis has seen social issues, such as labor management, health and safety, supply chain risk and product safety, move up the agenda for investors. We are monitoring the economic pressure the pandemic places on industries and how this may affect companies’ exposure to ESG risks and their ability to manage them.

Resources

ICE MSCI ESG Derivatives

Offering a simple tool for ESG Integration

Equity Derivatives Monthly Newsletter

Equity market highlights, volumes, and open interest updates.