ICE Sustainable Finance Monthly Report

Sign up to our mailing list to receive the newsletter and updates from the ICE Sustainable Finance team

President, Sustainable Finance & Chief Regulatory Officer, ICE

COP28 & Global Sustainability Forum

Our team participated at many of the official COP28 sustainability events, including co-hosting with ADNOC and the Posterity Institute a Global Sustainability Forum. The event brought together over 100 Chief Sustainability Officers and climate leaders from across the world. We were delighted to be joined by special guests, H.E. Ohood Al Roumi, the UAE (United Arab Emirates) Minister of State for Government Development and the Future, and the next generation of climate leaders from the UAE Sustainability Fellowship.

Our other conversations with clients and attendees at COP28 showed an enthusiasm for tackling the climate challenge. Discussions with local financial industry clients in Dubai focused on climate target setting and broadening emission reduction ambitions to Scope 3 emissions (investments). COP28 appears to have provided a boost to the climate ambitions of our clients in the region.

Insights

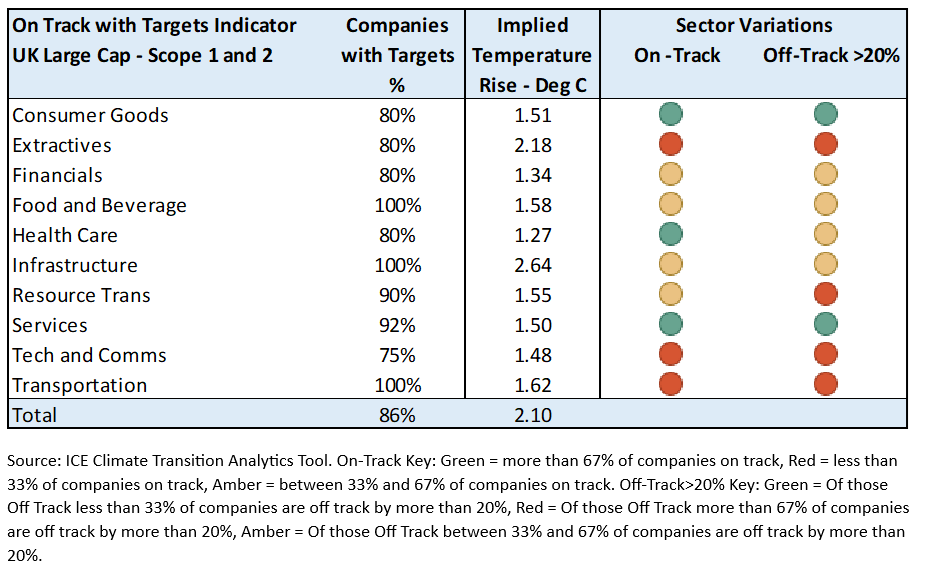

Temperature alignment - who's on track, and who's come off the rails

ICE Sustainable Finance recently published an article examining how to track the climate (decarbonization) performance of companies against their own published targets. Using ICE’s On-Track with Targets Indicator, recently launched on the Climate Transition Analytics Tool, the article highlights examples where companies are more likely on track to meet their stated climate ambitions and those which are more likely to miss their targets by a significant amount.

Source: Animation of annual projected property value at risk from inland flooding by school district across New York state under the IPCC’s RCP8.5 emissions scenario from 2021-2060. (Source: ICE Sustainable Finance as of 11/15/2023).

Municipal bond markets: the implications of rising inland flood risk

Many school districts across New York state are exposed to significant flood risk. By 2050, expected property value at risk due to inland flooding across New York state is estimated at over 2.5% and expected GDP impairment is over 6.5% - a ten-fold rise from 2023. These risks have implications for the municipal bond market and could become increasingly relevant for investors.

