2020

Annual Report

Dear Fellow Stockholders,

At Intercontinental Exchange®, our mission for over two decades has been to drive transparency and create workflow efficiencies for our customers. We do this by building and operating mission-critical digital networks that leverage our technology, data services and operating expertise to connect our customers to opportunity around the globe. For our stockholders, our successful execution of this strategy over the last two decades has constructed a business model that has delivered growth across an array of regulatory, political and economic environments. Looking back at the prior year, I can think of no tougher test of the efficacy of our business strategy than the unprecedented events of 2020.

Consolidated Financial Results

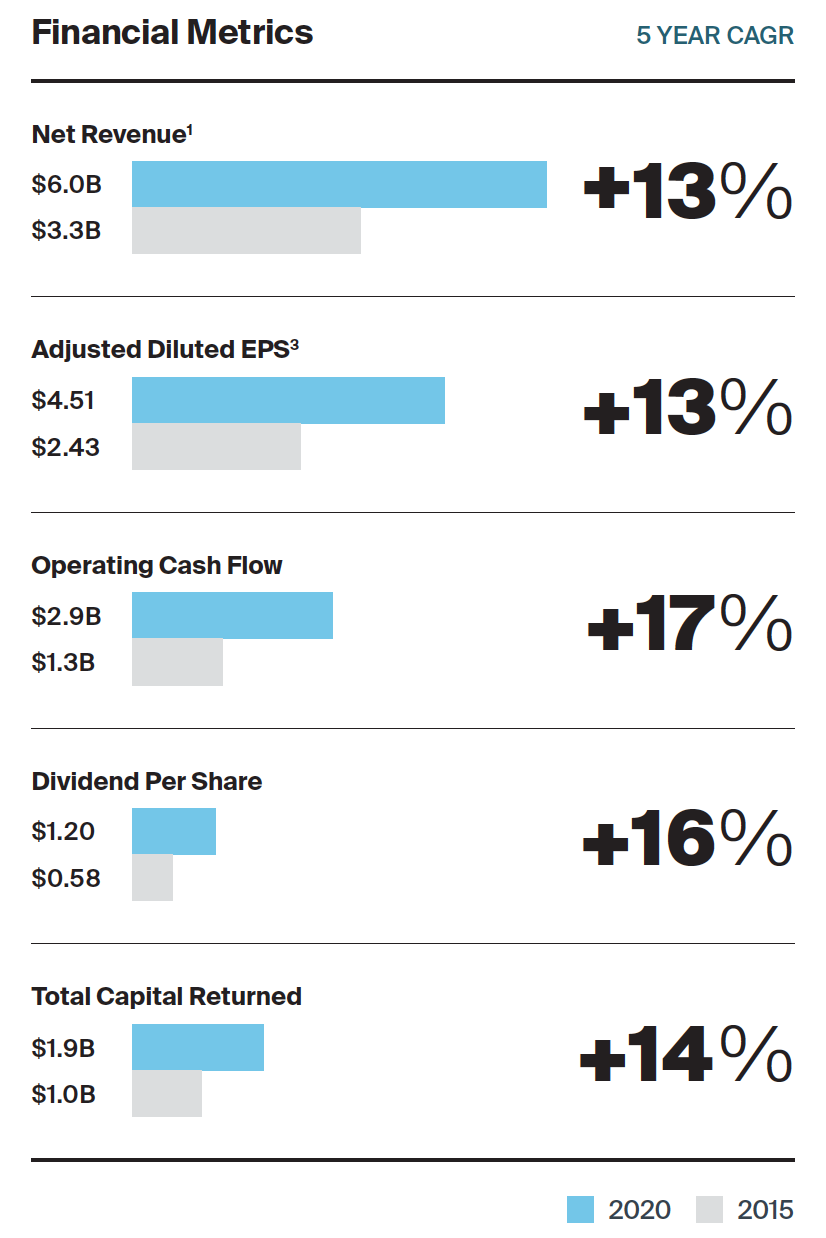

2020 was the strongest year in Intercontinental Exchange’s history; a statement we are proud to have been able to make every year since our IPO on the New York Stock Exchange in 2005. Total net revenues1 were a record $6 billion, up 16% year-over-year, driven by growth across all three of our business segments. While we are organized in three business segments, we operate as one team, leveraging our collective expertise, particularly in data services and technology, to enhance and expand our operations.

