The Prospects of Murban as a Benchmark

Head of Oil Market Research

This article was originally published by the Oxford Institute for Energy Studies on 25 May 2021, as part of the Oxford Energy Forum journal, in an issue on “Middle East Oil Pricing Systems in Flux".

On 29 March 2021, ICE Murban crude oil futures began trading on the new ICE Futures Abu Dhabi (IFAD) exchange. Nine of the world’s largest energy traders have joined ICE (exchange operator and majority shareholder) and the Abu Dhabi National Oil Company (ADNOC) as founding partners in IFAD; these partners include BP, GS Caltex, INPEX, ENEOS (formerly JXTG), PetroChina, PTT, Shell, Total, and Vitol.

This article will examine the fundamental characteristics of Murban that should make it a successful benchmark. In addition, we will cover some of the key technical aspects of how the futures contract works. We will also discuss the uses of ICE Murban crude oil futures, how it fits into the global oil market, and its trading dynamics since launch.

Fundamentals that support Murban as a benchmark

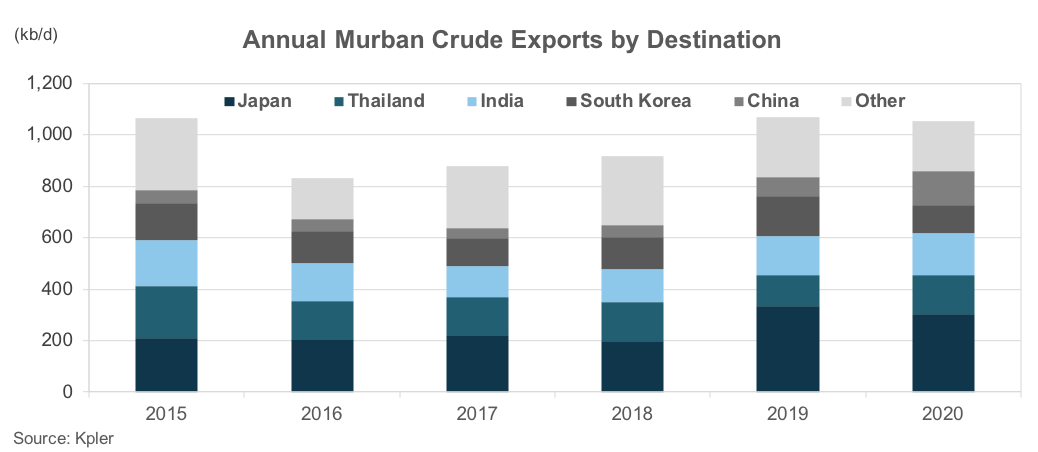

- High physical volumes: Murban has high, reliable, and stable volumes of both crude production and exports. Total UAE crude production capacity is currently over 4 Mb/d. Of this, Murban production capacity, operated by ADNOC Onshore, is around 2 Mb/d. Murban exports averaged approximately 1.1 Mb/d in 2019 and 2020, as shown in the chart below. Importantly, these volumes will provide physical liquidity to underpin ICE Murban crude oil futures and will be available for sale through the contract.

- Future growth plans: ADNOC plans to increase crude production capacity by 25 percent to 5 Mb/d by 2030. Murban production capacity is expected to remain about half of the total, and should grow from 2 Mb/d to 2.5 Mb/d. Murban exports should increase in line with production.

- Ruwais refinery upgrade: In addition to increasing production by 2030, a $3.5 billion upgrade to the 817 kb/d Ruwais refinery is due for completion next year. Ruwais currently processes mainly Murban crude, but the upgrade will give it the flexibility to refine around 400 kb/d of heavier and more sour crude grades, including imports. This will increase the volume of Murban available for exports.

- Transparent export plans: In order to provide greater transparency and visibility on Murban exports, ADNOC now publishes monthly “Murban Export Availability Reports”, available on ADNOC’s website. This provides projected volumes of Murban available for exports in the 12 months ahead.

- High quality crude: Murban is a consistently high-quality light sour crude, with API gravity of 39.9 degrees and sulphur content of 0.78%. It is lighter and sweeter than most Middle East crudes, which are medium and heavy sour grades. Indeed, Murban is closer in quality to UK Forties (part of the Brent assessment) and US WTI.

