Gasoil: Facilitating transitions to cleaner fuels for forty years

Executive Summary

The ICE Low Sulphur Gasoil Futures contract is the world’s leading refined product benchmark, with a successful 40-year history as a physically deliverable futures contract for what is now ultra-low sulphur diesel. ICE LS Gasoil Futures are used by commercial oil participants, including refiners, consumers and traders, to manage their price risk; it is also used by investors to express views on the global economy and refined product demand.

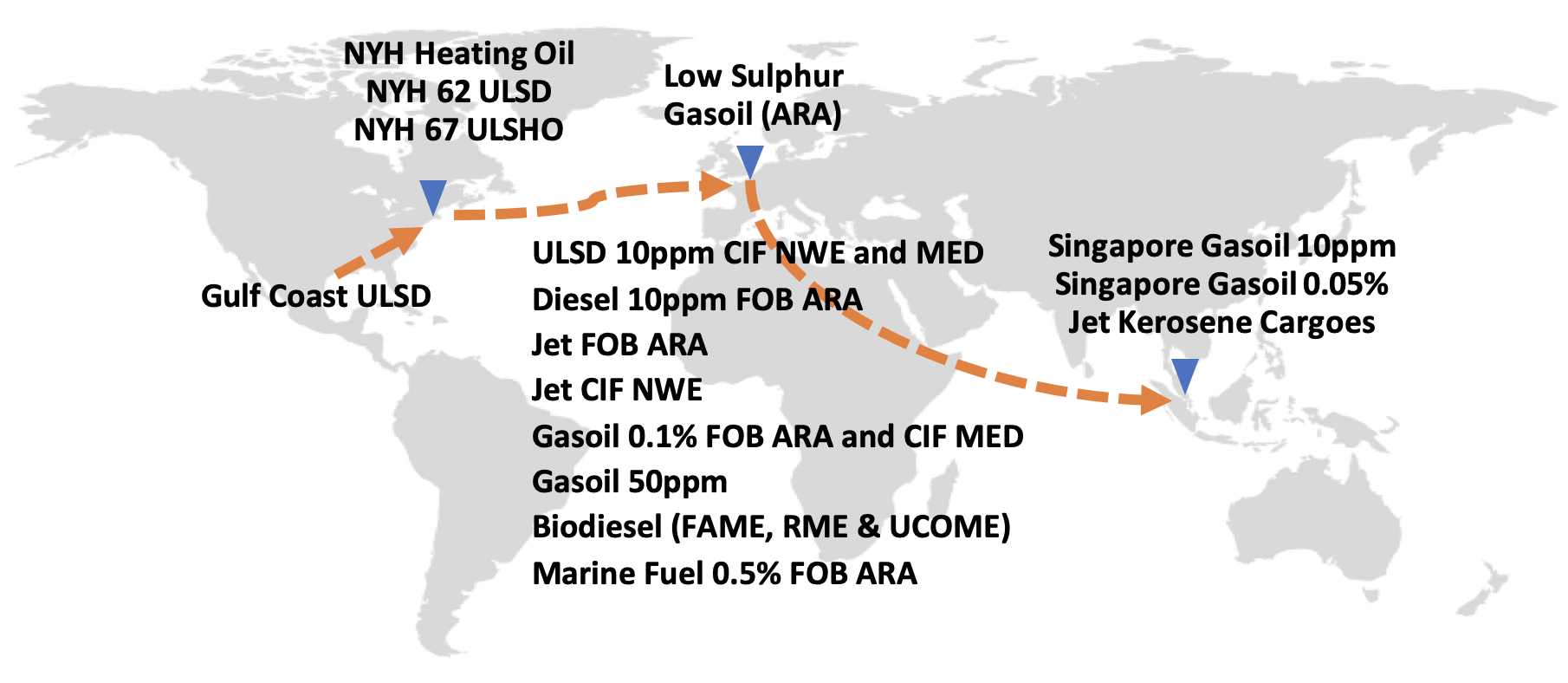

As a trusted efficient benchmark, ICE LS Gasoil Futures are at the centre of the European and global middle distillates markets, essential to price discovery, trading and risk management. In addition to diesel, it also anchors many parts of the global refined product complex, including gasoil/heating oil, jet fuel, and low-sulphur IMO-compliant marine fuel. Trading tools include cash-settled futures and options for geographic and quality differentials, inter-product spreads, product cracks, and timespreads.

Like any successful benchmark, ICE Low-Sulphur Gasoil Futures has evolved, changing with market fundamentals and environmental imperatives, such as desulphurisation. As the energy transition gains momentum, decarbonisation has come into sharp focus, with renewables rapidly gaining importance. European biodiesel products traded on ICE, such as FAME, RME, and UCOME, are growing quickly and are priced as a differential to ICE Low Sulphur Gasoil; other products include renewable jet fuel.

As the energy transition continues, supply, demand, and trade flows for refined products and crude oil will evolve, perhaps in unpredictable ways. As always, ICE Low Sulphur Gasoil Futures and related products, along with the broader ICE offerings in refined products and crude oil will adapt, driven by the needs of oil market participants. We look forward to continuing the dialogue with our customers.

ICE Gasoil: Forty years and counting

For over 40 years, the ICE Gasoil Futures contract, as the world’s leading refined oil product benchmark, has helped commercial oil participants -- including oil refiners, consumers, and traders -- in Europe and beyond, as well as investors, to manage or take price risk effectively and reliably in middle distillates and the broader refined product complex.