- Intercontinental Exchange's Exchange and Clearing segment, which includes our futures network as well as the New York Stock Exchange, net revenues1 increased 10% year-over-year to a record $3.6 billion. Results were highlighted by a 13% increase in energy futures revenues, which topped $1 billion for the first time.

- Intercontinental Exchange's Fixed Income and Data Segment generated total revenues of $1.8 billion. These results were driven by our fixed income data & analytics business, which grew 5% year-over-year to over $1 billion.

- Intercontinental Exchange's Mortgage Technology segment, pro-forma for our September 4, 2020 acquisition of Ellie Mae, revenues totaled $1.2 billion2, a 56% increase year-over-year, reflecting accelerating demand for both workflow automation tools and strong industry origination trends.

On a consolidated basis, adjusted operating income3 increased by 18% to $3.5 billion in 2020 and our adjusted operating margin3 expanded to 59%. Cash flow from operations totaled $2.9 billion, from which we deployed $1.2 billion towards share repurchases and nearly $670 million to shareholders in the form of dividends, an 8% increase over 2019.

The strong performance across our three segments delivered another year of record adjusted earnings per share3, or EPS, which increased 16% year-over-year to $4.51. I’m proud that our performance marks our 15th consecutive year of growth. We attribute this track record of growth to the many strategic investments we have made over the last two decades, the remarkable efforts of our employees, and our commitment to ensure that our technology performs at the highest level – particularly during times of stress – which was notably evident over the past year. From the digitization of the fixed income workflow and the automation of the mortgage origination process, to helping our customers navigate the long-tail evolution of global energy markets, it is our technology, coupled with our data services and operational expertise, that have been, and will continue to be, critical to enabling our long-term success.

Automating The Mortgage Workflow

We target asset classes that are in the early stages of an analog-to-digital conversion because we believe these asset classes will benefit from greater automation and create strong network effects. In September of 2020, we closed on our $11 billion acquisition of Ellie Mae, a strategic acquisition that complements our existing mortgage assets and positions us as a leading provider of digital solutions to the U.S. residential mortgage industry. Having generated pro-forma net revenues of $1.2 billion2 in 2020, ICE Mortgage Technology is at the center of an analog-to-digital conversion that we believe represents a total addressable market, or TAM, of roughly $10 billion.

However, Intercontinental Exchange’s journey to help automate the mortgage workflow did not begin with our acquisition of Ellie Mae. It began in 2016 with our acquisition of a majority investment in the Mortgage Electronic Registry System, or MERS, a database that tracks the ownership and servicing rights of roughly 85% of outstanding mortgages in the United States. We quickly applied our technology expertise and rebuilt the underlying database, a process that ultimately allowed industry participants to further digitize parts of their closing workflow. In 2019, we made another important acquisition within the mortgage ecosystem, Simplifile, which added key electronic closing and settlement products. The Simplifile team constructed an unparalleled network over two decades that connects over 28,000 settlement agents to more than 2,000 counties, representing over 85% of the U.S. population. That kind of connectivity and network is a hallmark of the Intercontinental Exchange business model.

While these products and networks, as well as the data that flows through them, had the potential to serve as a backbone for digitizing the closing and post-closing process, we still did not have direct connectivity to the front-end of the origination workflow. That changed with the addition of Ellie Mae.

This unmatched solution was built to meet the needs of our customers. Like our exchanges and fixed income businesses, ICE Mortgage Technology’s products and network excel by offering a value proposition that enables efficiency gains for our customers. Intercontinental Exchange’s demonstrated capabilities made us uniquely qualified to deliver these efficiency gains by harnessing unstructured data sets to create mission-critical information, analytics and value-enhancing workflow tools. Our experience also taught us that it is imperative that our products and networks link participants seamlessly to mission- critical information and that the underpinning technology is of the highest quality and security. It is the successful execution of this value proposition, regardless of the asset class, that has historically propelled an analog-to-digital conversion and which serves as the playbook we’ve successfully run across all our businesses for over two decades.

