Brent

The global benchmark for navigating crude oil markets

Precision matters. Throughout market cycles, managing opportunity costs is paramount. In oil markets, physical participants are looking to manage their exposure at the exact locations where fuel is produced and consumed. Financial traders depend on deep liquidity to take positions that will generate the best possible returns.

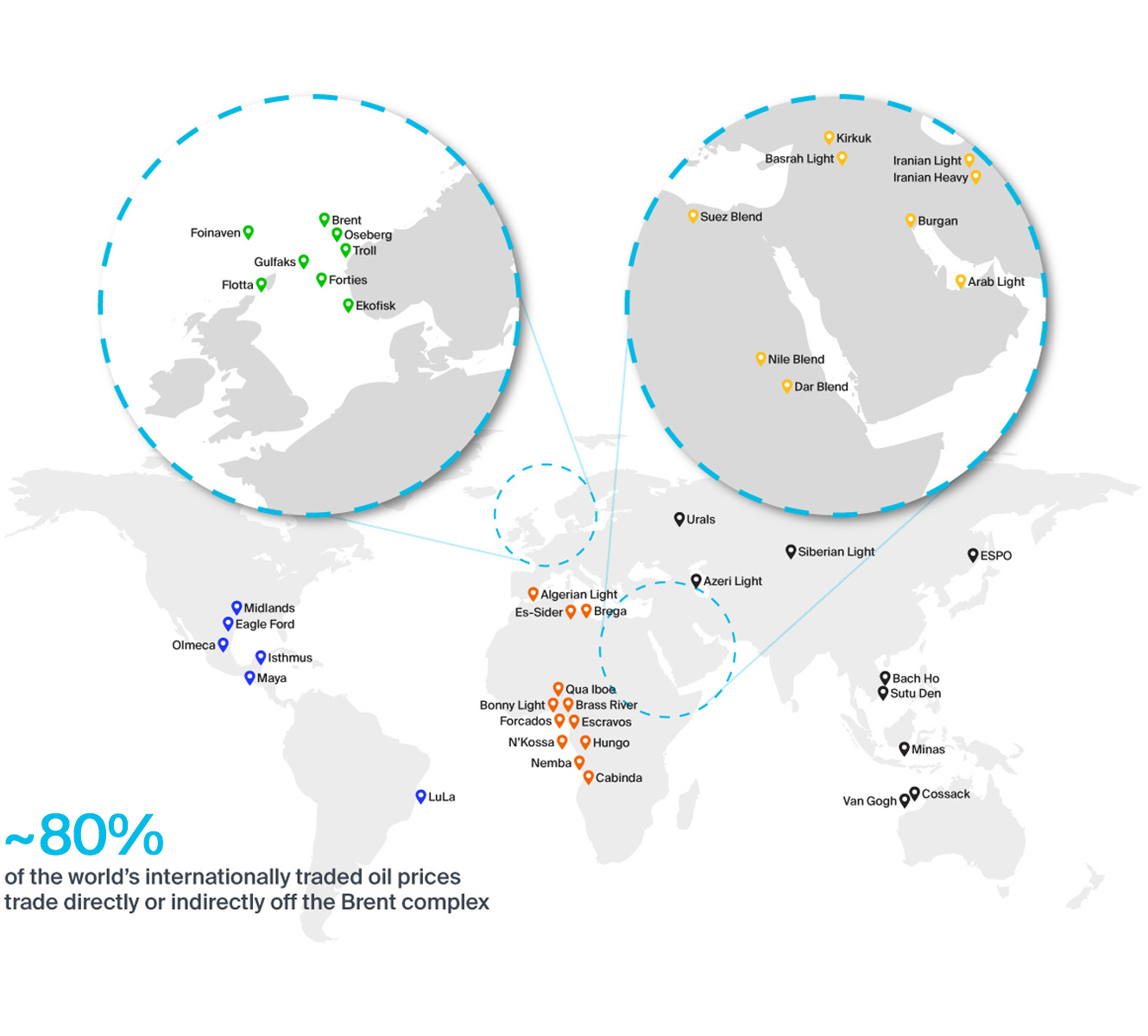

Brent is the price barometer for ~80% of global crude. As a waterborne crude - with access to global shipping, ports, and storage capacity - it is easily transported around the world. This gives Brent an advantage over landlocked crudes and provides a clear valuation opportunity for commercial and financial traders.

The Brent complex has been evolving for decades. As with the addition of other crude streams to Brent in the past, the addition of Midland WTI is expected to further enhance the Brent complex.

Beginning June 2023, WTI Midland crude will be added to the current Brent “basket” of BFOET (Brent, Forties, Oseberg, Ekofisk, and Troll). It will be reflected in Dated Brent and the “cash” (i.e., physical forward) Brent price assessments.

The ICE Brent crude future is based on a basket of North Sea crudes and has evolved to incorporate new grades, ensuring its ongoing utility to oil markets. The ICE Brent Crude futures contract is a physically deliverable contract with an option to cash settle against the ICE Brent Index price, which is calculated the day after the last trading day of the futures contract. The ICE Brent Index represents the average price of trading in the prevailing North Sea physical market for the relevant delivery month.

Only published full cargo size (currently 700,000 barrels) trades and assessments are taken into consideration in the calculation of the ICE Brent Index thus linking the price of the ICE Brent futures contract directly to the underlying physical market without the requirement of having to take physical delivery. The ICE Brent Index is published by ICE Futures Europe on the day after expiry of the front month ICE Brent futures contract and used by ICE Futures Europe as the final cash settlement price.

By working closely with market participants to ensure they have access to effective hedging mechanisms, ICE established Brent as the world’s largest oil futures contract. As a result, the Brent complex has expanded to include a vast range of local and regional hedging instruments, with many contracts clearable ahead of regulatory mandates.

The Brent Complex

As part of our stewardship role for the Brent oil complex, ICE Futures Europe is the benchmark administrator for the Brent Index. We provide transparent, reliable insight into the Brent benchmark to help market participants make informed decisions.

- Margin offsets between Brent and Dubai of up to 96% offer the most efficient way to cover East/West pricing exposure

- Up to 97% in initial margin savings when you trade Brent/WTI spreads on ICE

- Savings of nearly 90% in initial margin costs when you keep your Arb options and underlying hedge with ICE

- Margin offsets across the entire oil product range

- Additional margin offsets against non-oil contracts including coal, gas, power, emissions and freight

- A reduced fee structure for contracts held to expiry

- A selection of ICE Brent cracks across the barrel to help you cover your refining margin exposure

- A comprehensive list of Freight Forward Agreements (FFAs) to help you cover freight exposure while receiving margin offsets against your crude positions

- Around-the-clock-help for entering direct counterparty deals

Resources

The Contract

Front month Brent contract is the August contract - last trading date ahead of expiry is June 30, 2021 - settlement on July 1, 2021.

- Deliverable contract based on an Exchange of Futures for Physical (EFP) delivery with an option to cash settle

- Each lot equals 1000 barrels of crude

- Trading hours London time:

- Sunday Pre-Open 9:00 PM; Sunday Open 10:00 PM

- Monday to Friday: 1:00 AM - 11:00 PM with pre-open from 12:45am

- Trades in U.S. Dollars

- Trades in London and Cleared in London

- Settlement calculated daily as a weighted average price of trades during a two minute settlement period from 19:28pm, London time

- Contracts listed up to 96 consecutive months