USDX® Futures | Mini USDX® Futures | USDX® Options | |

Trade on | ICE Futures U.S. | ICE Futures Singapore | ICE Futures U.S. |

Contract size | One contract = $1000 X index value | One contract = US $200 x index value | One futures contract ($1000 X Index value) |

Expiry | Third Wednesday of the expiration month | Cash-settled against USDX® Futures on the last Trading Day for the expiry month | Third Wednesday of the expiration month |

Settlement | Physically settled against the six component currencies in their respective percentage weights | Cash-settled against the USDX® futures final settlement price | Physically settled against the six component currencies in their respective percentage weights |

Trading hours | 8:00 P.M. - 5.00 P.M. ET | 8:00 A.M. - 6.00 A.M. SGT | 8:00 P.M. - 5.00 P.M. ET |

Symbol | DX | SDX | DX |

Product spec |

U.S. Dollar Index® Futures

The simplest way to trade the greenback

Effectively managing exposure to currency risk requires FX markets that provide global access and broad currency coverage. With ICE, you’re able to trade more than 60 FX contracts including the world’s most heavily traded majors, cross rates and emerging markets currency pairs.

The USDX complex includes futures and options available for trading at ICE Futures U.S., as well as a cash settled mini futures contract available for trading at ICE Futures Singapore. The contracts offer capital efficiencies through margin offsets across our wider FX portfolio.

Manage and monitor U.S. Dollar risk

Managing U.S. dollar risk in uncertain times

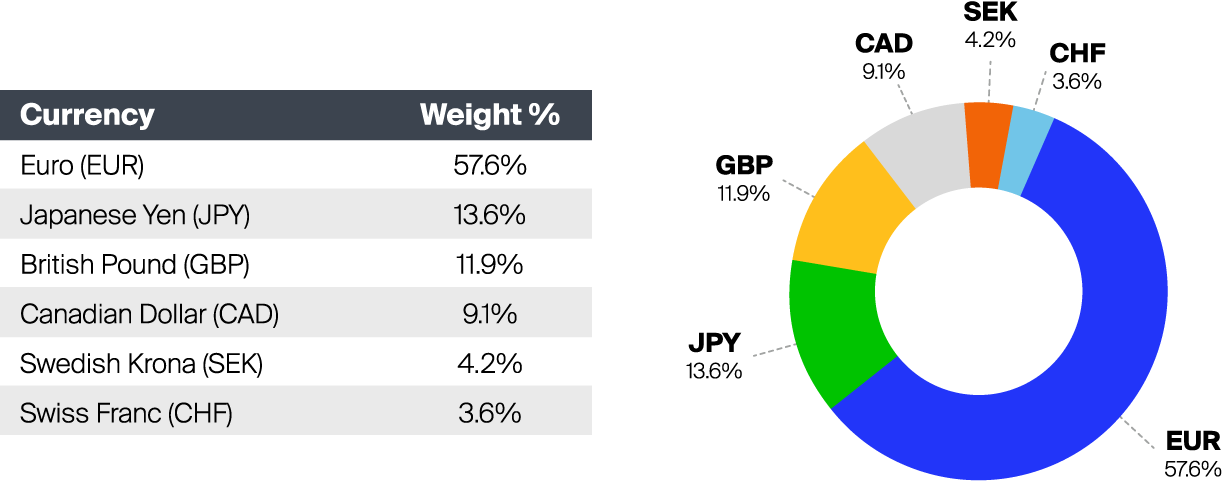

Index Composition

USDX Futures are benchmarked to the USDX, which is administered by ICE Data Indices, LLC and is differentiated among currency indices in its fixed weight composition. The composition of the USDX was changed only once in January 1999 when the Euro launched, replacing several single country European currencies. The cumulative exposure of those former European single country currencies remained fixed at 57.6%.

The USDX is a geometrically averaged calculation of six currencies weighted against the U.S. dollar, and is calculated in real time every second using the spot prices of the USDX’s component currencies. The prices used for the calculation of the USDX are the mid-points between the latest available bid and offer in the component currencies as sourced from ICE Data Derivatives. The methodology of the USDX can be found here.

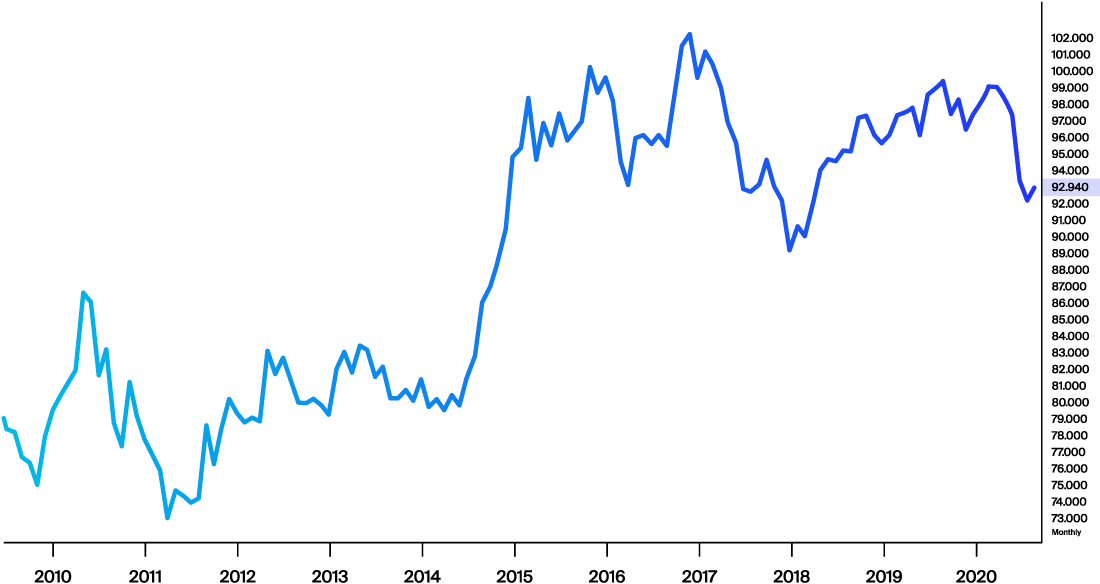

Index Performance

The USDX reached a high of 164.72 in February 1985 and a low of 70.698 in March 2008. As of September 16, 2020, the USDX Index closed at a value of 93.15, indicating that the U.S. dollar has depreciated in value versus the basket of constituent currencies since the USDX launched in March 1973. The USDX is impacted by several macroeconomic factors, including inflation/deflation in the U.S. dollar and foreign currencies included in the basket as well as recessions and economic growth in those countries.

Trading the futures

Instead of paying individual spreads on six separate currencies, you can take long or short positions on all six with only one bid and ask spread.

Continuous growth in open interest and volume is driven by a range of market participants as the need for transparent, efficient and cleared FX markets grows.