Launched in April 1981, the ICE Gasoil contract has evolved with changes in market fundamentals and environmental imperatives. Yet it remains an essential benchmark for a wide range of geographical and quality markers, while being a successful physically deliverable Futures contract for the primary middle distillate: ultra-low sulphur diesel (“ULSD”) in the Northwest Europe region.

As the ICE Gasoil Futures contract moves into its fifth decade, we reflect on the contract’s inception and ascendancy: how it became a price anchor for a multitude of products, how it has fared recently, and what lies ahead.

Humble beginnings

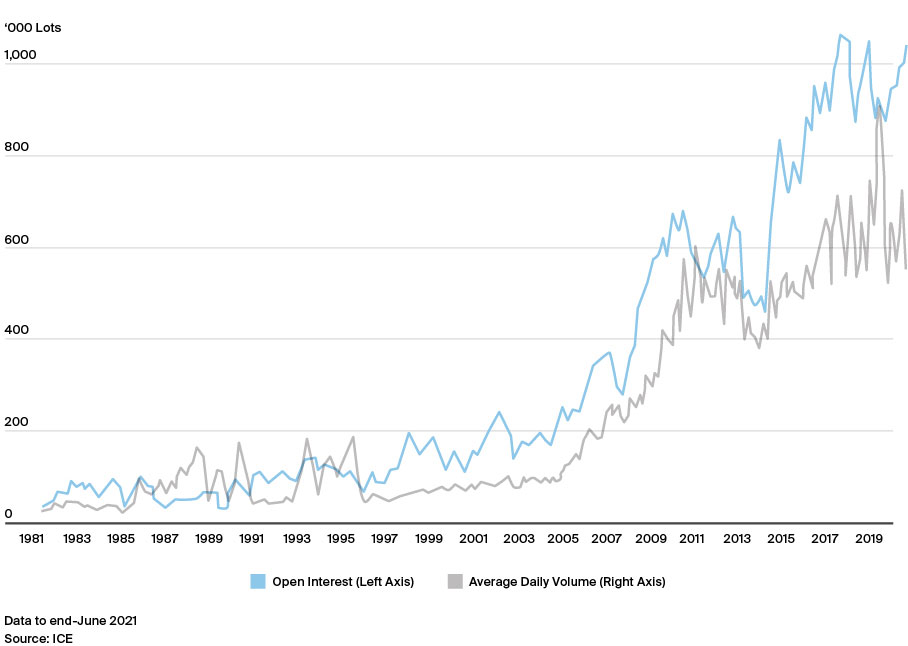

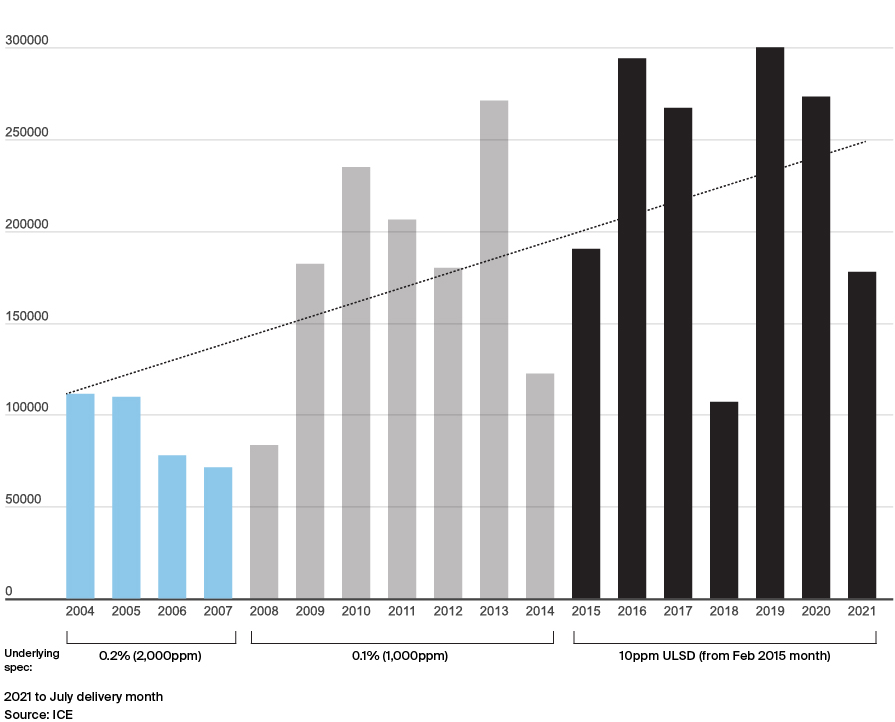

Long term success of ICE Gasoil Futures (3 Month Rolling Average)

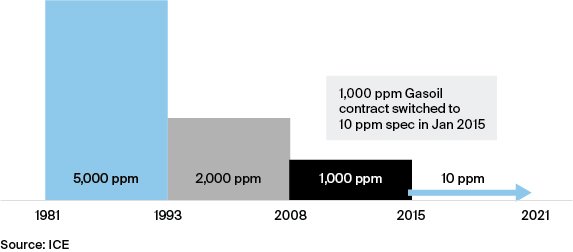

From 1981 until 1993, the underlying specification was representative of a heating oil with a maximum 5,000 parts per million (“ppm”) sulphur content. Over time as the global clean fuel agenda gathered momentum, the maximum sulphur content in the heating/diesel pool was reduced to what is now an “ultra-low sulphur diesel” specification that has increasingly become the global norm.

