ICE Low Sulphur Gasoil

The refined choice for global markets

ICE Low Sulphur Gasoil is the world’s leading refined benchmark, offering exceptional hedging and trading capabilities. Similar to ICE Brent Crude in the crude oil market, ICE Low Sulphur Gasoil plays a crucial role for middle distillate oil markets, providing stability and transparency to market participants worldwide.

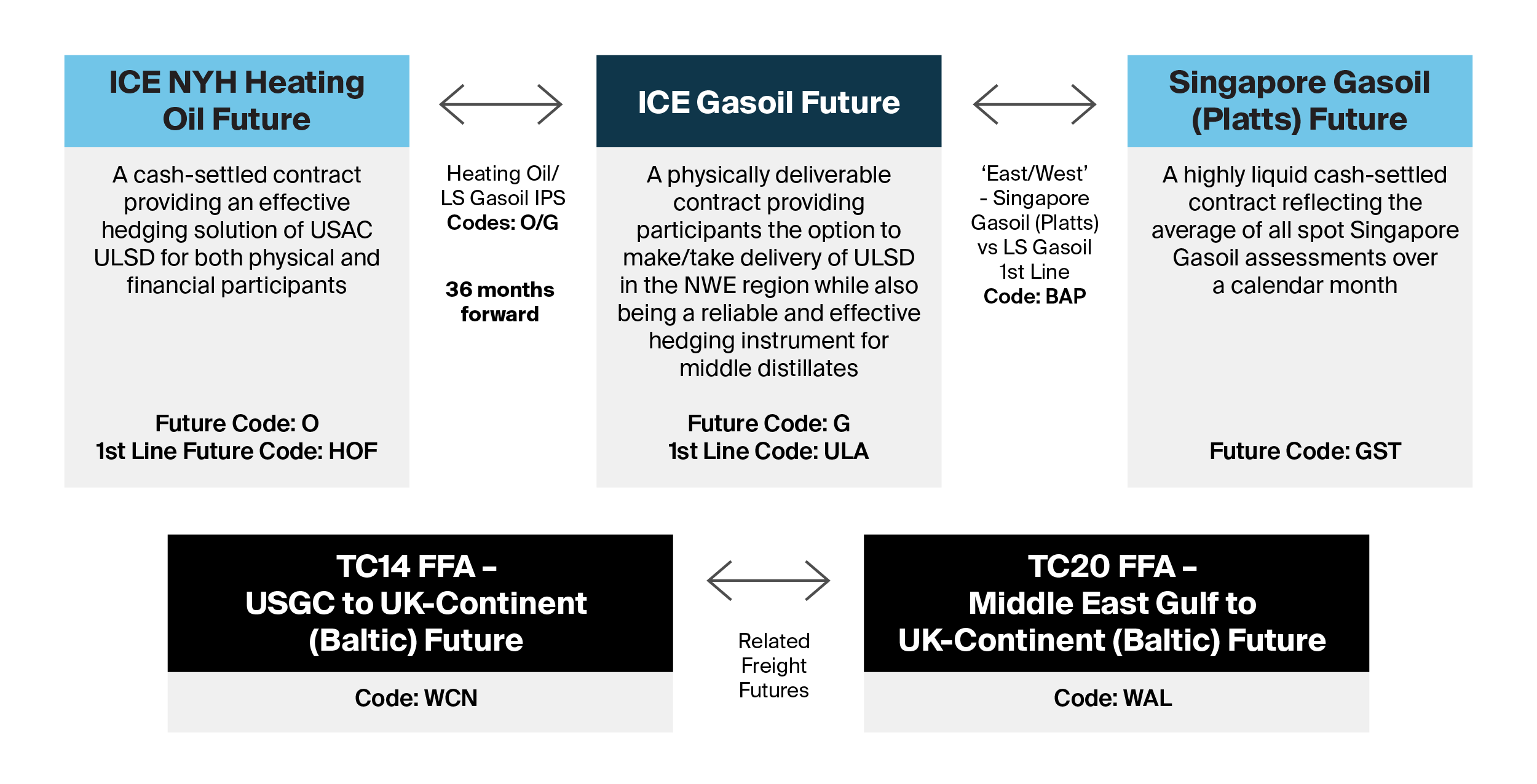

As the global middle distillates market remains volatile, ICE provides market participants with tools to hedge related products around the world, while being able to export and import ultra-low sulphur diesel (“ULSD”) in Europe.

