Capitalizing on nature’s value for a net zero world

Helping market participants mitigate their environmental impact

Published

June 2022

Authors

Utility Markets

NYSE

Nature and finance are concepts that historically have rarely been mentioned in the same sentence. But in the last two years, in part due to the effects of the COVID-19 pandemic, there has been an intensifying appreciation of the relationship between the two, and how our economic well-being is dependent on nature for resources that drive economic well-being.

In 2020, the UK government-commissioned Dasgupta Report laid out for the first time in stark terms the importance of natural capital to business and finance, and ultimately whole economiesi. It warned that ecosystems are in extreme danger from ongoing biodiversity destruction, undermining nature’s productivity and resilience, and threatening ecosystem collapse.

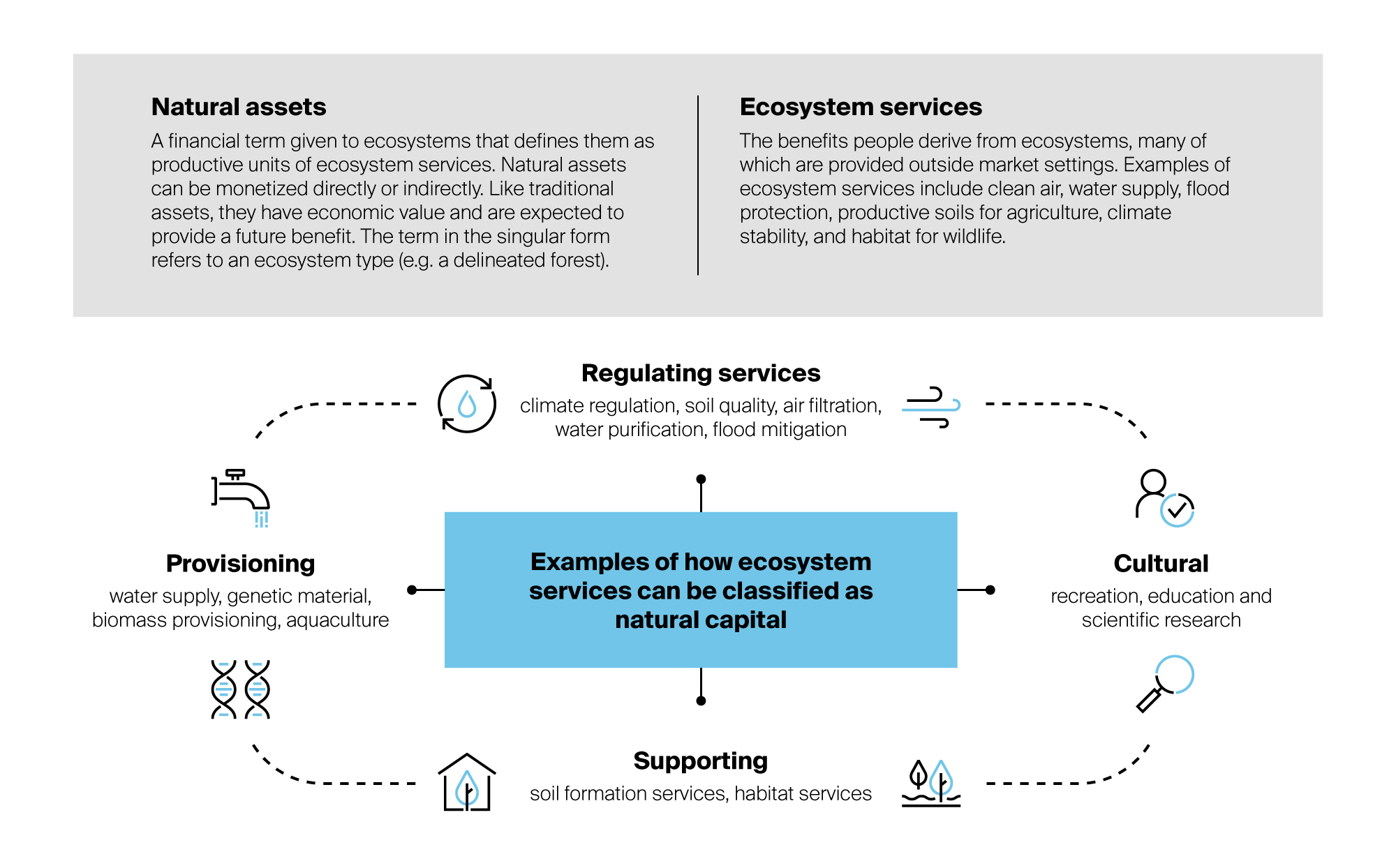

This matters, because healthy ecosystems provide clean air and water, foster biodiversity, regulate the climate, and provide the food. These crucial natural processes are called ecosystem services. All businesses depend on ecosystem services either directly or through their supply chains. They function as the foundational support for social and economic prosperity — more than half of global gross domestic product, in factii.

Limiting global warming requires the ability to value “externalities” - such as placing a price on pollution and a value on carbon-free electricity and carbon sequestration and storage. Alongside this, is the need to place an appropriate value on and encourage investment in ecosystem services, therefore putting a value on “natural capital assets”. Companies and countries that have made net zero commitments will be ready buyers of these assets, which can provide a hedge to investors exposed to carbon-intensive portfolios.

The creation of a new asset class

Advances in climate disclosures and environmental markets are improving investors’ ability to understand and manage the risks and “negative externalities” associated with industrial production, for example. Now, there is an opportunity to quantify and support the positive externalities created by preservation and restoration of natural landscapes.

Yet there is no standard way to value natural capital. Some initiatives have emerged to help solve this problem, such as the Finance for Biodiversity Initiative, established in 2019 in a bid to increase the materiality of biodiversity in financial decision-makingiii.

