Exploring the intersection of real estate carbon emissions and housing affordability

Published

August 2023

Authors

The skyrocketing cost of housing affects people across the United States, particularly lower to middle income residents1. Many households also struggle to pay their energy bills, adding to their cost burden. Could better energy efficiency provide housing cost relief while also cutting emissions? In this paper, we explore the contribution of real estate to global carbon emissions, and tools that may lead to a better understanding of the intersection between the two.

There are several factors contributing to soaring housing costs, including rising interest rates, higher inflation, and a growing imbalance between housing supply and demand. Increasingly, there is also growing appreciation from policymakers about the role that energy consumption plays in driving up housing costs. Of note, The Federal Inflation Reduction Act of 2022 and Bipartisan Infrastructure Law of 2021 include billions in loans and grants to promote energy efficiency and help reduce residential heating and electricity bills2.

This focus on energy efficiency seems logical from both an environmental and cost perspective. Residential homes account for over 20% of direct carbon emissions nationwide, and most of these emissions come from energy consumption3. Accordingly, over 25% of all U.S. households report energy cost concerns or have difficulty paying energy bills4. Therefore, improving energy efficiency and the decarbonization of electricity and home heating may yield dual benefits: reduced emissions and housing cost relief. Despite this, policymakers and the public have limited visibility into the carbon footprint of residential properties and how this increases costs for homeowners and renters. Furthermore, real estate lenders and investors are paying attention. Housing affordability can influence the likelihood of mortgage delinquencies and an increasing number of lenders are also interested in the environmental and social benefits derived from decarbonizing real estate5.

ICE Sustainable Finance is seeking to advance the understanding of the intersection of carbon emissions and real estate costs. Our initial approach for carbon footprinting in U.S. real estate covers residential properties and mortgages (whole loans and serviced loans) as well as residential mortgage-backed securities (RMBS). For mortgages and RMBS, we can estimate emissions for residential portfolios and loan pools comprised of properties within the continental U.S., in alignment with the Partnership for Carbon Accounting Financials (PCAF) Financed Emissions Standard. Importantly, our methodology estimates residential carbon footprints without compromising borrower privacy at the property level.

Our estimates of carbon emissions are derived from our proprietary geospatial dataset comprising most of the residential properties in the continental United States. We then incorporate building energy models (BEMs) to inform property-level energy demand. BEMs are detailed physics-based models of the factors that influence energy demand, from weather response (home insulation characteristics, heating fuels, HVAC efficiencies) to behavioral factors (cooking fuels, common washer/dryer efficiencies, electric vehicle uptake rates). We also incorporate hourly electricity grid emissions data to model energy demand under a set of actual meteorological conditions and expected usage patterns. All these components contribute to an estimate of scope 1 and scope 2 emissions for residential properties.

