The SEC’s Liquidity Risk Management rule and the portfolio holdings’ classification requirements state that funds should place each portfolio holding into a single classification bucket: Highly Liquid, Moderately Liquid, Less Liquid or Illiquid. The classification is not based on having to liquidate the fund’s entire holding, but instead on a “Reasonably Anticipated Trade Size”, which has affectionately received the industry nickname “RATS”.

The rule is not prescriptive on how the fund should calculate the RATS, although some guidelines and examples are provided in the SEC’s most recent FAQ – specifically, questions 19-21. Two notable answers from the SEC when a fund considers how to set their RATS:

(i) “The staff believes that a zero or near zero reasonably anticipated trade size would not be a reasonable assumption...” (FAQ 21); and

(ii) “A fund could continue to use that assumed reasonably anticipated trading size even in cases where a fund anticipates fully liquidating a position for investment reasons in the near term.” (FAQ 20)

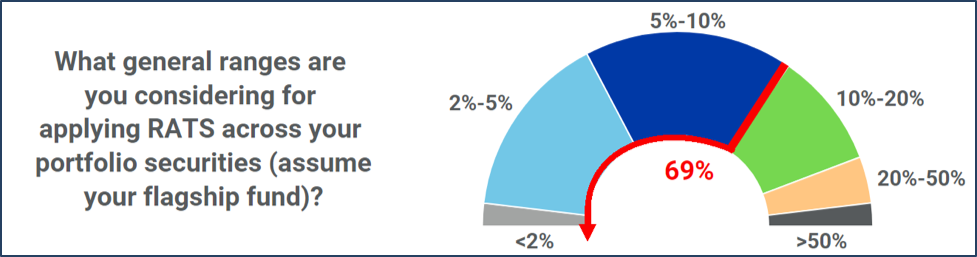

Figure 1: ICE Data Services March 2018 Webinar Poll (37 participants)

We have heard many different approaches for calculating the appropriate RATS, ranging from historical flow analysis to trade history analysis, most commonly in the range of 2% to 10% (see Figure 1) which seems to align with the “book-end” boundaries implied by the SEC in this FAQ release. We have spoken to some funds who have performed analysis of their more mature, stable funds and they have concluded that a sub 1% RATS could be justifiable, however are factoring in additional uncertainties to avoid being perceived as having an unreasonable assumption. In other words, they are accounting for probability-adjusted events in various market environments.

It is interesting that our poll (see Figure 1) has a nontrivial population of rather large RATS assumptions - nearly a third over 10% and a few in the 20+% and 50+% answers. From my perspective, and given the SEC guidance above in FAQ #20, such large RATS would be surprising. Regardless, it is evident that firms are still working through the RATS details.

So whether you’re leaning towards a less than 2% RATS or greater than 50% RATS, or whether your approach is to analyze recent redemptions or conduct an extensive study on the historical trading behavior of your portfolio managers… be prepared to show the SEC examination staff a sound and reasonable approach to how your firm derived these assumptions and make sure it is consistently applied. The three main principles of RATS determination will be documentation, documentation and documentation.

Find out how changes in RATS can influence liquidity classifications with a demo of ICE Liquidity IndicatorsTM.

Latest News

The “No Delay” Delay for N-PORT

The SEC’s Reporting Modernization rule has been updated to include a filing delay. This has broadly been received as a “no real delay” as funds are still required to calculate all of the information for Form N-PORT, archive it, and make it available to the SEC upon request.

View Now ›