ICE Low Sulphur Gasoil sits at the centre of this risk management network, serving as the global benchmark price for the middle part of the refined barrel. Being a trusted efficient benchmark with its many related markets on ICE for over 40 years, it provides market participants with a complete portfolio of products to navigate the changing energy landscape.

Described below is the usefulness and effectiveness of these tools:

ICE Gasoil at the centre of global middle distillates trading

All regional middle distillate contracts supported by liquid Brent crack contracts and/or interproduct futures spreads ('IPS')

Primarily, one of the major changes the market has experienced is the significant rerouting of trade flow after imports of Russian-origin diesel were banned from EU and G7 nations in February 2023. Prior to the sanctions, around 50-60% of Northwest Europe’s diesel seaborne imports came from Russia but have now been replaced by barrels from the Middle East, Asia and the Americas.

With the recent disruption of flows from the Middle East and Asia, cargoes have been diverting round the Cape of Good Hope and into the Atlantic Ocean. This has exposed more east of Suez oil to Atlantic-based pricing competing with equivalent products exported from the U.S. The ‘East/West’ Gasoil contract helps participants manage arbitrage between Middle East and Asian origin diesel barrels and European prices. ICE offers an Inter-product Futures spread1 between the New York Harbour Heating Oil Futures and Low Sulphur Gasoil Futures contracts.

The spread, commonly known as ‘HOGO’, provides market participants with a one-stop solution to trade the transatlantic arbitrage value between two middle distillate benchmarks2. ICE volumes traded of this “HOGO” spread grew significantly in 2020 and 2021, then surged in 2022 and 2023 as trade flows shifted significantly and participants hedged their exposure. So far, on an ADV basis, 2024 looks set to be another record year for ICE HOGO futures as U.S. exports of ULSD average over one million b/d and east of Suez ULSD cargoes travel west of Africa, via the Atlantic Ocean, towards Europe.

Heating Oil/Gasoil Interproduct Futures ADV (in lots)

Trading the HOGO strategy results in positions in the ICE Gasoil Futures and the cash-settled ICE Heating Oil Futures contracts. Traded volume in this cash-settled equivalent Futures contract has remained healthy, and it provides market participants with exposure to U.S. heating oil prices without the risk and volatility of physical delivery and smooth execution practice

The margin offsets of clearing both contracts at a single clearing house, ICE Clear Europe, provides market participants with significant capital efficiencies, while maintaining optimal levels of initial and intraday margin to safeguard the global marketplace. Trading a HOGO strategy of front-month vs front-month or second-month vs front-month can deliver margin offsets of nearly 90%. In addition to the arbitrage products, ICE is home to Wet Freight Futures, including contracts referencing the ULSD routes from the US to Europe (TC14) and Middle East to Europe (TC20). These contracts offer market participants an extra layer of risk management for these important diesel trade routes.

The ICE LS Gasoil Futures contract provides assured liquidity with the on-screen strategy to ICE Heating Oil Futures. With a multitude of related contracts, ICE continuously caters to the changes in global flows since Russian diesel was diverted away from Europe.

Related content

1 This is an onscreen spread which results in two separate positions in each of the contracts.

2 ICE offers cash-settled derivatives as well that reference the settlement prices of the two main Futures contracts. Open Interest in the Heating Oil 1st Line vs Low Sulphur Gasoil 1st Line Future (in bbls) (code: ULM) has more than doubled end-February 2024, compared to a year earlier, from 7,044 lots to 15,822 lots. ICE’s market share is 100% for this contract.