Connect to natural gas markets

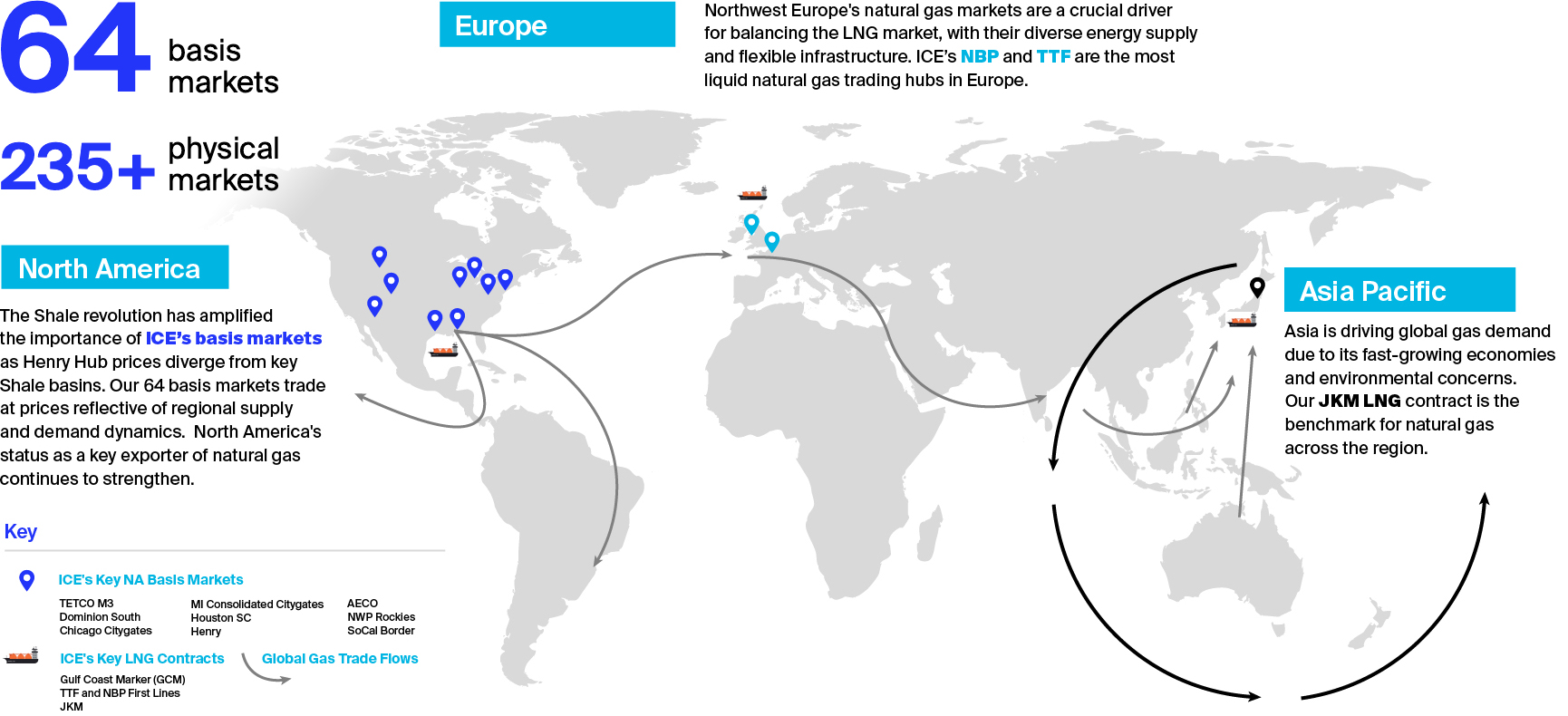

Explore diverse global energy benchmarks at ICE, from Brent to TTF to Environmental markets. Our natural gas portfolio spans hubs in the U.S., Canada, Europe, and Asia, supporting market liberalization worldwide.

Trade the global natural gas market

Trade the global natural gas market with ICE TTF, the benchmark for natural gas and the center of global natural gas dynamics. It sends crucial price signals for managing global natural gas exposure. Our portfolio includes physically delivered and cash-settled contracts across North America, allowing precise hedging and effective risk management up to and including 10 years ahead. The TTF and Henry Hub futures markets, with record volumes and participation, help balance supply and demand globally.

ICE LNG

LNG enhances market flexibility, offering diverse sources for exporting and importing nations. ICE JKM LNG (Platts) sets the benchmark for North-East Asia, with specialized NWE and SWE LNG contracts addressing European market dynamics.

ICE provides a broad range of natural gas benchmarks globally, from the US and Canada to Europe and Asia. As the only global energy exchange and home to Brent, we offer liquidity, versatility, and tools for your daily risk management needs across these geographies.

Trade the future of energy with ICE.

ICE Natural Gas Data Center

North American Gas Futures Open Interest

ICE Financial Gas Markets + Henry Hub