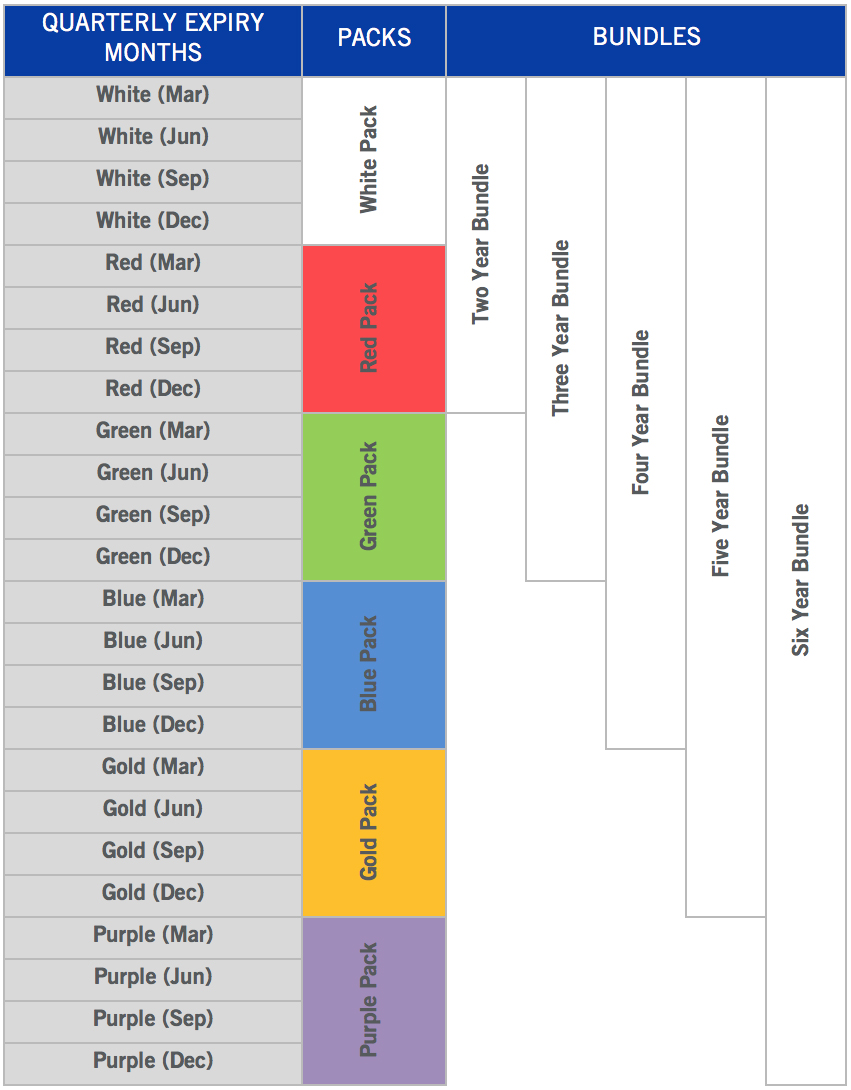

Packs and Bundles

ICE Futures Europe packs and bundles are recognized trading strategies that enable you to easily execute a combination of contract months in Short-Term Interest Rate (STIR) Euribor, ESTR, SONIA, and SOFR futures contracts. This allows users to gain exposure to longer term interest rates, without the legging risk of trading the individual months.

*Please note, White Packs and Bundles in SONIA and SOFR begin with the first non-accruing contract.

Leg Pricing for SONIA, Euribor and SOFR Futures

Arithmetic Average Methodology

SONIA, Euribor and SOFR Futures Packs and Bundles are to be priced as the arithmetic average of the constituent outright futures contract prices. The minimum price increment for the strategies will be 0.00125 index points. The strategies in Euribor, ESTR, SONIA and SOFR all have the implied pricing calculations turned on.

Example of Implied pricing

The below example using Three Month SONIA Futures (“SO3”) highlights how the methodology works.

| Outright Market Leg | Bid | Ask |

|---|---|---|

| SO3 Mar-22 | 99.455 | 99.465 |

| SO3 Jun-22 | 99.490 | 99.500 |

| SO3 Sep-22 | 99.520 | 99.530 |

| SO3 Dec-22 | 99.530 | 99.540 |

| Implied Pack Price | 99.49875 | 99.50875 |

Non-Implied Trading

When a pack or bundle is traded as a result of two non-implied orders, the leg prices allocated for the outright futures will be based off the exchange anchors at the time of the trade. Methodology is in place for the allocation of additional ticks to certain legs of the strategy when the strategy price is not divisible by the tick size in the outright contracts. For further information please contact the Rates team on [email protected].

Matching Algorithm

All of SONIA, Euribor and SOFR Packs and Bundles strategies will match using the Gradual Time-Based Pro-Rata (GTBPR) matching algorithm. They will use a time-weighting of 2 and priority is given to the first order at the best price subject to a minimum order size (collar) and limited to a maximum order size (cap).