Journey to become the world’s leading refined product benchmark

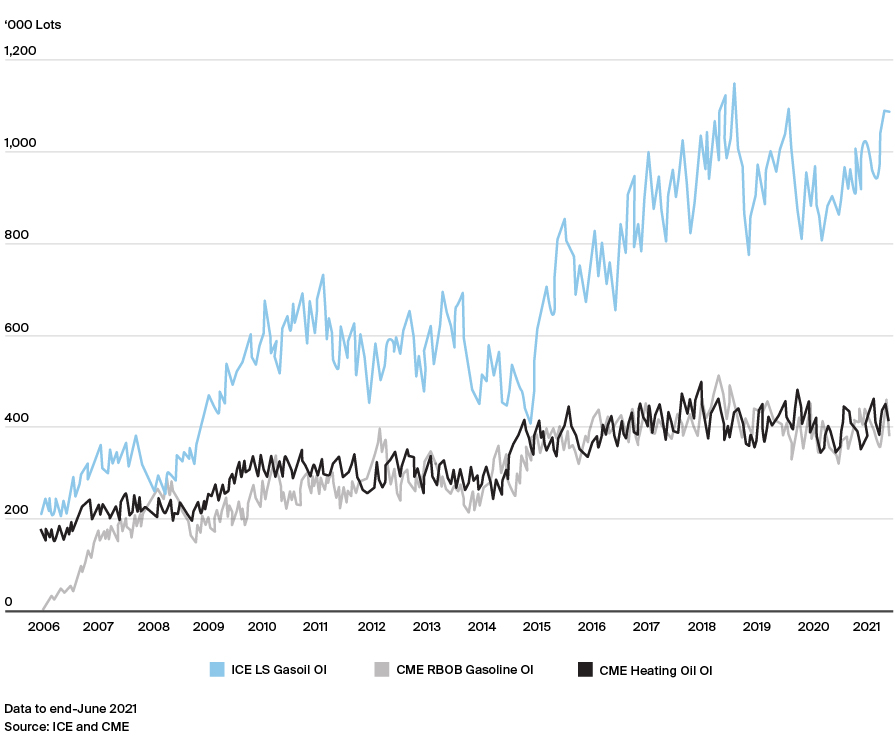

Despite its longevity, the ICE Gasoil contract was not the first middle distillate futures contract available to trade. In the US, the No. 2 Heating Oil Futures contract was launched in 1978 and adopted by the market due to its delivery location being in the northeast US, a densely populated region reliant on the fuel for home heating. As mentioned, Gasoil Futures (on the IPE) soon followed and quickly gained traction; in 2008 (when the contract moved to a 1,000 ppm sulphur gasoil specification) it established itself as the world’s leading refined product benchmark, eclipsing in both volume and (particularly) open interest the two other major refined product Futures.

Comparison of ICE LS Gasoil Futures Open Interest vs.

CME Heating Oil and RBOB Gasoline

The change to a gasoil specification with a maximum of 1,000 ppm sulphur was based on an EU mandate that took effect in 2008, meaning the deliverable product had to meet this quality specification. This saw a significant upturn in Futures volumes and was also the start of an increasing volume of physical material being delivered via the Futures delivery mechanism.

Physical delivery occurs in the ARA region (Amsterdam, Rotterdam and Antwerp, including Flushing and Ghent); this is the major trading hub in Northwest Europe, with refineries, storage terminals and inland waterway access to major middle distillate consuming nations such as France and Germany. While the Futures delivery mechanism has evolved in increments, fundamentally, it has remained relatively unchanged as a mechanism successfully used by a multitude of market participants over many years.

Average monthly delivery volume via ICE Gasoil Futures (in mt)

Diesel, an ultra-low sulphur product of just 10 ppm sulphur, became the largest component of the middle distillate market with its use for transportation, construction, and industry. Commercial participants increasingly hedged their exposure using the ICE Gasoil Futures contract. As it became evident that the middle distillate benchmark needed to evolve further, the underlying deliverable specification of the Futures contract shifted in 2015 in to what it now represents: ULSD.

Once again, this shift promoted traded volume and open interest, while physical delivery volumes kicked up another level, making it the standout refined product contract with consistent market liquidity deep throughout the curve. Participants rely on it to hedge their exposure and invest in all middle distillate markets, including diesel, gasoil, and jet fuel, as well as other refined products, in Europe and increasingly around the world.

Clearing efficiencies at ICE

Trading Low Sulphur Gasoil contracts at ICE and clearing at one clearing house, ICE Clear Europe (“ICEU”) provides market participants with capital efficiencies, while maintaining optimal levels of initial and intraday margin to safeguard the global marketplace.

Low Sulphur Gasoil-related contracts sit within ICE’s global energy futures platform which covers oil, natural gas and environmental markets. These too are cleared at ICEU, which acts as the buyer to every seller and the seller to every buyer. This means that customers benefit from margin offsets to enhance capital efficiency, as ICEU processes and risk manages the positions, removing the burden from participants.

