Crude oil from the North Sea forms the basis for global oil prices and is the foundation of the Brent crude oil price. The durability of this price benchmark comes from its ability to reflect global market conditions and its seaborne capacity which means it can be transported to anywhere in the world. The discovery of North Sea oil marked a new era in Europe with the supply of light sweet crude oil for the first time. It was also the start of the region’s role in the global pricing of crude oil.

The discovery of North Sea oil

Since 2014, North Sea oil production has increased 16%, driven by production efficiency and new field start-ups.

The discovery of oil in the North Sea can be dated back to the mid-19th century. In the 1900s much of the oil and gas exploration took place in this area. However it was in the early 1970s that both United Kingdom listed and international entities began making significant North Sea oil investments. Parallel to growing production and the commercialization of related markets, came the ‘first oil price shock’ where oil prices quadrupled following the Yom Kippur war in the Middle East in 1973.

Two of the biggest North Sea oil fields, Forties and Brent, were discovered by BP and Shell in 1970 and 1971 respectively. Alongside Norwegian crudes Oseberg and Ekofisk, these two oil fields still form part of the BFOE (Brent-Forties-Oseberg-Ekofisk) basket of crudes that underpin the ICE Brent crude futures market today.

In the Norwegian sector of the North Sea, the large, commercial Ekofisk and Oseberg oil fields were discovered in 1969 and 1979. And although crude oil from Norway’s Troll field was only added to the BFOE basket in January 2018, it was discovered in 1979 with production commencing in 1995.

Today, Troll which is operated by Statoil, still produces more than 75,0001 barrels a day which is a considerable amount of overall North Sea oil production. It remains one of the ten largest oil fields in Europe.

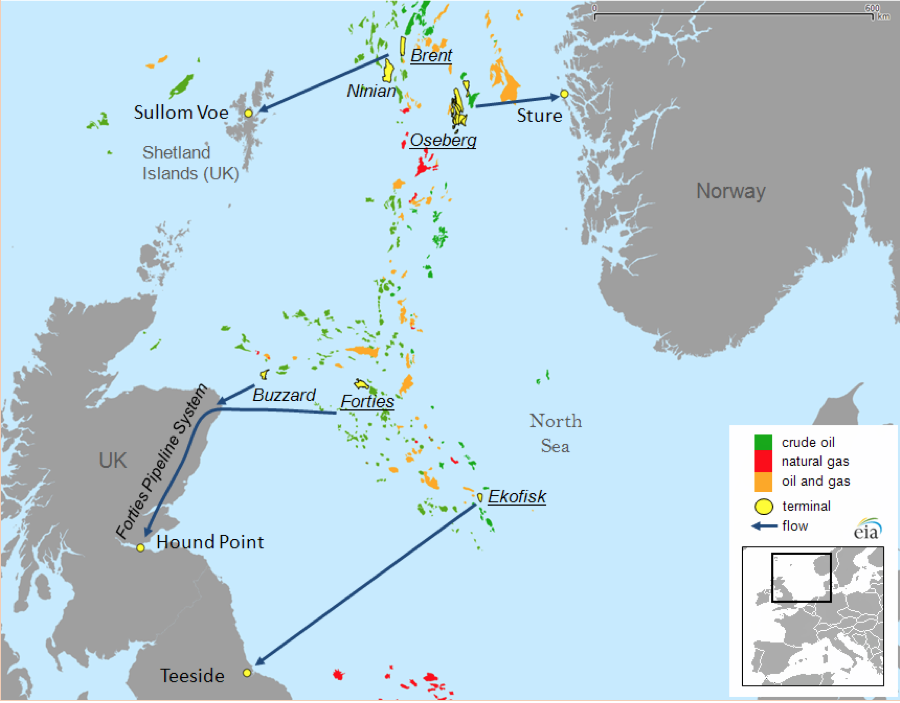

North Key Sea Oil and Natural Gas Fields and Terminals

Source: U.S. Energy Information Administration (EIA)

