Midland into Brent: A Practical Trading Guide

Published

May 2023

With the dramatic shift in U.S. crude fundamentals over the last decade, the marginal barrel that sets the domestic price has transitioned to Midland on the U.S. Gulf Coast. Houston’s direct connectivity to considerable volumes of Midland-origin and Midland-quality crude, more than half of U.S. refining capacity, and substantial waterborne exports, along with access to ~150 million barrels of crude storage capacity, solidify the Midland price in Houston as the most representative for U.S. crude oil.

Midland WTI is deliverable into the Brent Complex

ICE Midland WTI (Code: HOU) enables participants to directly price and hedge the marginal domestic barrel of Midland quality crude that meets Platts Midland specifications accepted into Dated Brent. Moreover, it is deliverable in Magellan and Enterprise's terminals; both are connected to water terminals included in Platts’ approved terminals list. Producers can hedge output while refiners and exporters can hedge supply and traders manage their positions.

How to hedge a Midland WTI cargo shipped from the U.S. Gulf Coast to Europe

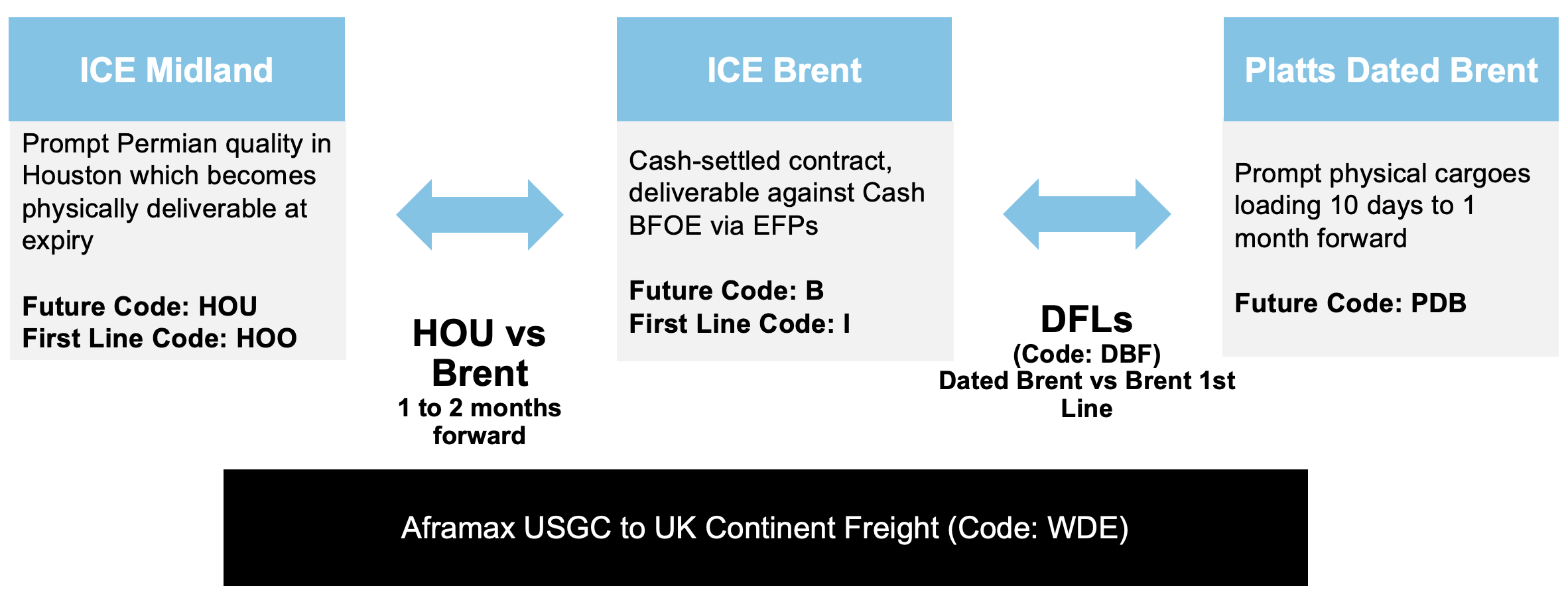

Now Midland can be delivered into the largest and most liquid oil contract in the world: Brent. The table below demonstrates how to trade and hedge Midland into Brent.

Hedging Midland into Dated Brent

Example:

ICE Product Specs

With the inclusion of Midland into the Brent complex, what has really changed?

The addition of Midland has seen the volume of barrels eligible for inclusion in both Cash BFOE (physical forward) and Dated Brent now double.

The cargo size for Cash BFOE and Dated Brent assessments has grown from 600,000 to 700,000 barrels. Aframax tankers have improved efficiency in the North Sea shipping fleet and are the standard choice for transatlantic barrel transportation.

Furthermore, the inclusion of Midland barrels in the physical forward cash markets means a link between the price for USGC Midland barrels and the settlement of ICE Brent futures.

When ICE Brent futures expire, prices converge with the physical Brent market through the ICE Brent Expiry Index, which represents the average price of BFOE in the physical market for the relevant delivery month. The Index includes inputs of M2 EFPs and M1/M2 cash spreads. In this way, the Cash BFOE (physical forward) market provides the link between ICE Brent futures and Dated Brent.

How do I trade HOU?

HOU is part of ICE’s oil benchmarks complex and is available to trade in WebICE or other futures trading platforms alongside Brent and other oil products. To trade HOU you need to request clearing limits from your clearer and complete the portfolio setup. For more information, contact [email protected].

Where can I see both HOU trades and Midland being offered in the Platts E-Window on the same platform?

Platts E-Window

- First, contact S&P Global- Platts at [email protected] to subscribe to a PGA license (Platts Global Alert);

- Then let the Platts e-window team know that you want access to the window. Contac Platts at [email protected];

- Next, contact ICE Account Services at [email protected] and they will send the Participant Agreement;

- Finally, ICE Admin will give you access after double checking with e-window team. Now HOU and Platts E-Window will both be available in WebICE.