Where are we now?

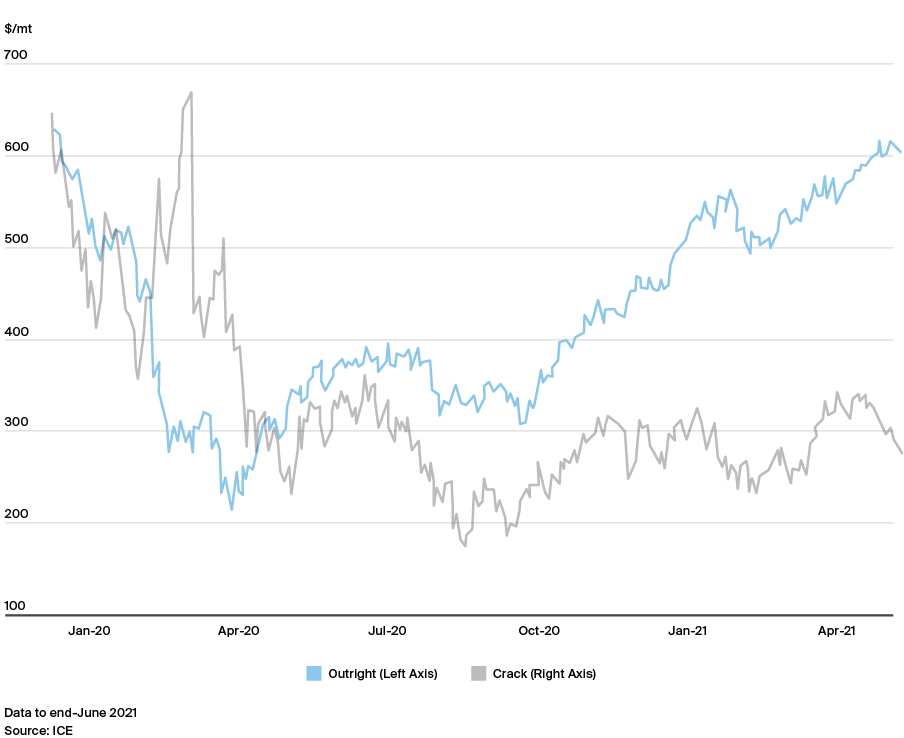

COVID-19 meant 2020 and the first half of 2021 was a tumultuous period, with global middle distillate demand (jet/diesel/gasoil) declining 5 Mb/d year-on-year in 2020, according to the International Energy Agency (“IEA”). Despite the unprecedented nature of 2020 and 2021, the ICE Low Sulphur Gasoil Futures contract remained a stalwart benchmark as participants navigated extreme price fluctuations and outright prices not seen since 2002.

Its benchmark status for a wide range of geographical and quality markers (see next section for more detail) provided strong reliability as a smoothly functioning benchmark during this turbulent period of time. Overall, volumes traded in the Futures contract alone were a record 84.5 M lots; a third of that took place in Q1 2020, as the coronavirus spread and oil production policy disagreements occurred between major oil producing nations.