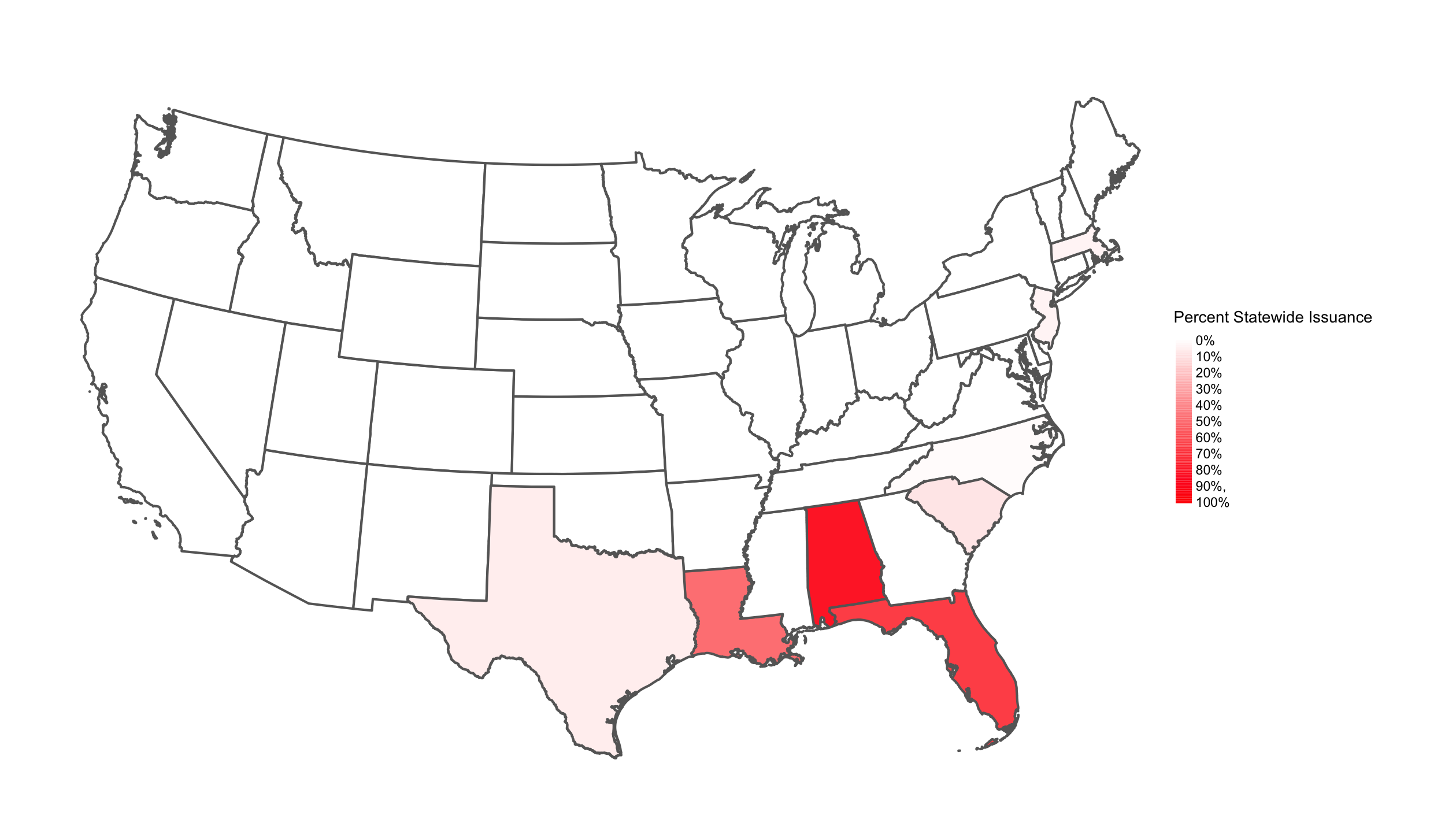

ICE Muni Bonds monthly report

In November, there was over $2.1B in high physical climate risk1 (ICE Climate Risk Score ≥ 3) municipal issuance across the 48 contiguous states, the majority concentrated across Florida, Alabama, and Texas.

All numbers and charts are sourced from ICE Sustainable Finance data and models as of 12/07/2023 and are available via product offerings. Municipal issuances outside of the 48 contiguous states are not included along with other issuances that cannot be associated with a specific geographic location.

Product enhancements

New Climate Transition Analytics and Metrics

The Net Zero Alignment analysis and the TCFD reporting capabilities of ICE’s Climate Transition Analytics Tool have been enhanced further, providing clients with a deeper understanding of potential portfolio climate misalignments and more detailed stakeholder and regulatory reporting.

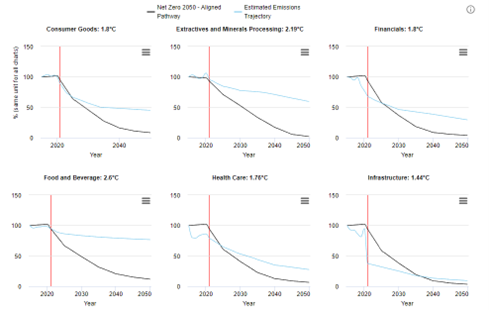

Net Zero Analysis Module Enhancements

The latest enhancements to the Net Zero Analysis Module on the ICE Climate Transition Analytics Tool include the ability to select multiple climate scenarios, the introduction of a new Sector Subplot tab showing the historical and aligned emissions of a portfolio at sector level and the ability to include/exclude targets from the trajectory estimations. The analytics have been further enhanced by an expansion of the Temperature Targets Dataset.