- Diverse group of sellers: Importantly for the proper functioning of a benchmark, production and sales of Murban are diverse and not dominated by a single player. Alongside ADNOC (60% equity production), other partners in ADNOC Onshore include BP, Total, CNPC, Inpex, Zhenhua, and GS Energy.

- Diverse group of buyers: Of equal importance, buyers are also diverse. Due to the high quality of Murban, it is attractive for refiners. As shown on the Murban exports chart above, essentially all Murban flows to refiners in Asia (including the “other” category). Approximately 30% goes to Japan, with roughly 15% each going to China, South Korea, Thailand, and India.

- Strong terminal/port infrastructure: Murban crude is exported from Fujairah and Jebel Dhanna, near Ruwais. The majority of the current 1-1.1 Mb/d of exports is from Fujairah, at around 840 kb/d. We focus on Fujairah here, because that is where physical delivery of Murban through the ICE Murban crude oil futures contract will take place. At this oil trading hub, three single-point buoy mooring points allow near-simultaneous loading of very large crude carriers (tankers).

- Ample crude storage at Fujairah: Another important factor for a crude benchmark is storage capacity at the physical delivery point. Existing crude storage capacity at Fujairah is 8 Mb. However, ADNOC is currently building a new 42 Mb underground crude storage facility, located next to Fujairah in the UAE’s Hajar mountains. This facility, which will bring total Fujairah-linked crude storage to 50 Mb, is due for completion in 2022 and will be connected to Fujairah by overland pipeline. The ample storage capacity at Fujairah will give ADNOC the ability to ensure uninterrupted physical liquidity for deliveries into the ICE Murban crude oil futures contracts; it also allows ADNOC to mitigate any impact from possible OPEC production cuts (more on this below).

Key changes to the Murban market

The launch of trading for ICE Murban crude oil futures was combined with two important and fundamental reforms in physical Murban pricing and physical trading.

On pricing, starting in June, the official selling price (OSP) for Murban will no longer be set as a differential to Platts Dubai assessments. Instead, it will be a transparent, market-driven, prospective price. Going forward, the OSP for Murban will be based on the monthly average of daily front-month Singapore Marker prices of ICE Murban crude oil futures in month M-2, where M is the month of loading.

For example, the price for Murban loading in June 2021 was based on the June ICE Murban crude oil futures contract, which was the front-month contract during the month of April 2021 and expired at the end of April 2021. The OSPs for ADNOC’s other export grades - Das, Upper Zakum, and Umm Lulu - will be set as differentials to Murban; therefore, all of them will be based on ICE Murban crude oil futures.

On trading, ADNOC has removed destination and resale restrictions on all its crude, also starting in June 2021. They will be able to be freely traded and delivered in the global market.

These two reforms are designed to work with each other and also to work hand-in-hand with ICE Murban crude oil futures. The removal of destination and resale restrictions will boost physical trading in Murban and other ADNOC crudes, while the move to pricing based on ICE Murban crude oil futures will facilitate the use of those futures to hedge those trades and build trading volumes and liquidity in the new contract. In short, the market will freely determine the price based on the forces of supply and demand, and market participants will be able to hedge their price risk.

Features of the ICE Murban crude oil futures contract

Some key features of the new ICE Murban crude oil futures contract are described here. ICE Murban futures are screen-traded, physically deliverable at maturity, and currently cover up to 48 consecutive months. Each 1,000-barrel contract is priced in US dollars and quoted to $0.01/bbl, the minimum price fluctuation. Trading of contracts ends on the last trading day of month M-2; again, the example we use is the June 2021 contract that expired at the end of April 2021. Traders holding contracts at maturity must deliver or receive Murban crude FOB (free on board) at ADNOC’s Fujairah terminal during the delivery month M (June 2021 in our example); the volume tolerance for a Murban cargo is +/- 0.2%.