Front Month ICE LS Gasoil Outright and Crack

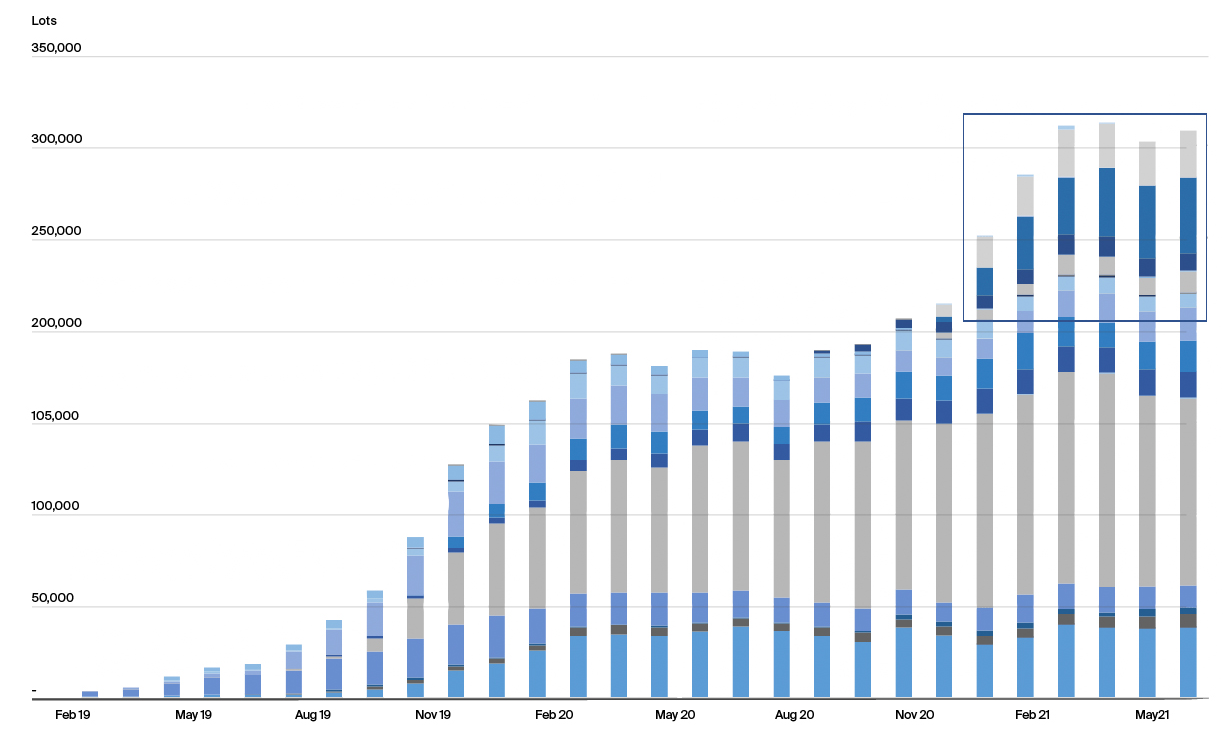

This overshadowed 1 January 2020 - the implementation date of the 0.5% sulphur cap for global shipping fuel mandated by the International Maritime Organisation (IMO)1. In the lead up to this date and in early 2020, there was considerable discussion regarding where Marine Fuel 0.5% sits in the refined product spectrum. Its quality meant it was sufficiently different to not be classed as residual fuel oil. Yet it was to be the primary shipping fuel used globally and was closely associated with Marine Gasoil. During this period of adjustment, it became clear that market participants often relied on ICE Gasoil Futures and their related derivatives to hedge exposure to this new bunker fuel.

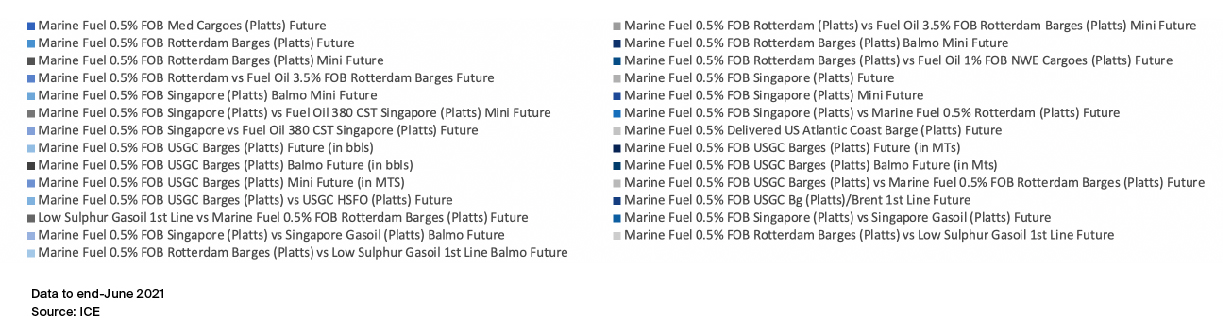

Marine Fuel 0.5% vs Low Sulphur Gasoil, or “5GOs”

In 2020, especially for more deferred periods, ICE Low Sulphur Gasoil Futures was used to hedge future exposure (an uplift in traded volume of Low Sulphur Gasoil Futures and the 1st Line Future was evident). Late in 2020, ICE Futures Europe listed tradable Marine Fuel 0.5% vs Low Sulphur Gasoil differentials in both Rotterdam and Singapore (and known as “5GOs” within the trading community); these were quickly adopted and have traded heavily, as seen in the chart.

The above example shows that during a period of uncertainty (and in 2020, unprecedented events) using established and trusted pricing mechanisms such as ICE Gasoil Futures allows for fair, reliable, and transparent price discovery and effective hedging in a new market.

The fulcrum of refined products

The ICE Low Sulphur Gasoil Futures contract is the glue connecting the European middle distillate market, while also stretching globally to related products in Asia and the US. It impacts middle distillate prices (jet, diesel, and gasoil) while acting as the benchmark for European biodiesel and more recently, shipping bunker fuel.

At ICE alone, there are sixty contracts that directly reference the ICE Gasoil Futures contract; this is one tenth of the entire crude and refined products portfolio of oil contracts available for trading on ICE. At the end of May 2021, there were almost 630,000 lots of Open Interest in all of the ICE Gasoil-related cash-settled derivatives, an increase of 130,000 lots since the start of the year. This confirms that the core Futures contract, which has Open Interest of over one million lots, remains an incredibly attractive and ‘sticky’ benchmark for risk management of a multitude of refined products across the globe.

The majority of these are differentials to other middle distillate products that include European-priced Jet Fuel, ULSD, Gasoil 0.1% and Gasoil 50ppm; Singapore-priced Gasoil 0.05% and Gasoil 10ppm; and US-priced Heating Oil and ULSHO on the Gulf Coast and Atlantic Coast. Also, it is the anchor for European biodiesel pricing and a reliable tool for the growing Marine Fuel 0.5% market.

Source: ICE

The cash-settled derivatives that comprise the majority of the product offering differ in risk management type. Firstly, there are a selection of Futures and Options, but within each there are subsets of contract types suiting different hedging requirements. Many of the Low Sulphur Gasoil-related contracts are full calendar-month average derivatives, yet there are contracts such as a “Balmo” (i.e., balance of the month) or a “Bullet”, which allows for trading specific date ranges within a calendar month.

In addition, the tradable lot size can vary depending on customer requests. One lot of Low Sulphur Gasoil Futures is 100 metric tonnes (“mt”) yet related cash-settled contracts have lot sizes of 1,000 mt, 100 mt and 1,000 barrels.