Ellie Mae’s unique core strength is in its platform that connects brokers, under writers and lenders. When combined with our existing services and products in the mortgage space, we’re enabling the business, which we have re-branded as ICE Mortgage Technology, to seamlessly link key stakeholders within a single, end-to-end digital ecosystem.

Intercontinental Exchange Performance

48%

Recurring Pro Forma Revenues2

59%

Adjusted Operating Margins3

15

Consecutive Years of Adjusted EPS Growth3

1 Net of transaction-based expenses.

2 Represents revenue on a pro-forma basis as if we had owned Ellie Mae since January 1, 2020.

3 Adjusted figures represent non-GAAP measures. Please refer to ICE’s 2020 Form 10-K filed on February 4, 2021, for reconciliations to the equivalent GAAP measures.

Data Fueling Compounding Growth

The cleansing and marshaling of data, in and out of databases, and the packaging of that data into information that fuels analytics and workflow tools, has been critical to building our track record of consistent and compounding growth. This may be most evident in our Fixed Income & Data Services business, where the annual subscription value, or ASV, entering 2021 is up 6% versus the prior year.

Driven by our multi-year investment in both information and technology, these data services businesses delivered a remarkably strong performance in 2020. As an example, our leading Fixed Income Pricing business merges cutting-edge technology with the expertise of over 200 human evaluators, many of whom are former fixed income traders or portfolio managers. During the spike in volatility in March of 2020, these human evaluators and our sophisticated algorithms sifted through a massive influx of fixed income trade data and enabled us to quickly provide our customers with quality evaluated prices on nearly three million securities around the globe; prices that are mission-critical to our customers’ workflows across the back, middle and front office.

These technology investments were also essential to our ability to launch new data products in 2020. By leveraging our existing reference data expertise and infrastructure, we now offer environmental, social and governance, or ESG, terms and conditions on over 2,500 companies, spanning 400 data points such as board diversity metrics and greenhouse gas emissions. In addition, as exchange traded fund, or ETF, assets benchmarked to our indices approach $300 billion, we continue to expand our suite of offerings, which today include an array of global fixed income, sustainability and commodity benchmarks. In essence, it was our expertise and our investments in technology and data that enabled us to support our customers in times of unprecedented stress and to build stronger, long-term relationships that we believe will ultimately create shareholder value.

Navigating The Energy Transition

From our earliest days, we have constructed a leading energy network where global corporations, sovereign nations, investors and traders convene to discover the price of many forms of energy that are critical to economic growth. As the world evolves, this community of market participants is constantly adjusting and weighing the price impact of an array of macroeconomic, geopolitical and regulatory forces, as well as externalities such as climate risk and the emergence of new renewable fuel sources. In other words, the price formation process is increasingly becoming more complex, and that additional complexity is driving customer demand for more precise risk management tools. At Intercontinental Exchange, we serve these needs through new product development, as well as by generating richer data sets and more sophisticated analytics.

Over the last five years, revenue growth across our energy markets has averaged 7% annually, with 2020 revenues reaching a record $1.1 billion, up 13% year-over-year. In our oil markets, growth was driven by record futures and options volumes across refined oil benchmarks such as gasoil, RBOB gasoline and heating oil, as well as our global suite of locational and product spreads.

Revenues across our global natural gas complex reached a record in 2020, increasing 23% year-over-year. Natural gas has emerged as a cleaner alternative to oil, which has accelerated the global risk management needs related to the commodity, and caused the markets across North America, Europe, and Asia to become increasingly interconnected. This evolution creates opportunities for new trading relationships to develop and adds an extra layer of complexity that fuels adoption of our global gas product suite.

This is best evidenced by the explosion of our Title Transfer Facility, or TTF, contract in Europe, where trading volumes have increased by an average annual rate of 44% since 2015, including 52% growth in 2020. Europe is often referred to as the balancing market for Liquefied Natural Gas, or LNG, due to its flexible infrastructure and its role in absorbing excess supply. As a result, TTF is increasingly being used by global commercial participants, financial traders and investors. Together, with a shift toward greater on-exchange trading activity, TTF is emerging as the “Brent of Natural Gas”, and, like the role that the Brent benchmark serves in our global oil complex, TTF provides a foundation for future product development and continued growth across our global gas network.