Tools are also emerging to make the valuation of natural capital possible. Just like traditional industrial investment, an equity market-based solution can be established for natural capital. Because valuing nature is more complex than placing a value on carbon sequestration and storage, an equity-style instrument is better placed to capture its heterogeneous qualities versus a commodity-like instrument suited to a more homogenous asset class. This could come in the form of holding stock in a company that would hold the rights to ecosystem services produced by natural, working, or hybrid lands.

The New York Stock Exchange, in partnership with the Intrinsic Exchange Group (IEG), proposes to launch just such a company in the form of a new class of listed securities called Natural Asset Companies (NACs). The NAC structure is designed to protect and restore healthy ecosystems and to provide investors with a direct way to monitor, measure and invest in nature.

Pending regulatory approval, NACs will be a new class of company that holds the rights to the ecosystem services produced in designated natural, working, or hybrid areas with the goal of increasing the health and productivity of these assets through active management. They will be a publicly investable asset for investors; NACs are intended to:

- facilitate capital formation to provide natural asset owners with a source of financing to achieve sustainability goals that may not otherwise be possible;

- provide both sustainability-focused investors and those with broader mandates an efficient, transparent vehicle to express their climate and biodiversity themes;

- generate price signaling to support efficient markets and reduce externalities; and

- provide environmental and social benefits for global and local communities.

Capital raised by NACs will be used to implement conservation plans or otherwise maximize ecological performance. NACs will be prohibited from conducting activities such as mining or timber harvesting. They will be required to establish an ��“Equitable Benefits Sharing” policy that describes how local stakeholders participate in the economic value generated by the NAC, as well as biodiversity, environmental and social policies.

Because most ecosystem services are not yet monetizable, investors will need information beyond standard financial statements to understand the value of a Natural Asset Company. Each NAC would produce both traditional financial statements as well as new materials called “Statements of Ecological Performance” that measure the productivity, value, and health of the landscapes whose ecosystem services rights are held by the NAC.

