Exposing speculation myths

One myth is that increases in commodity prices or large price movements in commodity markets are caused by “speculators” or algorithmic trading by financial participants in the futures markets. Most often people making this argument do not have evidence to support such claims. Higher commodity prices and commodity price movements are generally caused by changes in market fundamentals, economic conditions, and geopolitical drivers that cause imbalances in the supply and demand of physical commodities in the spot markets.

The central question is -- how are futures markets tied to the spot markets? Spot prices are based on transactions that are settled with commodities physically changing hands, such as a refinery buying a cargo of crude oil or a confectionary manufacturer purchasing an inventory of sugar. In a well-functioning market, the arbitrage between transacting today and in the future links the futures markets to the spot markets.

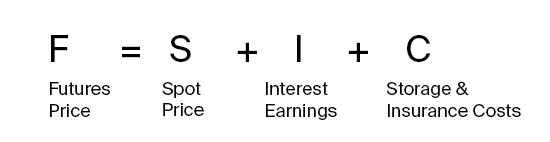

To elaborate further, let’s consider a simple example for a barrel of crude oil with prevailing spot price of S per barrel. If a trader were to sell this barrel today, they would receive an immediate payment of S. This money can be invested over a time period for interest earnings of I, whilst avoiding storage and insurance costs C that would have to be paid if the trader had decided to sell the barrel in the future. For equilibrium, the futures price F (i.e., price of the barrel in the future) must compensate the trader for their lost interest earnings and for incurring storage and insurance costs (collectively referred to as the ‘cost to carry’).

The above equation may not hold as perfectly in the real world, but nonetheless provides a good insight into how futures prices are linked to the spot markets. Should the futures price rise to a level significantly higher than that determined by the above equation, a trader would see the premium in the futures market and choose to sell barrels in the future by purchasing some inventory in the spot market today. As more traders discover the ‘arbitrage’ opportunity, the ensuing selling activity in the futures market and inventory purchases in the spot market may result in the futures price decreasing, while the spot price may increase depending on prevalent supply side constraints until the prices are once again in line with the above equation. Furthermore, as a futures contract approaches expiration, the cost to carry will gradually disappear and the futures price will converge to the spot price. It is this arbitrage linkage that keeps futures prices grounded in the underlying spot market and to the corresponding market fundamentals -- with futures prices primarily determined from spot prices as the starting point. Under normal market conditions, the futures price is generally higher than the spot price at a premium determined from the market’s perception of the cost of storage and lost interest earnings.

It follows from the above points that the activity of financial institutions and market makers in the futures markets cannot be the fundamental driver of prices. To blame speculation without evidence may result in overlooking important price discovery signals the markets are trying to send. Producers and consumers of commodities and energy depend on these signals being surfaced in the market to make critical decisions on investments, managing their risk exposure and their energy consumption.

In addition, financial firms entering the market increase competition within markets allowing a multitude of price opinions to be expressed and bring much-needed liquidity, allowing ease of trade executions at reduced costs for all participants and this may also lead to reduced volatility.

Speaking with Chris Rhodes, President of ICE Futures Europe, Europe's largest exchange for trading energy, interest rate and soft commodity futures markets, he says "If companies are not hedged, they’re speculating. They’re speculating that buying or selling on the spot market will be cheaper than the futures market. By hedging, the companies which provide the gas and electricity to your home, or the commodity producers producing the chocolate bars we eat, are allowed to reduce their exposure to what can be volatile spot markets.

“Financials firms are professional risk managers and without them, it would be harder for companies to hedge. Someone recently described traders as insurance agents, insuring against prices going up or down. I think that describes their role perfectly. They reduce risk in markets by allowing hedging to take place. And the majority of them are putting their own capital at risk in doing so.”

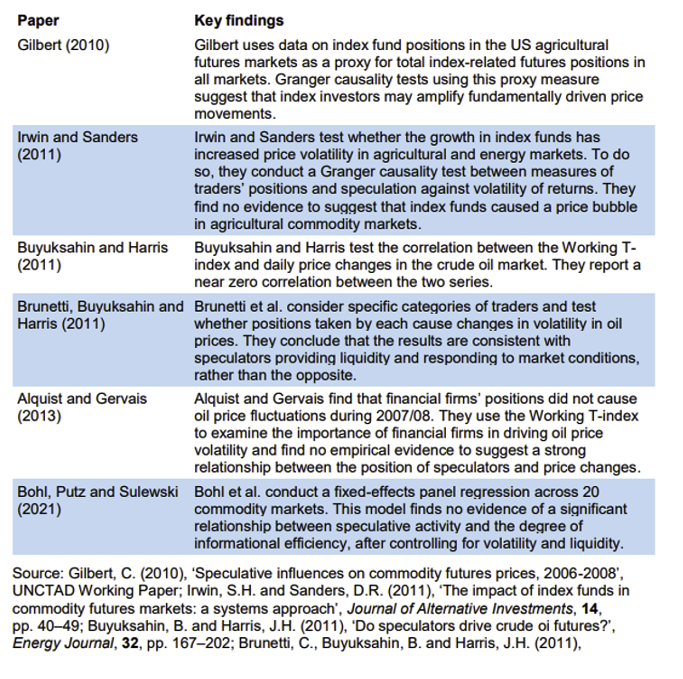

Several academic papers have empirically tested the relationship between speculative trading and price volatility in commodity markets. Overall, much of this empirical literature suggests that speculators tend to reduce, not increase, price volatility. Limiting participation in the futures markets would not make commodity prices less volatile. It would only make hedging more expensive by limiting the available pool of liquidity, which would in turn make running an oil or gas company, or an airline, or a clothing manufacturer, more expensive.

Exhibit 8: Literature review on speculators and price volatility