North Sea Oil Production Today

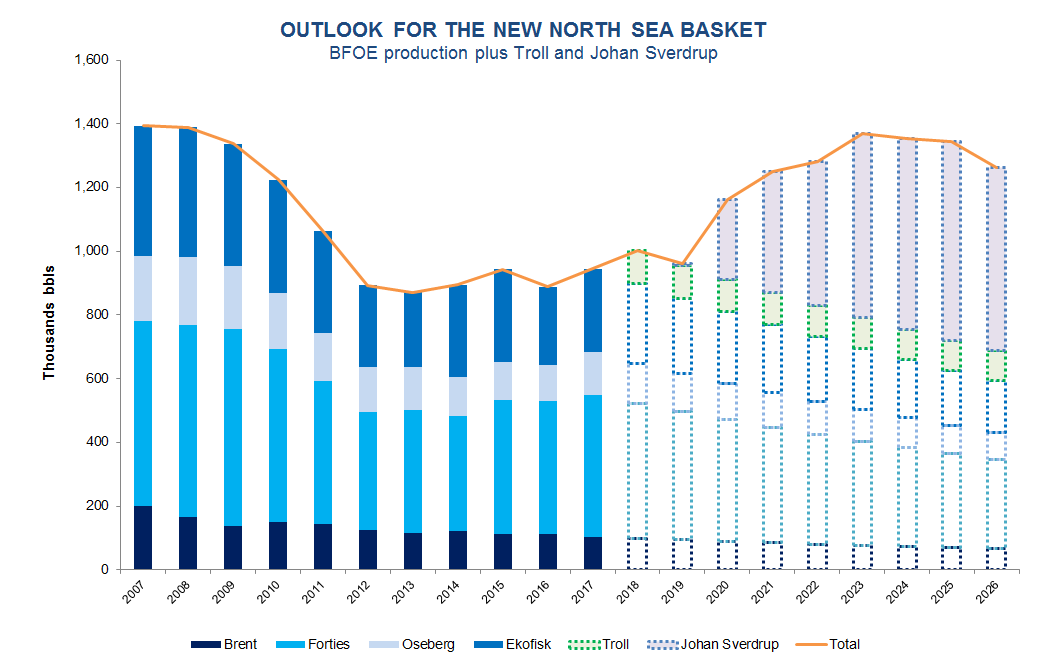

Despite a decline in some well-known North Sea oil fields, the region remains an important global oil producing region. New technologies, new discoveries and falling operating costs are making it easier and cheaper to extract oil from the region. Estimates by the UK Government’s Oil and Gas Authority for the total remaining recoverable reserves range between 10 and 20 billion barrels of oil from the UK continental shelf alone2. Today, the BFOE basket of oils represents a daily output of around a million barrels per day3.

Source: S&P Global Platts

Note: Troll was added to the BFOE basket in January 2018

Renewed Investment and New Discoveries

In recent years, the region has been buoyed by a new wave of discoveries, investment and technologies. North Sea oil has attracted investment from around the world with companies as far away as Asia announcing new projects to extend the life of some of the UK North Sea’s largest oil fields.

Since 2014, North Sea oil production has increased 16%4, driven by production efficiency and new field start-ups. Operating costs in the North Sea have also almost halved since 2016.

New drilling technology has made it easier and more efficient to extract oil from the North Sea and in many cases new technology has extended the life of older fields by decades, making it possible to extract previously unreachable oil. Thanks to a wave of investment in the region, new fields are being discovered which are expected to significantly contribute to output levels in the coming years.

New fields

In 2016, nine new North Sea oil fields began production (Laggan, Tormore, Conwy, Solan, Aviat, Cygnus, Alder, Crathes and Scolty) and several more began production in 2017 (for example, Schiehallion Quad 204, Callater, Stella, Shaw, Flyndre, Kraken and Cayley). An additional 12 fields are due on-stream by the end of 2018. The output from these new developments is expected to add a further 600,000 barrels of oil per day by the end of 20185.

New technology

In 2017, Chevron approved investment to boost production from its Captain oilfield by using new technology which involves injecting polymerized water into an oil field’s reservoir, making it easier to tap reserves in areas that are difficult to reach with conventional drilling techniques. This will be the first time this technology has been used on such a scale in the North Sea and is expected to improve the recovery rate from older fields and help extend the life of existing assets6.

Also in 2017, BP started extracting oil from the largest new North Sea project in recent years. The Quad 204 project uses new technology to redevelop the Schiehallion and the adjacent Loyal fields. This project is expected to unlock a further 450 million barrels, extending the lives of these fields beyond 20357.

New Investment

New technology, stabilizing oil prices and new discoveries have spurred investment and exploration in the region by a number of the leading energy companies.

In 2017, start-ups in the region surged to a 10-year high according to a report by Wood Mackenzie8 and recently there has been a renewed appetite for oil and gas assets in the North Sea. Total boosted its presence in the North Sea when it agreed to buy $7.45 bn of North Sea assets from AP Moller-Maersk in 20179.

New fields, such as the Johan Sverdrup field, and other recent significant discoveries in the North Sea are extending exploration and production in the region by decades. The Johan Sverdrup field is expected to add up to 3 billion barrels output over the next 50 years according to Statoil10.

In Summary

New discoveries are driving the role of the North Sea and its leading position in global oil pricing. Established in 1988, the ICE Brent futures contract, is the world’s most liquid oil futures contract and has expanded since inception to include a family of more than 400 related Brent-based hedging instruments.

Learn more about the Brent complex

1. Statoil

2. UK Government Oil & Gas Authority

3. S&P Global Platts

4. Oil & Gas UK, 2017 Economic Report, p. 7

5. Oil & Gas UK 2017 Economic Report, p.43

6. Chevron United Kingdom

7. BP

8. Wood Mackenzie

9. Total

10. Statoil