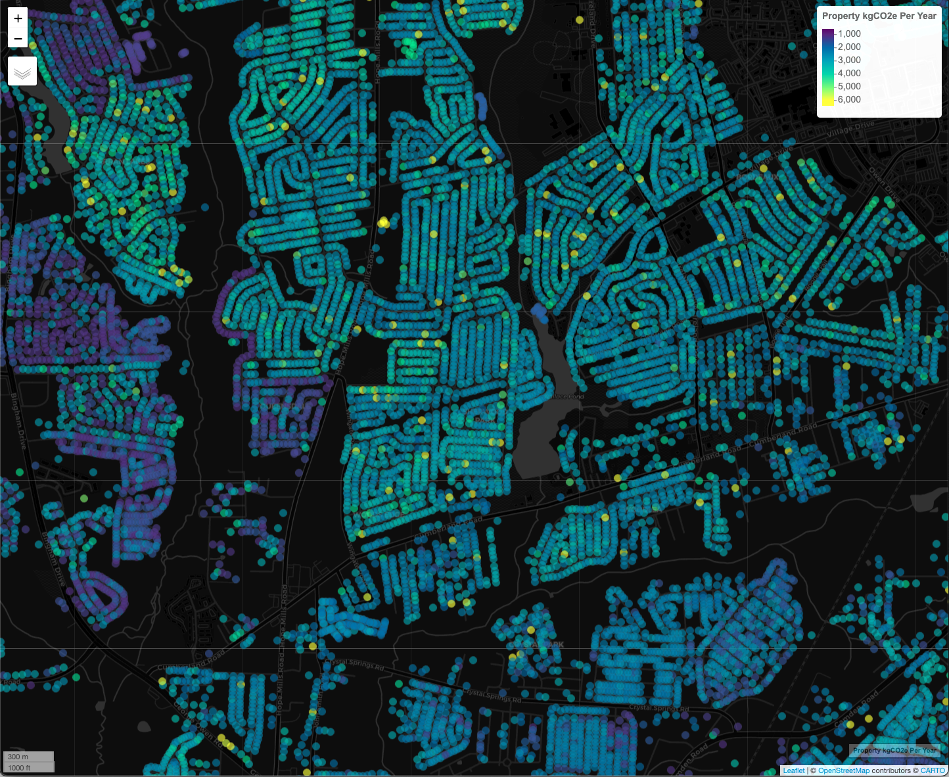

Property-level carbon emissions footprints in Cumberland County, NC. The patchwork single-family residential development pattern shown in the above image is typical for this region of the United States. Variation in residential parcel footprints reflects differences in property age, size, and construction materials6.

In the coming months, we’re planning additional enhancements to our emissions footprinting capabilities in the real estate sector. First, we intend to estimate the carbon footprints for most commercial properties, which may, in aggregate account for approximately 15-20% of U.S. carbon emissions7. We also plan to incorporate certain land use and transportation considerations into our footprinting modeling, which we believe will provide insight into additional indirect emissions attributable to spatial location and distance traveled to and from the property8. Furthermore, for residential real estate, we plan to incorporate more granular information on the specific operating inputs that drive housing costs higher, including insurance, property taxes and utilities. We believe this will enable us to deliver detailed cost of living analysis for a pool of loans or mortgage portfolio.

We plan to expand our granular, geospatial approach to real estate emissions footprinting to properties worldwide. Globally, close to 30% of greenhouse gas emissions are generated by the building and construction sectors9. Inventorying carbon footprints for real estate assets outside the United States presents additional complications, where building standards and construction materials can vary greatly by region and country. Furthermore, access to reliable and granular asset-level data can be very difficult to obtain in many parts of the world. Nonetheless, visibility into the carbon intensity of global real estate is crucial given that decarbonization of these assets is key to limiting global temperature rise to the 1.5C degree pathway to 2050 as stipulated in the Paris Agreement of 201510. With about 80% of the building stock that will exist in 2050 having already been built, improving the climate efficiency of existing buildings is perhaps more important than focusing on new construction11. As such, having an inventory of operational emissions of existing real estate and prioritizing the retrofitting of these assets go hand in hand.

1 “Cost, Crowding, or Commuting? Housing stress on the middle class”, Brookings, May 2019

2 “Building a Clean Energy Economy, White House, January 2023

3 “National Residential Energy Facts”, U.S. Department of Energy, retrieved August 2023

4 “In 2020, 27% of U.S. Households Had Difficulty Meeting Their Energy Needs”, U.S. Energy Information Association, April 2022

5 “The Impact of Climate Change On Housing and Housing Finance”, Research Institute for Housing America, September 2021

6 ICE Sustainable Finance, May 2023

7 “Annual Energy Outlook”, U.S. Energy Information Association, March 2023

8 https://www.tandfonline.com/doi/full/10.1080/10511482.2022.2012030

9 “Managing Transition Risk in Real Estate”, United Nations Environment Programme Finance Initiative, March 2022

10 Ibid

11 Ibid

Resources

Takeaways

- ICE Sustainable Finance’s approach for carbon footprinting in U.S. real estate covers residential properties, mortgages (whole loans and serviced loans) and residential mortgage-backed securities.

- ICE is planning enhancements to its emissions footprinting capabilities, include estimating footprints for most commercial properties, that account for ~15-20% of U.S. carbon emissions.

- For residential real estate, ICE plans to incorporate more granular information to deliver detailed cost of living analysis for a pool of loans or mortgage portfolio.

- ICE plans to expand its geospatial approach to real estate emissions footprinting worldwide. Globally, ~30% of greenhouse gas emissions are generated by the building and construction sectors.