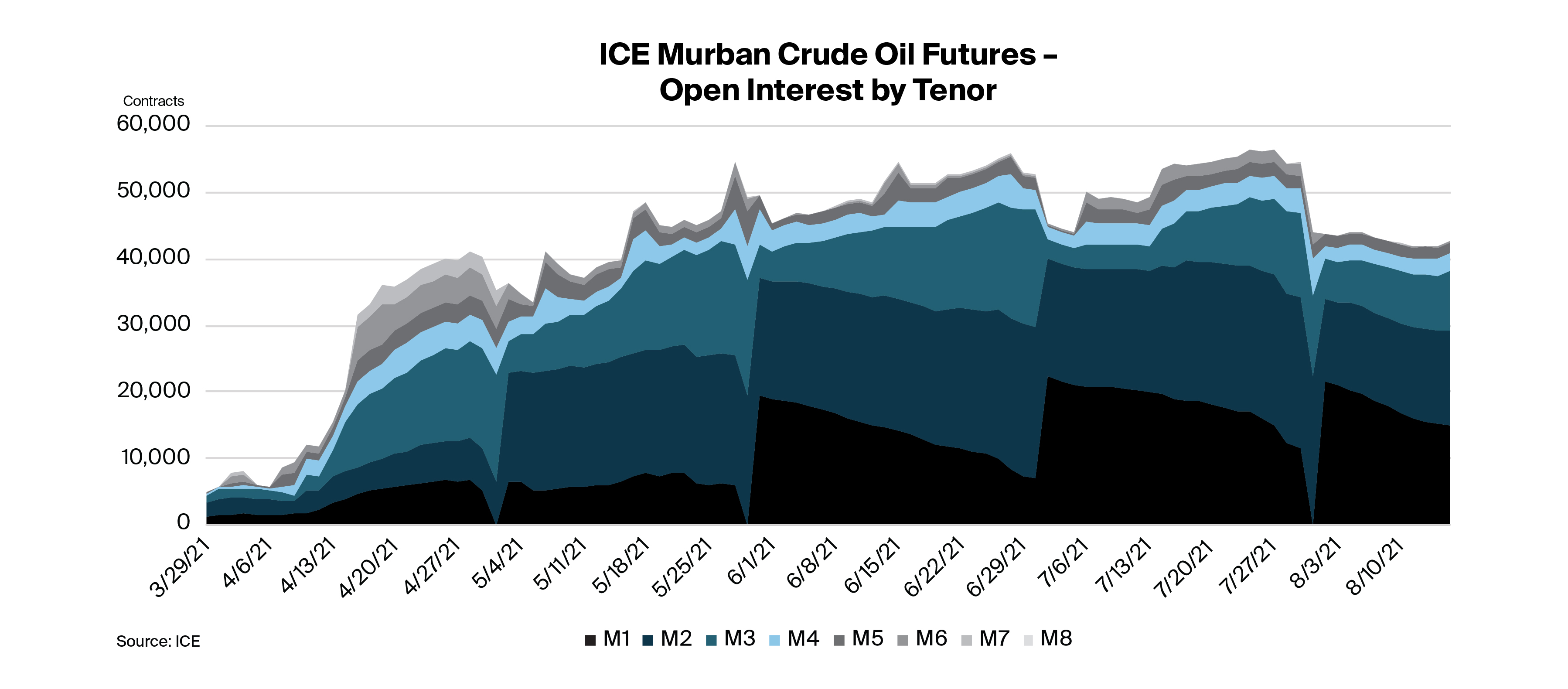

Due to the attributes of Murban discussed above, and its utility for hedging, as well as some early interest from financial investors, the first month of trading since the launch on 29 March has been a success. Daily open interest by tenor (in other words, contract maturity) is shown on the chart above. Since the launch, open interest has grown to over 40,000 contracts, spread over the first seven months of the futures curve (at the time of writing, M1 is the June 2021 contract and M7 is the December 2021 contract). Daily trading volumes since the launch have averaged 6,937 contracts.

There are currently 49 participants trading ICE Murban crude futures on ICE Futures Abu Dhabi, of which 37 are commercial customers - producers, refiners, and trading companies - and 12 are financial participants. The 49 participants come from across the US, Europe, the Middle East and Asia.