Biodiesel contracts

It’s not just petroleum-based refined products that rely on Low Sulphur Gasoil for price discovery. The European biodiesel sector, an important segment in transportation subject to national and EU mandates, is traded almost exclusively at a differential to ICE Low Sulphur Gasoil.

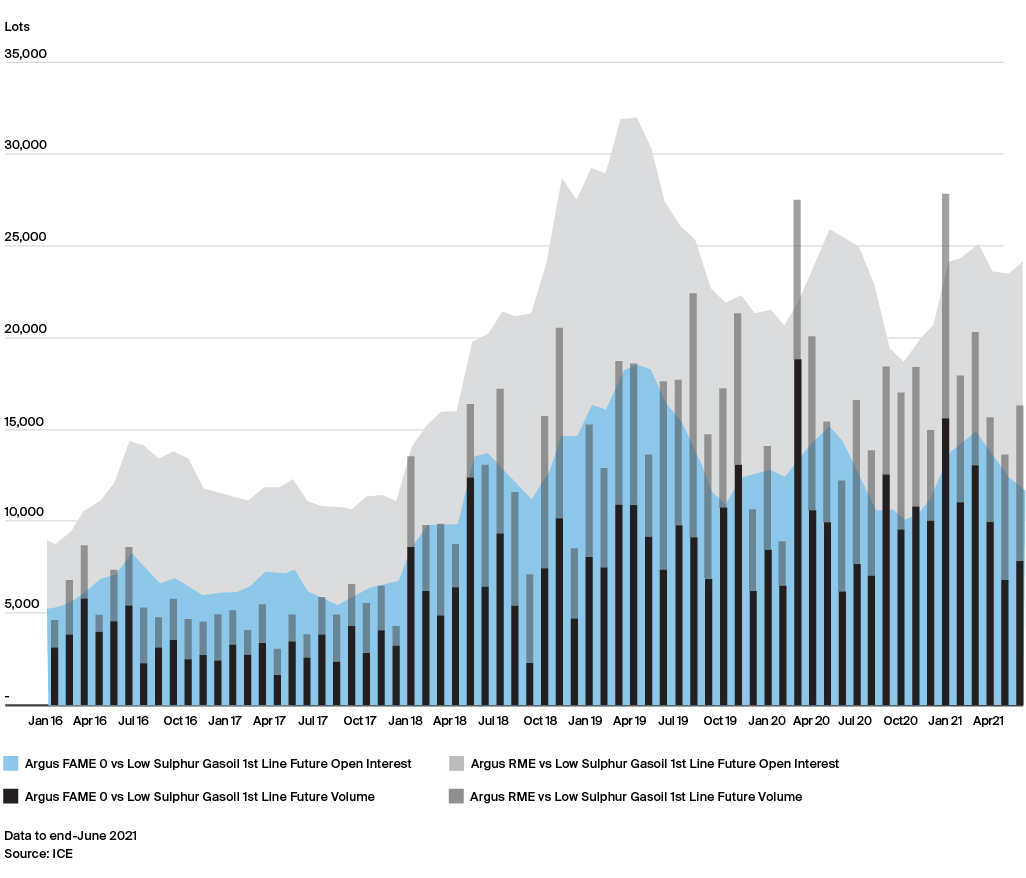

ICE Futures Europe is the home for European Biodiesel risk management, with 100% market share for the FAME, RME and UCOME2 differentials. FAME and RME have been available to trade for many years and as can be seen from the charts, volume and open interest have grown longer term; meanwhile, seasonal and EU directive changes have impacted short term traded volumes.

FAME and RME Futures (vs LS Gasoil) Volume and Open Interest

In December 2020, the UCOME differential was launched on ICE in response to another EU-directed shift to second-generation biofuels and market demand. It has traded steadily since. At the time of writing, open interest of 855 lots now extends in all months to December 2021.

Their success is based on the fact that the underlying Low Sulphur Gasoil Futures contract does the heavy lifting and provides participants with a highly liquid tool to hedge a good percentage of what can be a volatile biodiesel price. This is especially true for deferred months. Rarely is there open interest beyond 12 months in the FAME and RME differentials, yet the deferred Low Sulphur Gasoil Futures months can provide biodiesel traders a preliminary yet effective hedging tool for their exposure before their position becomes more prompt and liquidity then improves in the Biodiesel differential where they can then ‘fine tune’ their position using these ICE contracts.

Along with COVID-19, the “energy transition” has emerged as a key topic in global oil markets. The analysis above on biodiesel is part of this conversation. ICE believes that Low Sulphur Gasoil -- as well as related lower carbon and renewable products that price off Lower Sulphur Gasoil -- will remain an important factor as the energy transition progresses.

What lies ahead

Desulphurisation of fossil fuels has been on the agenda for many years. The ICE Low Sulphur Gasoil Future contract essentially represents a sulphur free diesel now, compliant with EU diesel standards, while other regions around the world have reduced the sulphur content allowable in diesel over the years. One only needs to look at the names of different grades of gasolines, middle distillates and residual fuels to see that the desulphurisation of refined products has been and still is an important part of refined product quality. Now though, decarbonisation is the main focus in an effort to tackle climate change, as efforts turn toward the energy transition and net-zero emissions.

