NYSE FactSet® Indices

The NYSE FactSet® Global Robotics and Artificial Intelligence Index is calculated and maintained by ICE Data Indices based on a methodology developed by FactSet®. The methodology leverages FactSet RBICS (Revere Business Industry Classification System) industry classifications to determine Infrastructure Enablers and Infrastructure Asset Owners and Operators.

For more information on the NYSE FactSet® Global Robotics and Artificial Intelligence Index, please contact the Index team.

The NYSE FactSet® U.S. Infrastructure Index (Ticker: NYFSINF) is an equity benchmark designed to track the performance of companies involved in the U.S. infrastructure value chain, from asset owners and operators to their upstream enablers. Within the asset owner and operator category, the index covers three asset types: energy transportation and storage, railroad transportation, and utilities. Within the enabler category, the index covers three upstream verticals: construction and engineering services, machineries, and materials.

This holistic approach to defining infrastructure not only retains the attractive attributes of traditional equity infrastructure investing – stable cash flows, high barriers to entry and acting as an inflation hedge – but also improves potential capital appreciation by including the more direct beneficiaries of U.S. infrastructure investment.

The index is modified equal-weighted and is reconstituted annually after the close of the third Friday in March each year. Index constituent weights are rebalanced quarterly after the close of the third Friday in March, June, September, and December each year.

The NYSE FactSet Global Robotics and Artificial Intelligence Index (Ticker: NYFSRAI) is an equity benchmark designed to track the performance of companies engaged in the fields of robotics and artificial intelligence (AI). In robotics, the index seeks to identify companies involved in the enablement, development, manufacturing, or operation of technologies designed to perform tasks with speed, precision, and automation. In AI, the index seeks to identify companies involved in the development, programming, or deployment of computer hardware or software that are capable of self-directed learning, language processing, pattern recognition, visual perception, predictive analysis, expert recommendation, or a combination of all the above. Robotics and AI will be a megatrend impacting economies and businesses of all sizes and across the globe, and the NYSE FactSet Global Robotics and Artificial Index (ticker) is built to capture this diverse ecosystem by covering companies in both emerging and developed markets, and from multiple sectors including Technology, Materials, Industrials, Healthcare, and Consumer.

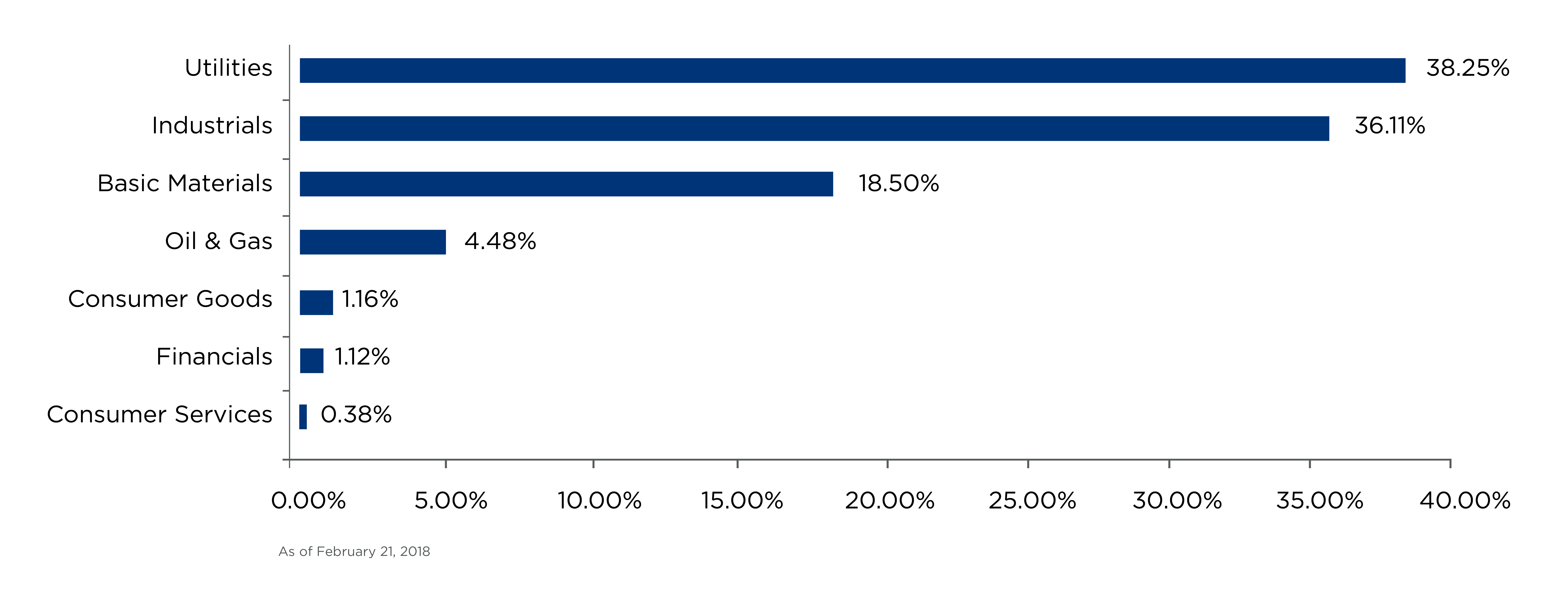

Sector Breakdown & Index Weighting