The importance of the evolution of energy markets also extends to our global environmental markets, where the number of market participants has grown by 40% since 2017 and revenues increased 18% in 2020. As customers increasingly seek solutions to help navigate these complex global energy dynamics, market-based mechanisms, such as our carbon cap and trade offering, are critical to enabling the price transparency that is needed to properly attribute a cost to pollution.

Today, billions of people around the world still lack easy access to energy. As a result, they find themselves denied the associated social, economic and health benefits that energy provides elsewhere. Over two billion people must still burn biomass or kerosene just to cook, while nearly one billion lack access to basic electricity. Harnessing the power and transparency of free markets is critical to meeting these energy demands, and we think the markets we operate will prove instrumental as the long-tail and complex evolution of global energy unfolds.

Intercontinental Exchange's 2020 Financial Metrics

Net Revenues1

+16% y/y

$6.0B

Adjusted Diluted EPS3

+16% y/y

$4.51

Operating Cash Flow

+8% y/y

$2.9B

ESG

As I just outlined, we think one of our greatest opportunities to make a difference in environmental and social matters will be through the markets we operate, the ESG data we provide and our efforts to help our customers make more sustainable choices. But it is important, as a global enterprise, to embrace these initiatives in our own offices as well. Below are a few areas we are currently focused on, and I encourage you to read our 5th annual corporate responsibility report, which can be found in the Corporate Citizenship section of our corporate website.

Reducing our Carbon Footprint: While we operate the world’s leading environmental markets, we are also committed to reducing our own carbon footprint. Through the purchase of renewable energy, renewable energy certificates, or RECs, and carbon offsets, we are working to mitigate the energy consumption associated with our data centers, offices and employee air travel, which account for much of the impact that our business has on the environment.

Our Response to COVID-19: We have a team in place that is dedicated to managing our response, adapting to rapidly changing developments, addressing individual concerns and sharing information across the Company. Additionally, while we take our stewardship of shareholder capital very seriously, it seemed incumbent upon us, in this situation, that we share a portion of our strong business results to support those impacted by, and helping to battle, the effects of COVID-19. And so, we donated $10 million to a wide range of charities globally to help those impacted by the crisis in each of the communities where we have offices.

Diversity: At Intercontinental Exchange, we have always focused on diversity. At the board level, in 2020, we welcomed three new board members including our 4th and 5th female board members. In 2019, we launched the NYSE Board Advisory Council, an initiative to increase diversity on the boards of NYSE-listed companies. Since its launch, the NYSE Board Advisory Council network has expanded rapidly, having nominated over 200 potential candidates. At an employee level, we continue to increase diversity and believe our workforce should reflect the broader communities where our offices are based, and we are providing our managers and employees with greater transparency through diversity metrics such as our most recent annual EEO-1 data.

Looking Forward

Intercontinental Exchange’s success reflects a culture of teamwork, collaboration and innovation, with a common mission of bringing transparency and efficiency to support our customers’ workflows. These core competencies helped us navigate not only one of the most challenging years on record in 2020, but more importantly, to consistently meet the needs of our customers and deliver value to our shareholders for 15 consecutive years as a public company and over the two decades since Intercontinental Exchange was established. We are confident that our strategy, our culture, our team and our commitment to our customers will enable us to continue to execute on the many opportunities before us, to invest in future growth, and, ultimately, to continue to create value for our stockholders.

I want to express our sincere hope that you, your families and your colleagues are safe and healthy. I’d also like to thank my colleagues at Intercontinental Exchange for their resilience and the remarkable effort and dedication that they exhibited this past year. Looking to 2021 and beyond, we will apply the same approach that we have for two decades: by applying our world-class technology, leading data services and our operating expertise we will better serve our customers, grow our business and create value for our shareholders. Thank you for your investment in Intercontinental Exchange, and I look forward to reporting on our progress in the coming year.

My best,