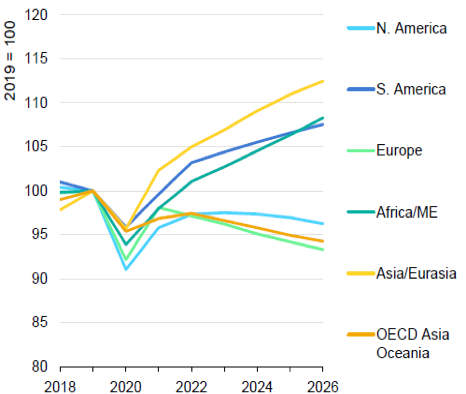

The path will be formidable and long; however, in the medium term (five-year horizon), middle distillate demand is expected to increase, especially in non-OECD countries in comparison with 2019 (pre-COVID-19 pandemic) levels. Middle distillates (even excluding jet/kerosene) are still the biggest product group by demand (followed by gasoline) and according to the IEA3 will remain so in the next five years.

In the IEA’s most recent medium term (five-year) outlook, published in March 2021, global gasoil/diesel demand was forecast to increase to 29.5 Mb/d by 2026, from 28.8 Mb/d in 2019, the last full year prior to the COVID-19 -related disruption. As can be seen from the IEA chart, growth will primarily come from the Asia/Eurasia region, increasing by just under 1 Mb/d, with the majority of that originating in China and India. Smaller increases will occur in South America and Africa.

In contrast, demand will decrease in Europe from 7 Mb/d in 2019, to 6.6 Mb/d in 2026, while smaller declines will be seen in North America and the OECD Asia Oceania region.

In short, middle distillate demand will decline in the advanced economies (i.e., OECD countries) where current and future energy policies are strongly geared towards lowering greenhouse gas emissions. However, the decline is gradual, and future replacement renewable fuels and their value will be closely associated with, if not depend on, the robust and transparent price discovery process within the ICE Low Sulphur Gasoil Futures contract.

In Asia, where GDP growth is expected to be relatively stronger versus Europe and the US, oil demand is forecast to increase over the medium term. There is no well-established or dominant refined product benchmark in the region and for many years, middle distillate price discovery in Asia (particularly at the Asian pricing hub of Singapore) has been strongly linked back to the liquid ICE Low Sulphur Gasoil Futures contract, through the so called “east/west” arbitrages. There is no evidence to suggest this link (even indirectly) will weaken any time soon.

Returning to the role Low Sulphur Gasoil Futures plays now and in the future regarding emission reduction efforts, below we have focused on examples of emerging trends and their relationship with ICE’s Gasoil Futures contract.

Sustainable Aviation Fuel (“SAF”) and Hydrotreated Vegetable Oil (“HVO”)

The lowering of greenhouse gas emissions is a goal for many economies. Leading the charge are countries within the European Union which have set an aggressive target on reducing emissions by 55% by 2030 compared with 1990 levels. In an effort to achieve this, there will be a focus on renewable and sustainable energy while also improving energy efficiency in road transportation, power generation and building infrastructure.

A key focus area is the shift to second-generation biofuels in the EU. After many years of having a successful first-generation biofuels mandate to replace fossil fuel-based energy, there is a raft of emerging technologies supporting waste-based biofuel generation. Two of these short-to-medium term solutions to reduce carbon emissions are SAF and HVO. In short, both are produced from waste oil (while SAF can come from municipal waste and woody biomass) resulting in a replacement “Jet-A1” fuel, for air transportation, or a synthetic diesel, for road transportation.

After years of development, both products are now at a stage where quality standardisation is still being refined (making effective standardised hedging instruments a step away from being widely adopted and accepted) yet are at a point where price discovery is increasingly important as demand for them rises. Independent Price Reporting Agencies started monitoring their progress in recent years and have launched a variety of spot price assessments, derived from observed market activity. All these price assessments are done as a differential to ICE Low Sulphur Gasoil. Similar to the first-generation biofuels, the link back to an established price benchmark has aided in the price discovery process while providing market participants a high degree of liquidity for a good portion of the price in an otherwise less liquid market.

Interestingly, SAF is valued currently, as a differential to HVO which is priced as a differential to ICE Low Sulphur Gasoil. It is expected that in time, SAF price discovery may well skip the HVO link and be a differential to Gasoil only.

US Renewable Identification Numbers (“RINs”)