Most initial trading liquidity is expected to be related to hedging of Murban and other ADNOC export crude by producers, refiners, and trading companies. As liquidity develops, ICE Murban futures could serve to hedge physical trade for similar Middle Eastern crudes and other similar crudes traded into Asia, including WTI-linked US grades. To drive these changes, ICE and ADNOC have signed Memorandums of Understanding with several companies to explore and assess pricing crude trade using ICE Murban futures. These companies include China’s Unipec and Rongsheng Petrochemical, Japan’s Cosmo Oil, and Chevron, Trafigura, and Occidental; the latter three companies would potentially use ICE Murban futures to price US crude exports to Asia.

It should also be noted that IFAD has complemented the launch of ICE Murban crude oil futures with a series of tradable cash-settled spread instruments to other ICE crude benchmarks; these include Murban versus ICE Brent, ICE Dated Brent (Platts), ICE WTI, and ICE Permian WTI. Other instruments include refined product cracks versus Murban. ICE Murban also has been mentioned as a way to hedge LNG cargoes to Asia, where crude is a significant part of the pricing formulas. In short, based on the attributes described above, our view is that Murban will emerge as an important complement to Dubai.

In the final part of this article, we examine some questions on ICE Murban futures.

Will potential OPEC supply cuts mean that physical Murban volumes might, at times, be restricted?

As the UAE is core member of OPEC, some have questioned whether potential OPEC supply cuts could occasionally restrict the flows of Murban crude that underpin the physically deliverable ICE Murban crude oil futures contract.

While this is a fair question to ask, there are some points to consider that give a more complete and balanced picture, and indeed argue against OPEC policy causing Murban supply issues.

First, OPEC+ policy in the form of cuts or increases is about crude production; this leaves crude exports (that is, actual supply to customers and to the market) up to the discretion of the producer in the short term. When cutting production, the producer can cut exports less, by drawing from domestic crude inventories. The opposite also holds; when increasing production, the producer can increase exports less, by building domestic crude inventories. ADNOC has this flexibility, as do other key Middle East OPEC producers.

The second point follows from the first: as mentioned above, there is 8 Mb of existing crude storage capacity at Fujairah, with another 42 Mb due for completion in 2022. ADNOC has explicitly stated that crude in storage - and the amounts will be substantial - can be tapped as needed to maintain the physical trading associated with the futures contract. The 12-month production guidance that ADNOC publishes monthly is specifically to provide forward transparency - and reassurance - to the market, the message being that the production estimates can be supported with crude in storage in the event of OPEC cuts.

What are the trading dynamics in ICE Murban Crude Oil Futures?

With almost five full weeks of trading complete, the trading dynamics in Murban futures look appropriate for a brand-new market like this. The split between volumes of trades transacted via the central limit order book (so-called “on the screen”) and those conducted via “block” trades is approximately split 50/50.

First let’s explain what a block trade is. Block trades allow market participants to agree a price off-exchange, often in a large size. These trades bring liquidity, which attracts liquidity from other participants, and contribute to the volumes and open interest reported by exchanges.

Newer, less mature markets typically see a high percentage of volumes conducted through block trades (a high percentage being more than 50%), as price is discovered across a hybrid market model involving the central limit order book and broker-conducted trading. As activity in the order book for Murban futures grows, more and more of the activity will develop to be done on the screen; however, as we can see from the development of other energy benchmarks, this takes time.

For comparison, let’s look at the block/ screen trading split in other energy benchmarks. Volume in ICE Dubai (Platts) futures is around 42% block trades, compared to 50% a year ago. Exchange trading in TTF natural gas, coined as “the Brent of gas”, is now around 80% conducted on the screen but was closer to the 60% mark only a few years ago. JKM LNG (Platts) futures, the Asian natural gas benchmark, is currently 90% block volumes and 10% screen-based volumes, reflecting the fact that this is a newer and developing market.

At the fully developed end of the market maturity spectrum, we have Brent futures which have traded for 33 years and WTI futures which have existed for 37 years. These markets are approximately 90% screen-based trading and 10% block trades.

Murban futures are a brand-new market with very new levels of transparency brought through two key changes: the recent ending of destination restrictions by ADNOC and the end of retroactive pricing, replaced by transparent futures-based pricing. Both of these reforms will help the development of a more active spot market.

As futures markets mature, screen trading typically grows relative to block trading. The examples above show that Murban’s approximately 50/50 screen/block proportion sits comfortably in the middle of the spectrum. A fully mature market takes more than one month to develop.