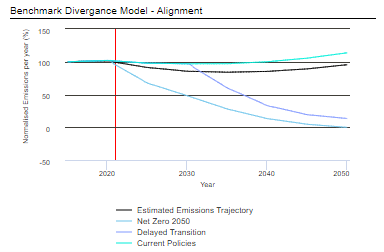

TCFD & Portfolio Analytics Reporting Enhancements

The TCFD and Portfolio Reporting functionality on the ICE Climate Transition Analytics Tool have been further enhanced by the introduction of more granular carbon footprinting metrics, such as per asset class reporting, the ability to compare portfolio alignment against three climate scenarios (Net Zero 2050, Delayed Transition & Current Policies) and more detailed data tables, including the Top 10 portfolio holdings by Intensity.

Source: ICE Climate Transition Analytics Tool

Source: ICE Climate Transition Analytics Tool

Solution spotlight

Mortgage-Backed Securities gain ESG data coverage

We recently launched ESG data coverage on over 1.5M mortgage-backed securities (MBS) boosting our total fixed income coverage to over 3M instruments. ICE’s MBS data set accounts for ~95% of all outstanding securitized real estate loan volume in the U.S. and provides CUSIP-linked climate and socioeconomic data for single-family, multi-family and commercial mortgage-related securities

Helping meet SFDR requirements

The European Union’s Sustainable Finance Disclosure Regulation (EU SFDR) requires financial market participants to identify and disclose certain sustainable impacts. To help clients meet their obligations, our data solution offers event-triggered updates for all mandatory adverse sustainability indicators applicable to investments in companies, sovereigns and supranationals.

Mortgage-Backed Securities gain ESG data coverage

We recently launched ESG data coverage on over 1.5M mortgage-backed securities (MBS) boosting our total fixed income coverage to over 3M instruments. ICE’s MBS data set accounts for ~95% of all outstanding securitized real estate loan volume in the U.S. and provides CUSIP-linked climate and socioeconomic data for single-family, multi-family and commercial mortgage-related securities

Helping meet SFDR requirements

The European Union’s Sustainable Finance Disclosure Regulation (EU SFDR) requires financial market participants to identify and disclose certain sustainable impacts. To help clients meet their obligations, our data solution offers event-triggered updates for all mandatory adverse sustainability indicators applicable to investments in companies, sovereigns and supranationals.

This material contains information that is confidential and proprietary property and/or trade secrets of ICE Data Pricing & Reference Data, LLC and/or its affiliates, and is not to be published, reproduced, copied, disclosed, or used without the express written consent of ICE Data Pricing & Reference Data, LLC. This document is provided for informational purposes only. The information contained in this document is subject to change without notice and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between ICE Data Pricing & Reference Data, LLC and/or affiliates their clients relating to any of the products or services described herein. ICE Data Pricing & Reference Data, LLC does not provide legal, tax, accounting, or other professional advice. This document is not an offer of advisory services and is not meant to be a solicitation, or recommendation to buy, sell or hold securities. This document represents Intercontinental Exchange, Inc. and/or its affiliates’ observations of general market movements. Please note that the information may have become outdated since its publication.

Clients should consult with an attorney, tax, or accounting professional regarding any specific legal, tax, or accounting situation. Intercontinental Exchange, Inc., and its affiliates are not registered as nationally registered statistical rating organizations, nor should this presentation be construed to constitute an assessment of the creditworthiness of any company or financial instrument. Fixed income evaluations, continuous evaluated pricing, end-of-day evaluations, evaluated curves, model based curves, market sentiment scores and Fair Value Information Services related to securities are provided in the US through ICE Data Pricing & Reference Data, LLC and internationally through ICE Data Services entities in Europe and Asia Pacific. ICE Data Pricing & Reference Data, LLC is a registered investment adviser with the US Securities and Exchange Commission. Additional information about ICE Data Pricing & Reference Data, LLC is available on the SEC’s website at www.adviserinfo.sec.gov. A copy of ICE Data Pricing & Reference Data, LLC’s Form ADV is available upon request.

ICE Data Pricing & Reference Data, LLC and/or affiliates make no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. Without limiting the foregoing, ICE Data Pricing & Reference Data, LLC and/or affiliates make no representation or warranty that any data or information (including but not limited to evaluations) supplied to or by it are complete or free from errors, omissions, or defects. Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located at www.intercontinentalexchange.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.