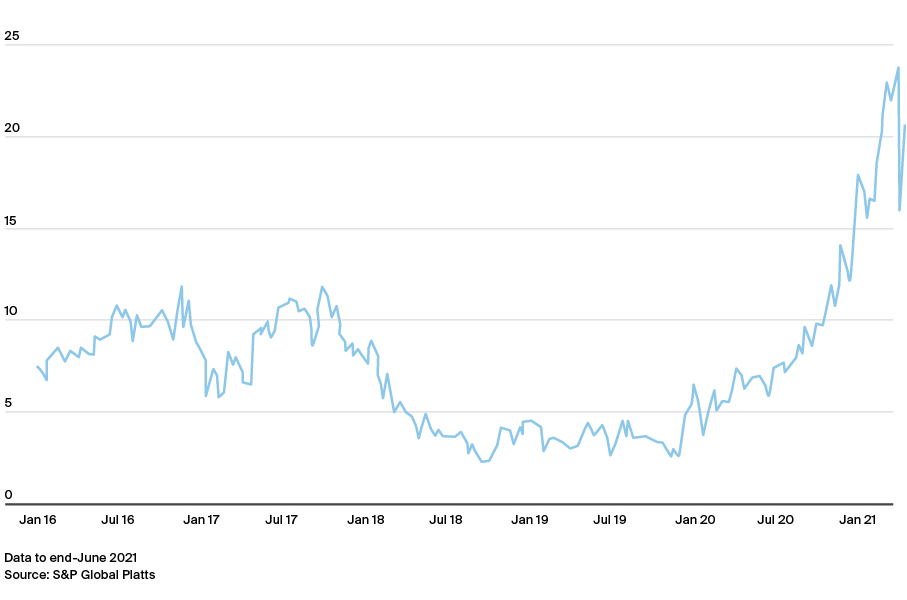

RVO (Current Year) - cts/USG

The US Renewable Fuel Standard4 or RFS is a federal program to meet biofuel blending targets into the gasoline and diesel pools, which uses RINs as credits for compliance. In recent months, the cost of complying with the Renewable Volume Obligation (“RVO”) has surged to unprecedented highs as the US emerged from COVID-19 related restrictions, pushing up gasoline and diesel demand. As a result, refiners have upped refinery runs and will need to purchase more RINs, to meet their RFS obligation, which face a potential shortage this year.

The RINs situation is very specific to the US and primarily impacts gasoline (due to ethanol blending requirements) yet there is an indirect relationship with European diesel and ultimately the ICE Low Sulphur Gasoil Futures contract. This is because RINs prices are factored into refining margin calculations. Depending on the outcome, this can impact US refinery yields of gasoline, diesel and jet fuel (the latter being excluded from the RFS mandate) and also how much remains in the US or is exported (and therefore not subject to the RFS mandate).

As seen over recent years, diesel exports from the US Gulf Coast now regularly exceed 1 Mb/d and travel to Europe, South America and Asia. European Gasoil prices are affected by the same usual fundamentals as many other oil products: supply (local refinery output and imports), demand (local demand and exports), as well as factors such as stock levels and product cracks (i.e., product to crude price differentials), among others. In short, an extended period of RINs high prices in the US is more than likely to impact markets beyond US shores5.

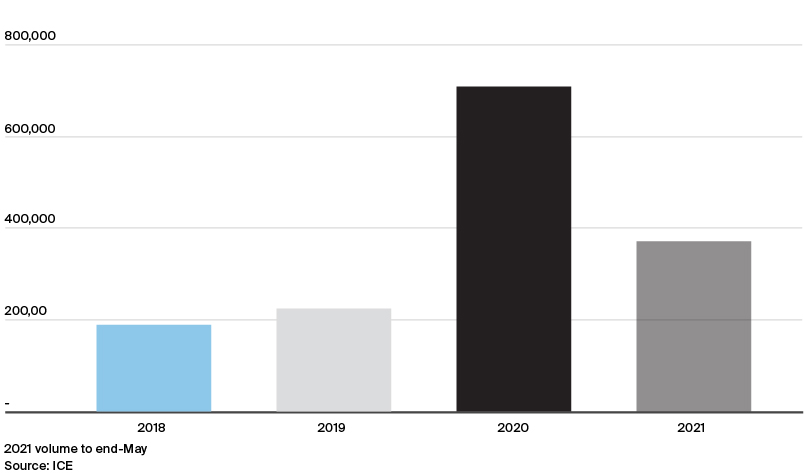

Heating Oil/Gasoil Interproduct Futures Spread Volume (in lots)

ICE offers an Interproduct Futures spread between the New York Harbour Heating Oil Futures and Low Sulphur Gasoil Futures6. It provides market participants a one-stop solution to trade the transatlantic arbitrage value between two middle distillate benchmarks7. Volumes traded of this “HOGO” spread grew significantly in 2020 and look set to exceed 2020 levels again in 2021, if the current trend continues. It is difficult to conclude that this is related to the volatility in the RINs markets starting in 2020 but due to the factors explained above, there may have been a shift in trading behaviour, resulting in market participants looking to manage their exposure to both New York Harbour Heating Oil and European Low Sulphur Gasoil providing them with optionality in an increasingly unpredictable period as RINS prices rose.

Conclusion

Through all market conditions, oil market participants have always relied on a Futures benchmark, where liquidity is assured in a contract that reflects the underlying physical market. Regardless of what the future holds, this paper has shown that continual adaptation in the ICE Low Sulphur Gasoil Futures contract is essential to its success as an effective risk management and investment tool.

ICE has successfully hosted the primary global refined product benchmark for the last 40 years and will continue to support new products and the development of existing contracts. The sixty contracts directly related to Low Sulphur Gasoil Futures are a testament to its robust global status, and we are proud to invest in its ongoing evolution.

Footnotes

Gasoil: Facilitating transitions to cleaner fuels for 40 years

Learn how ICE Low Sulphur Gasoil Futures continues to be the world’s leading refined product benchmark.

In this whitepaper:

ICE Gasoil: Forty years and counting

Journey to become the world’s leading refined product benchmark

Marine Fuel 0.5% vs Low Sulphur Gasoil, or “5GO

The fulcrum of refined products

Sustainable Aviation Fuel (“SAF”) and Hydrotreated Vegetable Oil (“HVO”)