These are based on an Ecological Performance Framework developed by Intrinsic Exchange Group in consultation with experts.

Tools to manage carbon liabilities

Alongside the development of natural capital as an asset class, quoted derivative markets, led by ICE, are evolving to allow participants to negotiate and hedge exposure to future price risk for a range of externalities, along with renewable fuels. Carbon pricing is a key component in navigating the transition to cleaner fuels. Here, a price signal for pollution through a carbon allowance can incentivise switching away from more carbon-intensive fuels and promote innovation in cleaner technologies. ICE’s environmental markets are instrumental in providing price signals for negative and positive externalities, incentivizing the efficient allocation of capital across the carbon cycle to balance the world’s carbon budget and help companies meet their net zero goals. In 2021, over 18 billion tonnes of carbon allowances traded on ICE Exchanges, equivalent to ~$1 trillion in notional value and equal to over half the world’s estimated total annual energy-related emissions footprint.

Building on its experience operating environmental markets for almost two decades, ICE last month launched a Nature-Based Solutions Carbon Credit Futures Contract(“NBS”). This is ICE’s first contract specifically designed to measure the carbon sequestration and storage capabilities of nature, which it is hoped will be an important valuation tool to conserve and grow the world’s natural capital base.

Each NBS futures contract is equal to 1,000 carbon credits, where each credit is equal to the removal or reduction of one metric tonne of greenhouse gas emissions achieved by projects that conserve and maintain natural ecosystems.

In this way, the carbon credits and NACs are complementary products, where one of the income streams from a NAC could be carbon credits. Having a long-term transparent price signal allows NACs to reduce the volatility in this income stream and allows investors to be more precise in the valuation models of a NAC.

This, and the NAC structure, illustrate some of the many ways that markets facilitate efficient capital allocation across the carbon cycle, and ultimately, help to address the challenge of climate change.

i https://www.gov.uk/government/publications/final-report-the-economics-of-biodiversity-the-dasgupta-review

ii https://www3.weforum.org/docs/WEF_New_Nature_Economy_Report_2020.pdf

iii https://www.f4b-initiative.net/

The information contained in this paper - including text, graphics, links or other items - are provided "as is" and "as available." Intercontinental Exchange, Inc. its subsidiaries and affiliates (“ICE”) and third party providers do not warrant the accuracy, adequacy, timeliness, or completeness of this information, and expressly disclaims liability for errors, omissions or other defects, or delays or interruptions in this information. ICE does not verify any data and disclaims any obligation to do so. The information provided in this paper is also liable to change at short notice. You should not rely on any information contained in this paper without first checking with us that it is correct and up to date.

No warranty of any kind, implied, express or statutory, is given in conjunction with the information. The reliance on any information contained in this paper is done at your own risk and discretion and you alone will be responsible for any damage or loss to you, including but not limited to loss of data or loss or damage to any property or loss of data or loss of revenue that results from the use and reliance on such information.

In no event will ICE or its third party providers be liable for any damages, including without limitation direct or indirect, special, incidental, punitive, or consequential damages, losses or expenses arising out of or relating to your use of this information. Past performance is no guarantee of future results.

The content provided in this paper is not to be construed as a recommendation or offer to buy or sell or the solicitation of an offer to buy or sell any security, financial product or instrument, or to participate in any particular trading strategy. ICE does not make any recommendations regarding the merit of any company, security or other financial product or investment identified in this paper, nor does it make any recommendation regarding the purchase or sale of any such company, security, financial product or investment that may be described or referred to in this paper, nor endorse or sponsor any company identified in this paper. Prior to the execution of a purchase or sale of any security or investment, you are advised to consult with your banker, financial advisor or other relevant professionals (e.g. legal, tax and/or accounting counsel). Neither ICE nor its third party providers shall be liable for any investment decisions based upon or results obtained from the content provided in this paper. Nothing contained on this paper is intended to be, nor shall it be construed to be, legal, tax, accounting or investment advice.