ICE Oil Markets:

Driving Growth Across Benchmarks and Refined Oil Markets

Manage exposure on a single platform for capital efficiencies across the global oil complex.

Start HereAs home to the global oil

benchmarks, ICE provides depth

and liquidity the industry relies on

To Top

As home to

the global oil

benchmarks,

ICE provides depth

and liquidity the

industry relies on

years of consecutive record volume for oil

years of consecutive record volume for oil

related oil products

related oil products

Market participants can access a broad refined product complex including Gasoil, Diesel

and Jet Fuel

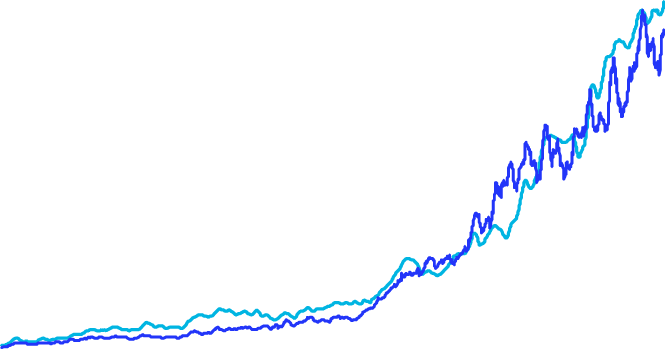

ICE transitioned the

Brent market from open

outcry to electronic trading

in 2005, providing global

access for the oil market

and driving record trading

participation ever since

Dubai

The ICE Platts Dubai Future represents the price for Dubai crude, the main reference for crude delivered into Asian refineries from the Middle East.

Dubai 1st Line Future -DBI

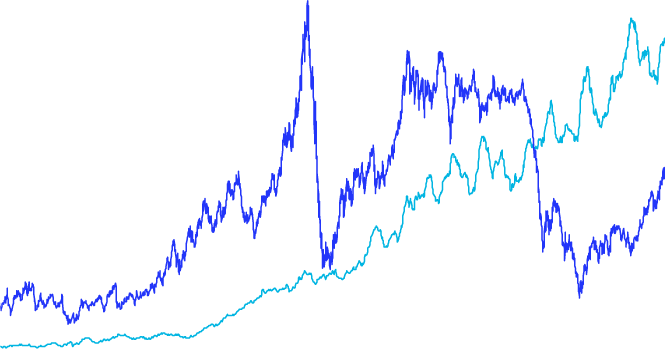

Brent

Launched in 1988, Brent is the world's benchmark crude futures contract for two thirds of the world's oil and originates from the North Sea.

WTI

The ICE West Texas Intermediate contract (also known as Texas light sweet) enables trading in a highly liquid, electronic marketplace. The benchmark for U.S. light crude with delivery into Cushing, Oklahoma.

ICE offers hedging across a wide range of crude grades, and consistently expands its offering to meet customer demand.

HoustonMMP

Market participants can

access a broad refined

product complex including

Gasoil, Diesel and Jet Fuel

ICE transitioned the

Brent market from open outcry to electronic trading in 2005, providing global access for the oil market and driving record trading participation ever since

Brent and Dubai are

the most widely used

global benchmarks for

physical crude oil.

Leading Global

Oil Markets

Intercontinental Exchange

Market

Liquidity

Trade on the platform

for half the world's oil

futures volumes

Capital

Efficiencies

A wide range of

margin offsets

maximizes capital

efficiencies

Advanced

Technology

Advanced platform

with live market

access & seamless

interaction

Global

Distribution

An exchange built on

relationships of the

world's largest energy

market participants

Product

Innovation

More than 1,000

new energy products

covering the US to

Europe and Asia

WTI

The ICE West Texas Intermediate contract (also known as Texas light sweet) enables trading in a highly liquid, electronic marketplace. The benchmark for U.S. light crude with delivery into Cushing, Oklahoma.

ICE offers hedging across a wide range of crude grades, and consistently expands its offering to meet customer demand.