Year-end wrap...and trends we're watching

As we round out a year full of surprises, there’s still uncertainty on the horizon. But traders, portfolio managers and other market participants recognize that with this, comes opportunity. At ICE, we’re excited to continue connecting our customers to opportunity across global markets. We wish you a happy and prosperous New Year.

Markets had another big year in 2021

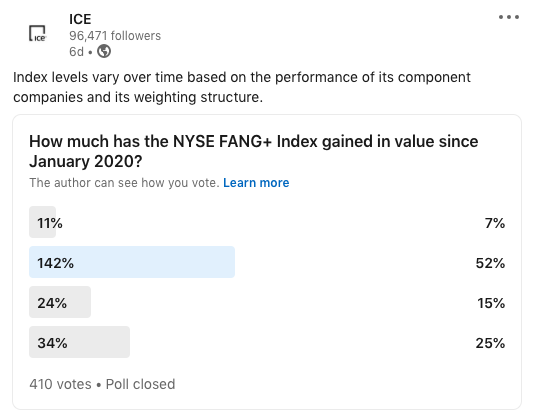

*U.S. equity markets hit new highs despite ongoing uncertainty with COVID-19, with the NYSE data insights team offering in-depth analysis along the way.

*Uncertainty about interest rates saw a key bond volatility indicator, the ICE BofA MOVE index, spike in November, hitting levels not seen since early 2020 market dislocation.

*Reaching net zero carbon emissions was a huge topic at COP26. Markets can help companies and economies accelerate the transition to a more sustainable future, as Gordon Bennett discusses.

Looking ahead

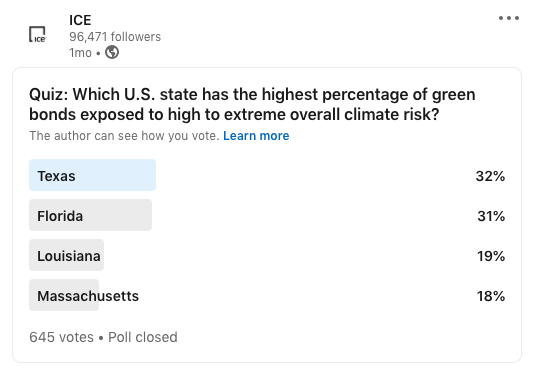

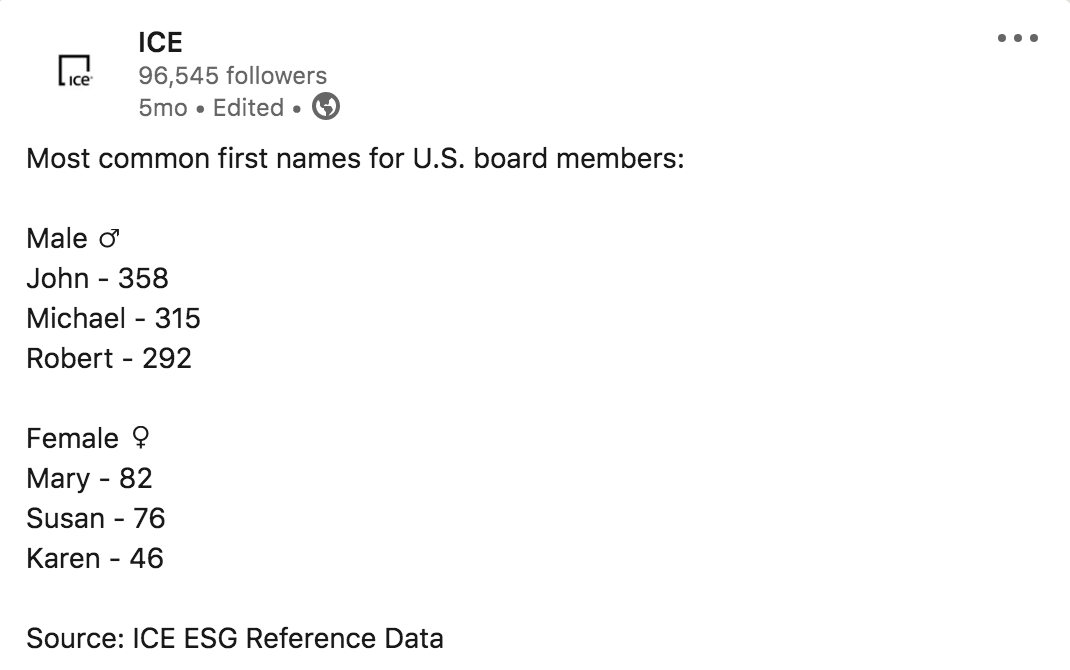

One thing we’re confident in: the ESG boom will continue. This year, the pandemic cast a spotlight on the social aspect of ESG while the growing sophistication of ESG data makes it vital to understand the motivations of different users. Meanwhile in the Asia-Pacific, the ESG regulatory landscape remains fragmented.

Amid the transition to cleaner fuels, benchmarks like gasoil are in a strong position. Natural gas markets also continue to globalize, with Europe’s TTF establishing benchmark status. Separately in oil markets, several fundamentals are supporting Murban’s emergence as a benchmark.

Structural changes such as low interest rates and aging populations have seen thematic investing flourish - and it shows no signs of slowing. Similarly, an explosion in data consumption has seen companies change their business models to be more data centric - and data scientists can help solve some of companies’ biggest challenges.

Another investment trend: infrastructure. In the U.S. it’s bolstered municipal bond credits, a market which is seeing fundamental shifts as technology and data create new opportunity for investors and issuers. Elsewhere in bond markets, the rise of passive investing has fueled the advancement of new trading protocols.

In equities, Asian and U.S. tech stocks remain highly sought after, with new appreciation for risk management tools amid market uncertainty.

Term of the year: Carbonomics

Why? In the energy sector, fund flows are no longer solely dictated by traditional economics. The rise of Net Zero targets means the need to ascribe a cost to pollution. Carbonomics places a cost on the negative externality of pollution and a value on positive externalities like renewable energy. This changes the economic ranking of energy sources, by promoting capital allocation to greener energy and eroding its additional cost. It also allows us to conserve, restore and improve how we utilize nature, by valuing positive externalities like carbon storage. In this way, carbonomics incentivizes the use of less carbon-intensive fuels and places a value on nature-based solutions.

Here are some key sustainable finance terms. Do you know what a green attribute is?

In a fast changing world, data will play an ever-expanding role. From equities to mortgages and bond markets, access to data and expertise is propelling industries forward. Here, data scientists can play a critical role in helping solve some of the markets’ most perplexing challenges.

Check out this video of members of our data science team in ICE’s New York offices.